Don't call Kansas' tax-slashing experiment a total failure quite yet

So far the "revolution in a cornfield" has produced little more than red ink. But it's not over yet.

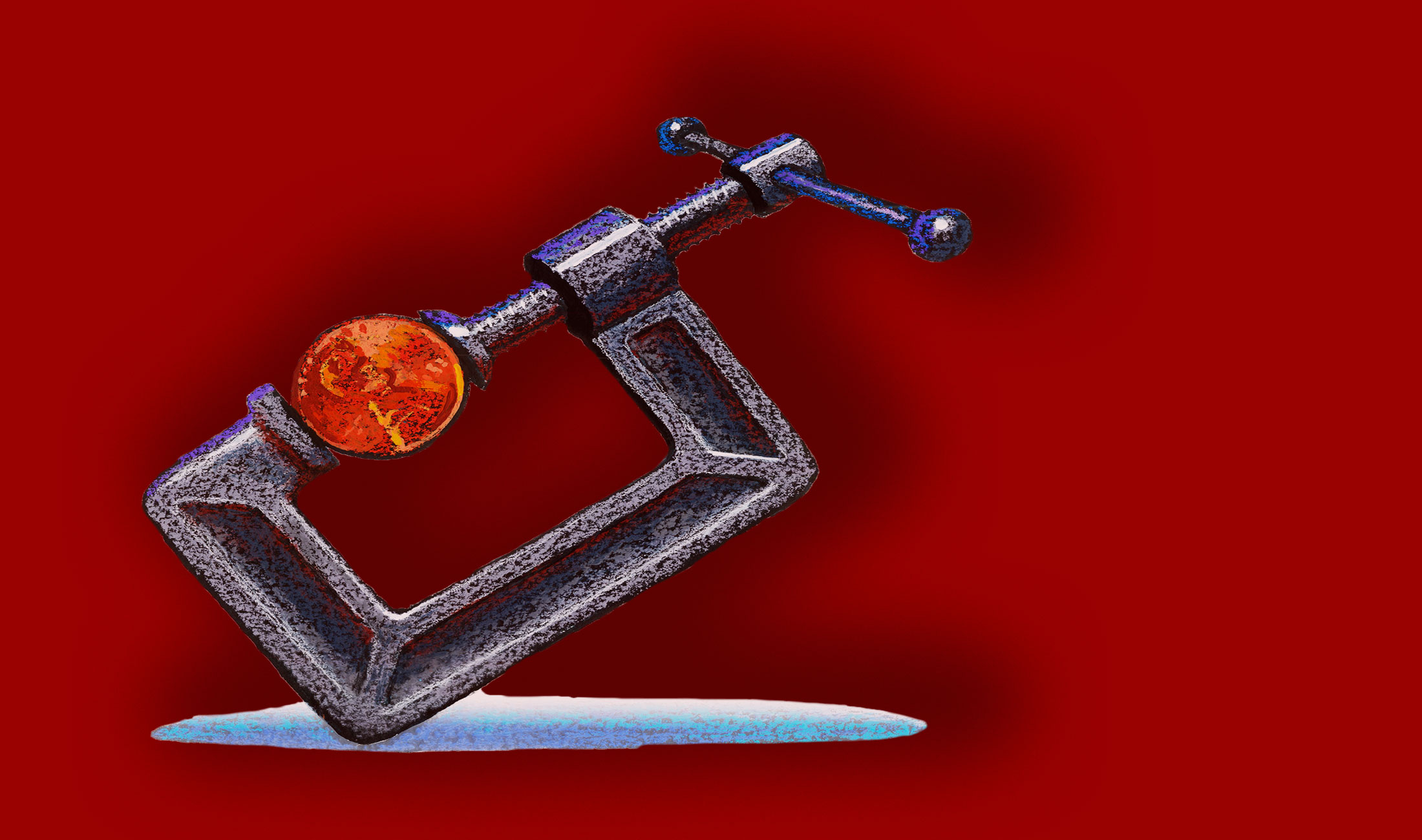

Republican presidential candidates touting big tax-cut plans should be sobered by what's happening in Kansas right now. The state legislature is scrambling to pass a budget that would close a projected $400 million shortfall in the next fiscal year. The fiscal crisis is the result of red ink that started gushing after the state passed massive tax cuts in 2012. Back then, Gov. Sam Brownback, a Republican, predicted, "Our new pro-growth tax policy will be like a shot of adrenaline into the heart of the Kansas economy."

As natural economic experiments go, this was a pretty bold one. The top personal income tax rate was reduced from 6.5 percent to 4.9 percent — and eliminated for small business owners who file as individuals. The reduction was "the biggest tax cut of any state, relative to the size of its economy, in recent history," according to Andrew Wilson, a fellow at the Show-Me Institute, a free-market think tank in Missouri. Economist Arthur Laffer, a Brownback adviser and the "supply-side" architect of the 1980s Reagan tax cuts, called it "a revolution in a cornfield. Brownback and his whole group there, it's an amazing thing they're doing. Truly revolutionary."

But it's hard to see any economic revolution in the data — at least not yet.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Over the past two years, Kansas' jobless rate has fallen by 1.1 percentage point — from 5.4 percent to 4.3 percent — versus a 1.5-point drop for its four neighboring states and a 2.2 point drop for the U.S. economy overall. And the Sunflower State's labor force participation rate has been flat. Nor does the Kansas economy appear to be gaining much momentum as the tax cuts' supposed pro-growth effects finally "kick in." Over the past six months, the Philadelphia Fed's economic activity tracker finds Kansas again lagging the overall U.S. economy. And in April, Kansas wage and income growth trailed the national average.

The reaction to these numbers by Democrats and left-wing pundits has been, unsurprisingly, scathing. New York Times columnist Paul Krugman calls the Kansas experiment a "spectacular policy failure" that the GOP will fail to learn from because "gold bugs and Austrians are more dominant in GOP circles than they were before seven years of wrongly predicting runaway inflation."

Let's set aside the liberal hyperbole for a moment, and instead ask a serious question: What should Republicans learn from the Kansas experiment, especially the GOP's crop of White House wannabes who have plans to deeply cut top tax rates?

First, don't expect tax cuts to pay for themselves or even come close. They almost never do. That should be clear not only from the Kansas experiment, but the Bush tax cuts in the 2000s and the Reagan tax cuts in the 1980s. Tax cuts need to be accompanied by budget cuts or some other tax increases or risk bigger deficits.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Second, don't expect an immediate economic boom. This is one reason why tax cuts don't pay for themselves. Republicans often favor high-end tax cuts, but such reductions may be more likely to change long-term incentives than provide short-term stimulus. If you're looking for a quick fillip, recent research by University of Chicago economist Owen Zidar finds the "stimulative effects of income tax cuts are largely driven by tax cuts for the bottom 90 percent." Also, the link between job growth and tax changes for upper-income earners appears to be "weak to negligible" over the business cycle.

Third, focus on the long term. Whatever their fiscal impact, the Kansas tax cuts may yet earn some significant economic benefits. A new paper by Enrico Moretti and Daniel Wilson, "The Effect of State Taxes on the Geographical Location of Top Earners: Evidence from Star Scientists," finds that state taxes "have a significant effect on the geographical location of star scientists and possibly other highly skilled workers." They calculate, for instance, the effect of New York cutting its marginal tax rate on the top 1 percent of earners in 2006 was "12 fewer star scientists moving away and 12 more stars moving into New York, for a net increase of 24 stars, a 2.1 percent increase." Now, that may not sound like much bang for the buck, but it only took the arrival of two pretty smart guys, Bill Gates and Paul Allen, to launch Seattle's tech boom. Likewise, while the Reagan tax cuts may have not boosted U.S. productivity in the 1980s, a case can be made that changing incentives played a key role in the 1990s tech boom. The lesson from Kansas should not be that we ought never, ever cut taxes for rich people or business.

And indeed, there may already be some green shoots. As Wilson points out in a Wall Street Journal op-ed, the state has significantly improved its private-sector job growth versus other states.

So be patient, Kansas. And while you're waiting, get those bills paid!

James Pethokoukis is the DeWitt Wallace Fellow at the American Enterprise Institute where he runs the AEIdeas blog. He has also written for The New York Times, National Review, Commentary, The Weekly Standard, and other places.

-

What is at stake for Starmer in China

What is at stake for Starmer in ChinaToday’s Big Question The British PM will have to ‘play it tough’ to achieve ‘substantive’ outcomes, while China looks to draw Britain away from US influence

-

How the ‘British FBI’ will work

How the ‘British FBI’ will workThe Explainer New National Police Service to focus on fighting terrorism, fraud and organised crime, freeing up local forces to tackle everyday offences

-

The best family hotels in Europe

The best family hotels in EuropeThe Week Recommends Top kid-friendly hotels with clubs, crèches and fun activities for children of all ages – and some downtime for the grown-ups

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred