Why Marco Rubio's fearmongering about Social Security is so clueless

What debt crisis?

One of the most remarkable features of the American political landscape is the widespread conviction that Social Security is doomed.

According to Gallup, 51 percent of Americans in 2015 didn't think Social Security would pay them a benefit when they retire. Among Americans under 30, it was 64 percent.

The apocalyptic rhetoric from some of our politicians is probably a factor here. "Anyone who tells you that Social Security can stay the way it is is lying," Sen. Marco Rubio insisted at the Republican debate in Florida last week. Sen. Ted Cruz declared that Social Security "is careening towards insolvency." Rubio wants to cut Social Security's benefits and raise its retirement age, while Cruz and John Kasich suggested partial privatization. Even Donald Trump, who wants to leave the program's benefits and retirement age alone, said spending had to be cut elsewhere. No one contested Rubio's central thesis that "if we don't do anything, we will have a debt crisis."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

So let's unpack this idea that if we don't tame Social Security and other entitlements like Medicare, we're all headed for Mad Max: Fiscal Apocalypse.

The first thing to understand is that Social Security's looming "insolvency" is merely a looming cut in benefit payments. Right now the retirement of the Baby Boomers is projected to drain the program's trust fund dry, at which point the law says annual benefit payments to retirees will have to be drastically decreased to bring them in line with annual revenue from the payroll tax.

But here's the thing: The trust fund is not a savings account outside the government. It exists entirely within the government's own finances and always has — an intermediary step between its revenue and spending. If the government wanted to simply ignore the depletion of the trust fund and continue paying out all promised Social Security benefits in perpetuity, it could.

In fact, projections of future government spending by the Congressional Budget Office (CBO) — which give Rubio and everyone else the talking point that the U.S. is headed for a "debt crisis" — already assume this is what Congress will do. That future spending is a large part of why CBO also projects a rising debt load in the coming decades. If Congress actually did cut Social Security benefits when the trust fund depletes, the CBO's future spending projections would drop dramatically.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

So when Rubio said "Social Security will go bankrupt and it will bankrupt the country with it," he got things exactly backwards. CBO's debt projections assume that nothing happens to Social Security benefits. The debt crisis and the Social Security crisis are mutually exclusive.

But Rubio's even more wrong than this.

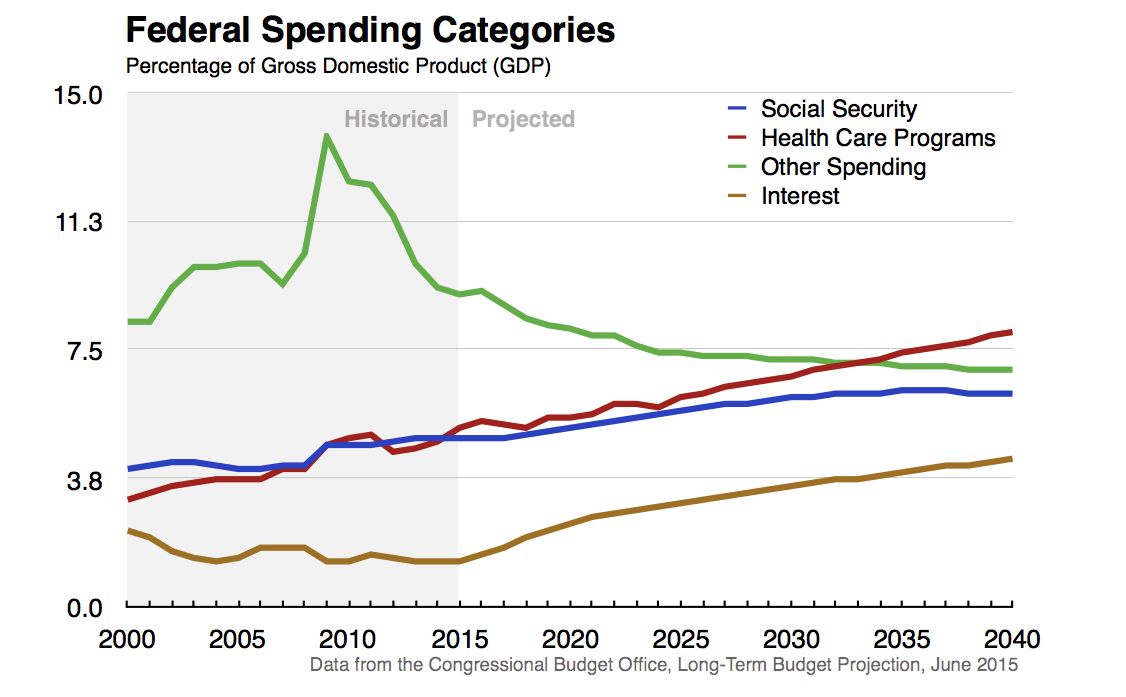

Here's the long-term spending projection CBO made in 2015. It includes all the major categories — Social Security (in blue), Medicare, Medicaid, CHIP, and ObamaCare (in red), interest on the debt (in brown), and everything else (in green) — through 2040:

What stands out? First off, the "everything else" category slowly falls as a percentage of the economy over the entire time period. So that's definitely not driving the debt problem.

As for Social Security, it will rise from 4.9 percent of GDP to 6.2 percent, as America's retirees grow as a portion of the overall population. But the rise stops by 2035, after which spending stays at 6.2 percent. Once we get "over the hump" of the Baby Boomers' retirement, our demographics will stabilize. Long term, we just need to come up with an extra 1.3 percent of GDP to cover all of Social Security's benefits as promised.

That will not be hard. Total tax revenue for all levels of government was 26 percent of GDP in 2014. Other advanced countries like Canada, France, and Germany bring in considerably more. A few go almost to 50 percent, with no discernible damage to their economies. A lot of oxygen gets spent on changes we could make to the payroll tax specifically to come up with that extra 1.3 percent, but the revenue can actually come from anywhere. And we have a host of options. This may be a political or an ideological challenge, but it is not an economic one.

What of the rising spending on health programs and interest rates? That's the problem, according to CBO's projections. But to say that predicting the future of these programs is tricky is a massive understatement. Health care programs like Medicare don't simply send people checks; they buy them health care. So to project this spending CBO has to make an educated guess about the path of health care costs for the next 25 years. It has to guess what the Federal Reserve will do about interest rates and how financial markets will behave.

In fact, in recent years CBO has consistently and dramatically overshot the path of interest rates on the U.S. debt load.

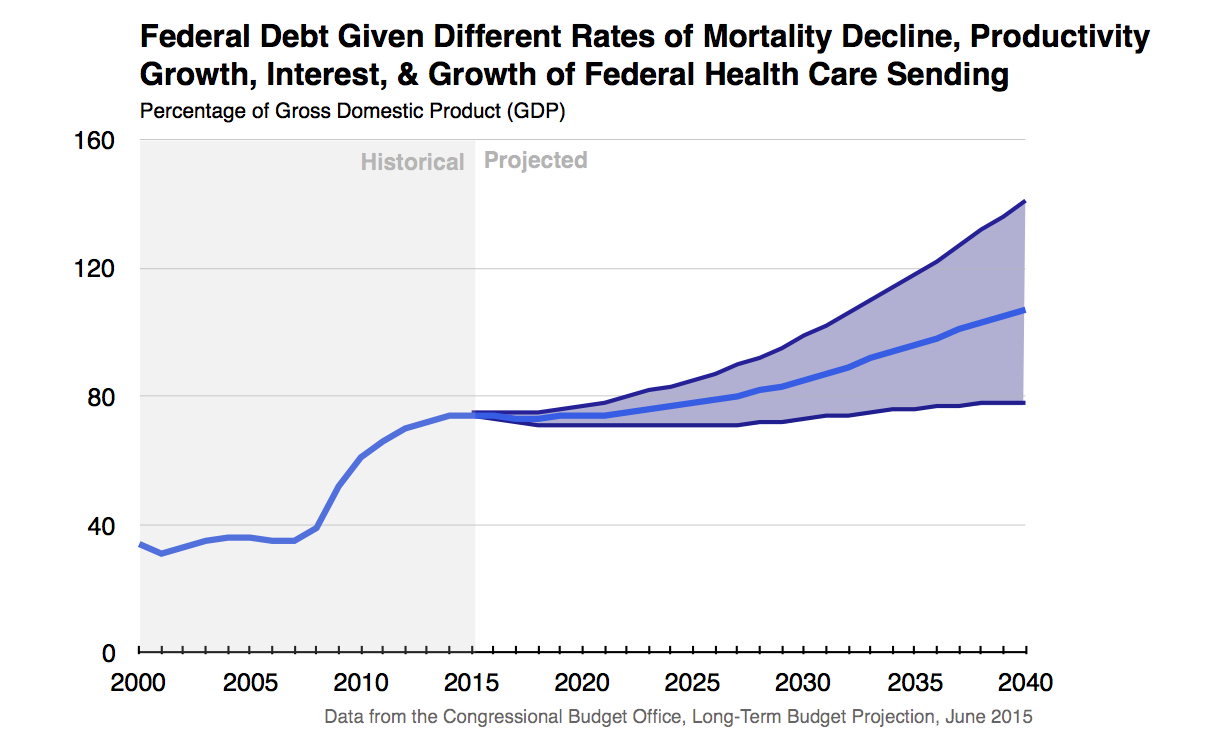

This all introduces huge variability into future debt projections. If health care costs continue slowing (thank you, ObamaCare) and interest rates increase less than CBO projects, and other things like productivity growth and mortality rates go our way, it's entirely possible the debt will only rise from 74 percent of GDP to 78 percent by 2040.

And even if debt does reach 140 percent or 175 percent in 2040, under CBO's worst-case scenarios, so what? Interest rates on our debt have been trending downwards for decades, and are now at historic lows. Japan's debt is 226 percent of GDP, and it has not suffered a debt crisis and still enjoys remarkably low interest rates. As advanced nations, America and Japan both have the advantage that they issue their own currency. In a pinch, they can pay off their debt obligations by printing money rather than with tax revenue. The only upper limit on that is inflation, and inflation rates for both countries are rock bottom. The simple fact is, we have no idea what debt load America can carry.

So not only is Marco Rubio wrong that Social Security is contributing to the debt crisis, he's quite likely wrong that there's any looming debt crisis it could contribute to. My fellow Millennials will get their Social Security checks when they retire.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

Antibiotic resistance: the hidden danger on Ukraine’s frontlines

Antibiotic resistance: the hidden danger on Ukraine’s frontlinesUnder The Radar Threat is spreading beyond war zones to the ‘doorstep’ of western Europe

-

‘Capitalism: A Global History’ by Sven Beckert and ‘American Canto’ by Olivia Nuzzi

‘Capitalism: A Global History’ by Sven Beckert and ‘American Canto’ by Olivia NuzziFeature A consummate history of capitalism and a memoir from the journalist who fell in love with RFK Jr.

-

Who will the new limits on student loans affect?

Who will the new limits on student loans affect?The Explainer The Trump administration is imposing new limits for federal student loans starting on July 1, 2026

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred

-

Will Trump's 'madman' strategy pay off?

Will Trump's 'madman' strategy pay off?Today's Big Question Incoming US president likes to seem unpredictable but, this time round, world leaders could be wise to his playbook

-

Democrats vs. Republicans: who are US billionaires backing?

Democrats vs. Republicans: who are US billionaires backing?The Explainer Younger tech titans join 'boys' club throwing money and support' behind President Trump, while older plutocrats quietly rebuke new administration