Has Janet Yellen seen the light on productivity growth?

America's productivity isn't what it used to be — and the head of the Federal Reserve might finally understand why

What happened to America's productivity boom?

In the mid-20th century, productivity growth — which basically means workers doing more with less — bounced around at 2 to 4 percent. It fell in the 1970s and '80s to under 2 percent, then jumped briefly back to the mid-century trend in the late '90s and early 2000s. Then it collapsed again with the Great Recession and has stayed at rock-bottom since. And economists don't really know why.

There have been a few theories, of course. Since we're swimming in iPhones and personal apps, what if our methods of measuring productivity are just off? Recent research put the kibosh on that idea. Or maybe the quality of American workers just isn't what it once was? Research nixed that one too. Maybe taxes and regulations are discouraging innovation — but the slowdown is everywhere: Canada, Britain, Japan, Germany, etc. Economist Robert Gordon theorizes that 20th Century technology gains — electricity, cars, washing machines, toilets, airplanes — were by their nature one-of-a-kind advances we won't ever repeat. Which is possible. But who can predict the future?

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

There is, however, another theory that more left-leaning economists like Jared Bernstein and Josh Bivens have been pushing. And this week it got a subtle boost from none other than Federal Reserve Chair Janet Yellen, in a speech she gave in Philadelphia.

There is some evidence that the deep recession had a long-lasting effect in depressing investment, research and development spending, and the start-up of new firms, and that these factors have, in turn, lowered productivity growth. With time, I expect this effect to ease in a stronger economy. I also see no obvious slowdown in the pace or the potential benefits of innovation in America, which likewise may bear fruit more readily in a stronger economy. [Yellen]

Where Yellen matches the thinking of left-wing economists is on the "long-lasting effect" of the Great Recession and the possibility that innovation will return with a stronger economy. Because a strong economy has one key characteristic: It's really hard for businesses to find enough workers.

Think about it: When the economy is strong, jobs are plentiful. And when jobs are plentiful, companies live in terror of losing their workers to competitors that will pay them more. So businesses have to constantly invest in new capital, labor-saving technology, and research and development in order to do more with the dwindling supply of workers they can afford. But crucially this only holds true when the ratio of job seekers to openings is one-to-one.

Right now there are 1.4 seekers for every job — meaning it's workers, not businesses, who are terrified. That means workers aren't demanding higher wages, which means businesses can maintain a profit by squeezing their employees with depressed wages rather than boosting productivity. Plus, in a depressed economy, borrowing is cheap and interest rates are low because there's lots of excess money floating around. That allows unproductive companies to roll over cheap loans and extend their lives.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

When Vox editor Ezra Klein looked at the productivity mystery, he concluded new technological advances are happening, but they just aren't changing the way we work, specifically. The tech is there, but it's not diffusing through the market. The lack of enough jobs for everyone is probably why: Businesses aren't creating, learning, or adopting new technologies simply because they don't have to in order to stay profitable.

As it turns out, the last time the job seekers-to-openings neared the 1-to-1 ratio was in that late '90s economic and innovation boom. The data doesn't go back before that, but we have other measures showing the only other time jobs were similarly plentiful was back in the mid-century, up to the mid-'70s, which roughly matches up with rising productivity.

Basically, the economy has gone through long periods over the last few decades when there's more available workers than available jobs. When that happens, businesses get lazy.

The fact that the head of the Federal Reserve understands this is huge — because she might be the only one left who can whip them into shape.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

Sudoku: January 2026

Sudoku: January 2026Puzzles The daily medium sudoku puzzle from The Week

-

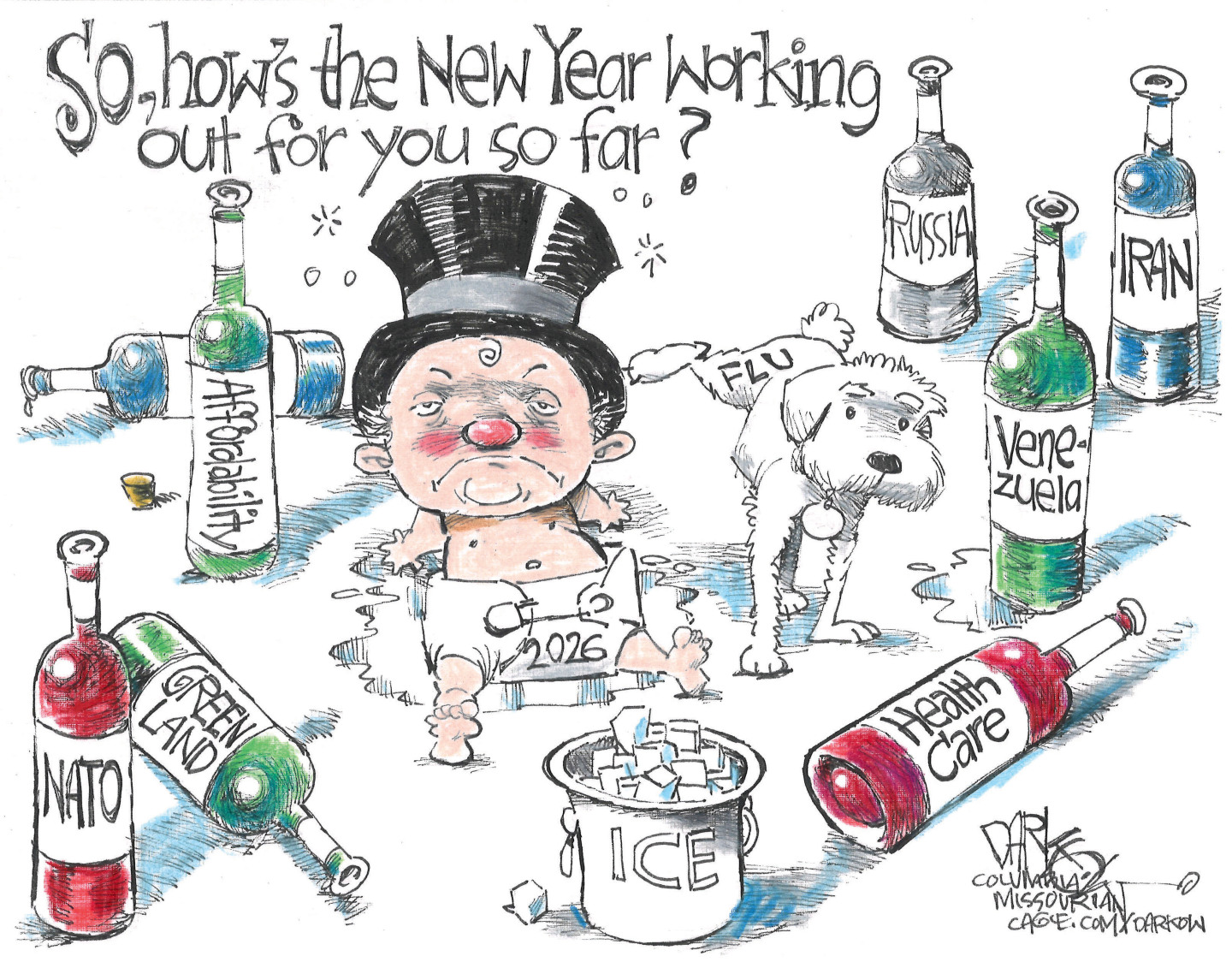

Political cartoons for January 13

Political cartoons for January 13Cartoons Tuesday’s political cartoons include a rocky start, domestic threats, and more

-

Judge clears wind farm construction to resume

Judge clears wind farm construction to resumeSpeed Read The Trump administration had ordered the farm shuttered in December over national security issues

-

The pros and cons of noncompete agreements

The pros and cons of noncompete agreementsThe Explainer The FTC wants to ban companies from binding their employees with noncompete agreements. Who would this benefit, and who would it hurt?

-

What experts are saying about the economy's surprise contraction

What experts are saying about the economy's surprise contractionThe Explainer The sharpest opinions on the debate from around the web

-

The death of cities was greatly exaggerated

The death of cities was greatly exaggeratedThe Explainer Why the pandemic predictions about urban flight were wrong

-

The housing crisis is here

The housing crisis is hereThe Explainer As the pandemic takes its toll, renters face eviction even as buyers are bidding higher

-

How to be an ally to marginalized coworkers

How to be an ally to marginalized coworkersThe Explainer Show up for your colleagues by showing that you see them and their struggles

-

What the stock market knows

What the stock market knowsThe Explainer Publicly traded companies are going to wallop small businesses

-

Can the government save small businesses?

Can the government save small businesses?The Explainer Many are fighting for a fair share of the coronavirus rescue package

-

How the oil crash could turn into a much bigger economic shock

How the oil crash could turn into a much bigger economic shockThe Explainer This could be a huge problem for the entire economy