What the AT&T-Time Warner deal means for the future of media

I, for one, welcome our new telco overlords

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

It's official: AT&T wants to buy Time Warner for a whopping $85 billion. For anyone who doesn't know, AT&T mostly sells telecommunications services: phone, cable, and internet subscriptions. Time Warner, on the other hand, mostly makes content: TV and movies.

This merger is important — not just because of the eye-popping amount of money involved — but because it heralds a new industry trend of telecommunications companies buying into media.

The internet has upended the media world. Thanks to the internet, much of today's digital media has no marginal cost of production. It costs zero to make an extra copy of a song, an article, or a movie. Even without piracy, this means that entrepreneurs will take advantage of this cost differential to offer lower-cost media, and that consumers will demand lower-cost media. This is causing media companies to carefully rethink their business models.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

For telecommunications companies (or "telcos" for short), buying into media makes sense. These giants are also threatened by the internet. In an industry where everybody is selling the same product — access to the web — it becomes very difficult to differentiate between companies, and competition becomes a matter of ruthless cost-cutting. Telcos fear becoming like the airline industry, where price competition rules the day, consumers only care about getting the cheapest flight, and no company can eke out a profit.

An obvious answer is to do what management consultants call "moving up the value chain." Time Warner owns HBO. If AT&T owns Time Warner, AT&T now has something Verizon doesn't: It can offer customers a sweet deal on HBO subscriptions.

We'll probably see many more deals like this in the near future. In my own country of France, this kind of thing has been happening for a while. During the heyday of the dotcom bubble, Vivendi became a conglomerate based on the strategy of owning "both the container and the content." For that particular company it all came crashing down when the bubble popped under a mountain of debt, but the strategic insight was sound. More recently, the cable conglomerate Altice has been buying up media companies left and right.

What does this mean for the future of media?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Well, actually, it's probably a good thing. Producing good content costs money, and that money has to come from somewhere. It's going to come less and less from consumers directly (even if they still pay, they'll pay less — Netflix has less revenue per customer than HBO, Kindle books cost less than physical books, an iTunes movie is cheaper than a DVD, and so on). And as the endless sea of content reduces the average rate at which average inventory is sold, advertisers will pay less, too. So it's possible that, more and more, the money for producing content will come from companies that subsidize media for strategic reasons. And as far as philanthropists go, telecommunications conglomerates are probably better bets than, say, Russian oligarchs.

There is no such thing as an unbiased news organization or a perfect creative ecosystem. The question is not whether such tensions exist, because they always have and always will, the question is how bad are they, and can they be managed? For many years, NBC was owned by General Electric, a global financial-industrial conglomerate with a finger in countless industries, and yet NBC News was a respected news-gathering organization. Companies that own media do have a reputational interest in preserving their independence, whether creative or political. And, honestly, if it weren't a telecommunications companies vying for media companies, it would be something else: advertisers, Google and Facebook's algorithms, Apple's distribution schemes.

As far as these things go, this ink-stained wretch welcomes his new telco overlords.

Pascal-Emmanuel Gobry is a writer and fellow at the Ethics and Public Policy Center. His writing has appeared at Forbes, The Atlantic, First Things, Commentary Magazine, The Daily Beast, The Federalist, Quartz, and other places. He lives in Paris with his beloved wife and daughter.

-

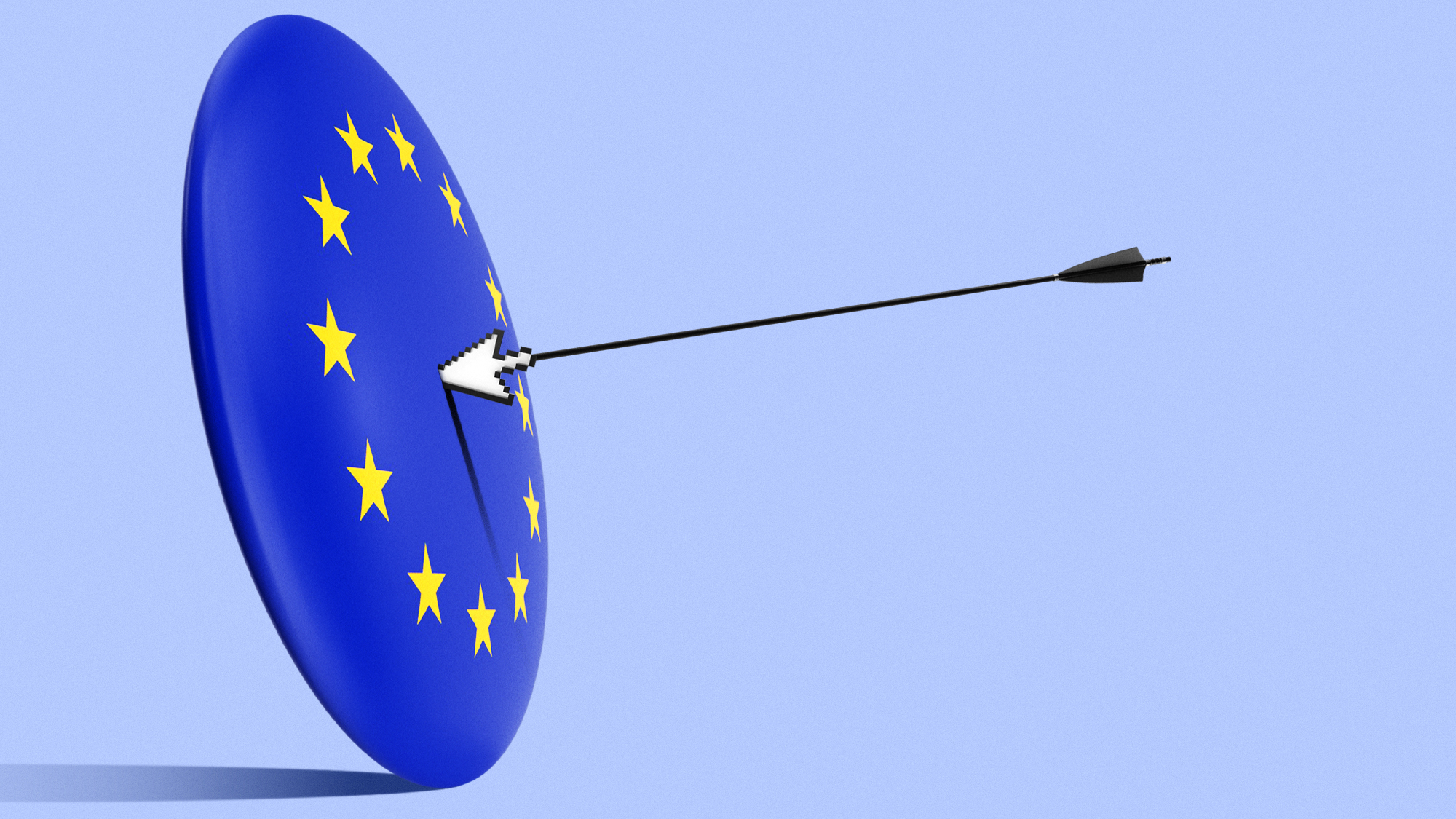

Can Europe regain its digital sovereignty?

Can Europe regain its digital sovereignty?Today’s Big Question EU is trying to reduce reliance on US Big Tech and cloud computing in face of hostile Donald Trump, but lack of comparable alternatives remains a worry

-

The Mandelson files: Labour Svengali’s parting gift to Starmer

The Mandelson files: Labour Svengali’s parting gift to StarmerThe Explainer Texts and emails about Mandelson’s appointment as US ambassador could fuel biggest political scandal ‘for a generation’

-

Magazine printables - February 13, 2026

Magazine printables - February 13, 2026Puzzle and Quizzes Magazine printables - February 13, 2026

-

The pros and cons of noncompete agreements

The pros and cons of noncompete agreementsThe Explainer The FTC wants to ban companies from binding their employees with noncompete agreements. Who would this benefit, and who would it hurt?

-

What experts are saying about the economy's surprise contraction

What experts are saying about the economy's surprise contractionThe Explainer The sharpest opinions on the debate from around the web

-

The death of cities was greatly exaggerated

The death of cities was greatly exaggeratedThe Explainer Why the pandemic predictions about urban flight were wrong

-

The housing crisis is here

The housing crisis is hereThe Explainer As the pandemic takes its toll, renters face eviction even as buyers are bidding higher

-

How to be an ally to marginalized coworkers

How to be an ally to marginalized coworkersThe Explainer Show up for your colleagues by showing that you see them and their struggles

-

What the stock market knows

What the stock market knowsThe Explainer Publicly traded companies are going to wallop small businesses

-

Can the government save small businesses?

Can the government save small businesses?The Explainer Many are fighting for a fair share of the coronavirus rescue package

-

How the oil crash could turn into a much bigger economic shock

How the oil crash could turn into a much bigger economic shockThe Explainer This could be a huge problem for the entire economy