Why a tax bill failure would be good for the GOP

Another legislative faceplant would be embarrassing. But in the long run, it might just be a good thing.

Fear can be a great motivator. And that goes a long way toward explaining why congressional Republicans are more likely than not to pass their unpopular tax cut plan.

Republican lawmakers fear heading into the 2018 midterm elections with no significant accomplishments while also bungling what is supposed to be their core competency: cutting taxes. No wonder many GOPers on Capitol Hill fervently believe that failure to pass tax cuts would present them with an existential electoral threat. Their party's leader, President Trump, would attack them as do-nothing swamp creatures. Their voters would dismiss them as incompetent elitists. And their impatient donors would close their wallets.

This is hardly a crazy scenario. The fear emanating from Republicans is both palpable and understandable. They can't fail. They just can't. Then again, failure really didn't look like an option with ObamaCare repeal, either. Certainly not after so many votes and promises during the Obama presidency. And yet fail Republicans did!

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

With a slim 52-to-48 advantage, the GOP has little margin for error in the Senate — and even less if the sausage-making process gets extended and Democrats scoop up an Alabama Senate seat in the Dec. 12 special election. Republicans think time is of essence — they're hoping for a floor vote as early as Thursday — and they might be right. Let's put it this way: If Republicans are still talking about their tax bill much past New Year's Day, they might well be apportioning blame rather than taking credit.

But this alarmist impulse, although understandable, might be wrong. Failure might not be catastrophic. It might even be a blessing in disguise.

Remember, the U.S. is in its 101st month of a steady-if-unspectacular economic expansion. The unemployment rate is low. While there are obviously millions upon millions of Americans who continue to struggle, overall the economy simply isn't the priority for voters that it is in times of real economic crisis. What's more, a failed tax cut is unlikely to derail the expansion, since expectations of a fat tax cut aren't responsible for the growing economy and rising stock market. (You can thank a global economic upturn for that.) And tax cuts — much less corporate tax cuts — weren't the motivating factor behind the Trumpopulist surge. Tax cuts never jazzed core Trump voters the way immigration restriction and The Wall did. Trump's diehard supporters won't howl over a failure to slash corporate tax rates.

This tax bill is also terribly flawed. Its benefits are too tilted toward wealthier Americans. It would increase deficits and debt at a time when both are already high and headed higher. And the changes to business taxes are hardly constructed to optimize economic growth. What's more, passing a fiscally reckless bill on a party-line vote ensures Democrats will be highly motivated to try to repeal and replace it as soon as they have the required political muscle. Hardly a recipe for business certainty.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

But if, on the other hand, the GOP tax plan failed, lawmakers might actually be able to cook up a long-lasting bipartisan agreement such as combining a simple payroll tax cut with a less drastic corporate tax-rate cut to 28 percent, as President Obama proposed back in 2012.

It's not crazy. Imagine: A tax failure might begin to free up the oxygen needed for the GOP to think about all the other ways smart policy might enable faster economic growth that is more broadly shared. As a party that still professes a deep faith in market economics, how about a GOP agenda aimed at rooting out cronyism and other anti-competitive behaviors that weigh down growth? In their new book, The Captured Economy, Brink Lindsey and Steven Teles outline various ways in which "political entrepreneurship" is draining the economy of its dynamism and vigor: subsidies for financial risk-taking, stronger intellectual property law, occupational licensing, and draconian restrictions on new housing. These are all cases in which narrow interests are distorting competition to the harm of the many.

Real reform is desperately needed. And it might take the failure of this flawed bill to get us there.

Of course, it would be better if Republicans simply looked at the data and evidence and realized that no magic tax cut will turn 2 percent GDP growth into sustained 3 percent or 4 percent growth. Tax reform might be necessary, but it is hardly sufficient.

Experience may well have to do to convince Republicans. Odds are that this tax cut won't kick the U.S. economy into a higher gear and generate budget surpluses as far as the eye can see. And when it doesn't, maybe then the party will realize it has an opportunity to go in a different direction — and not fear doing so.

James Pethokoukis is the DeWitt Wallace Fellow at the American Enterprise Institute where he runs the AEIdeas blog. He has also written for The New York Times, National Review, Commentary, The Weekly Standard, and other places.

-

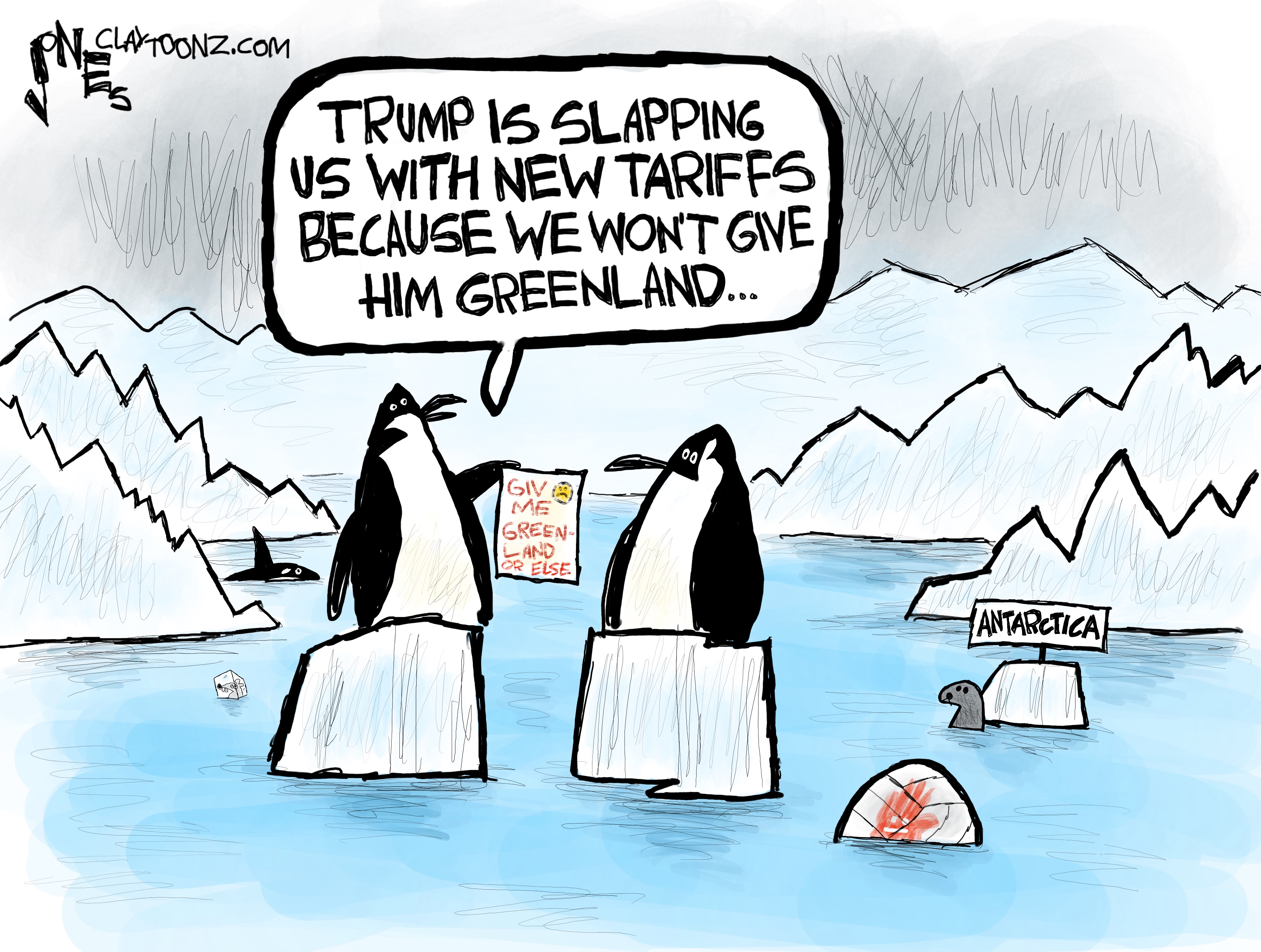

Political cartoons for January 19

Political cartoons for January 19Cartoons Monday's political cartoons include Greenland tariffs, fighting the Fed, and more

-

Spain’s deadly high-speed train crash

Spain’s deadly high-speed train crashThe Explainer The country experienced its worst rail accident since 2013, with the death toll of 39 ‘not yet final’

-

Can Starmer continue to walk the Trump tightrope?

Can Starmer continue to walk the Trump tightrope?Today's Big Question PM condemns US tariff threat but is less confrontational than some European allies

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred