The GOP's smart bet on the economy

The GOP tax bill is all about giving Republicans credit for a booming economy. Here's how.

The conventional wisdom is firming up that the Republican tax cut bill, which will surely become law now that it just needs to make it through conference, is the action of a party that expects to lose and just wants to pay off its donors before it does. The bill is hugely unpopular for a tax cut, and represents a blatant betrayal of the putative populism of the Trump administration. If they had any prayer of surviving the midterms, they'd never have tried it.

I see a somewhat different picture. It seems to me that, in the age of negative partisanship, the GOP is making the best move they have.

First of all, Republicans now have a legislative victory, and nothing succeeds like success. While I cheekily suggested back in June that the GOP should do literally nothing rather than pursue any of its unpopular agenda, that was partly because I didn't believe at the time that they were capable of passing a bill. But it's obviously better to have a win than a loss. I'd expect the bill to become more popular with those who lean Republican now that it's a win for their side.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Moreover, in notable contrast to the attempt to repeal ObamaCare, the tax cut has been sold primarily with an argument that is not obscenely contrary to fact. Repeal of ObamaCare was sold as something that would provide better health insurance more cheaply, which was not a remotely accurate description of any version of the bill. The core of the tax cut, on the other hand, is a huge reduction in corporate tax rates — and nobody has really tried to hide this. Rather, its proponents have made the case that the cuts will boost domestic investment, both by raising returns to capital and by encouraging repatriation of earnings by multinational corporations, and thereby boost growth and employment.

To be sure, this is a highly implausible theory under current economic conditions. Returns to capital are already at extraordinary highs, while public investment is starved. The frantic last-minute scribbling that preceded passage only made it less effective on its own terms; for example, the bill may actually discourage spending on R&D. And unless the Federal Reserve believes the rosiest of supply-side scenarios for productivity growth, they are likely to view increased deficits as a predicate to higher inflation, and bias monetary policy accordingly, more than undoing any stimulative impact of those deficits.

But correct or not, it's the GOP's theory — and, more to the point, it's the theory that was articulated to justify the bill. Which means the voters should be able to judge the tree by its fruit, and vote accordingly in 2018 and 2020 — precisely as Senate Majority Leader Mitch McConnell says they will.

Unfortunately, it's going to be very hard for voters to discern its effects in the short term — and the GOP leadership knows that. Had Republicans promised to put a lot of money in people's pockets directly, they'd have a problem — because they aren't doing that. But they promised higher growth. How will voters be able to tell whether they've gotten it?

They'll be able to tell whether their financial situation is better, and whether their neighbors are doing better. But they won't be able to tell whether an improving economy is due to the tax cut or due to factors that preceded it, or are entirely independent of it. And given the observed massive partisan divide on basic economic performance, it's a good bet that any data that does come in will, in the short term at least, be interpreted in the most favorable light by those who already lean Republican. So long as we don't enter a recession, a Democratic attack runs the risk of sounding like an attempt to convince someone the Earth is round when they can see for themselves that it is flat.

Of course, some people are going to see their taxes go up. Those people are going to be furious. But they are mostly people in high tax states who itemize their deductions. A great many middle- and working-class Americans will see their taxes increase over time, because of changes to how brackets are adjusted for inflation, but in the short term the tax hikes in the bill mostly transfer money from the upper middle class to the wealthy. So Democratic attacks on the bill in those terms will look an awful lot like defending wealthy homeowners in blue states — which may undercut rather than enhance any broader message about growing the economy more fairly.

Similarly, the elimination of the health insurance mandate may cripple the exchanges on which millions of Americans rely for health insurance. But while massive premium increases will be unpopular, the question is whether Americans will believe those increases are due to Republican sabotage or due to flaws in the original design of the program. Remember that, even to explain how the program has been sabotaged, Democrats effectively need to blame voters who, after the mandate is repealed, choose not to buy health insurance that they believe they don't need or can't afford. Accurate or not, that's not a winning message.

The tax bill is structured very much as a divide-and-conquer bill, one that punishes Democratic-leaning voters far more than Republican-leaning ones. That kind of politics has proven effective for Republicans. Even if voters wind up splitting the difference and blaming both parties for not coming together in the national interest, that's a net win for Republicans.

Even the guilty plea by former National Security Adviser Michael Flynn has a silver lining in this context. Now that they've passed their tax cut, Republicans in Congress and the Senate should feel freer to do whatever is necessary to hold their seats, whether that's defending President Trump or denouncing him, as the polls dictate. If the GOP can run in 2018 on the economy while the Democrats run on Russia, that's about as favorable terrain as Republicans are likely to get.

The Democrats should still be favored to make gains in 2018. And they'll still be able to run against the tax cut as a huge giveaway to the rich. But if a big business-friendly tax cut doesn't give Republican voters something to be enthusiastic about, they might as well go home. Now the question is whether the Democrats have an agenda of their own to get enthusiastic about — or whether negative partisanship can work as well for them as it has worked for the GOP.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Noah Millman is a screenwriter and filmmaker, a political columnist and a critic. From 2012 through 2017 he was a senior editor and featured blogger at The American Conservative. His work has also appeared in The New York Times Book Review, Politico, USA Today, The New Republic, The Weekly Standard, Foreign Policy, Modern Age, First Things, and the Jewish Review of Books, among other publications. Noah lives in Brooklyn with his wife and son.

-

Colleges are canceling affinity graduations amid DEI attacks but students are pressing on

Colleges are canceling affinity graduations amid DEI attacks but students are pressing onIn the Spotlight The commencement at Harvard University was in the news, but other colleges are also taking action

-

When did computer passwords become a thing?

When did computer passwords become a thing?The Explainer People have been racking their brains for good codes for longer than you might think

-

What to know before 'buying the dip'

What to know before 'buying the dip'the explainer Purchasing a stock once it has fallen in value can pay off — or cost you big

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred

-

Will Trump's 'madman' strategy pay off?

Will Trump's 'madman' strategy pay off?Today's Big Question Incoming US president likes to seem unpredictable but, this time round, world leaders could be wise to his playbook

-

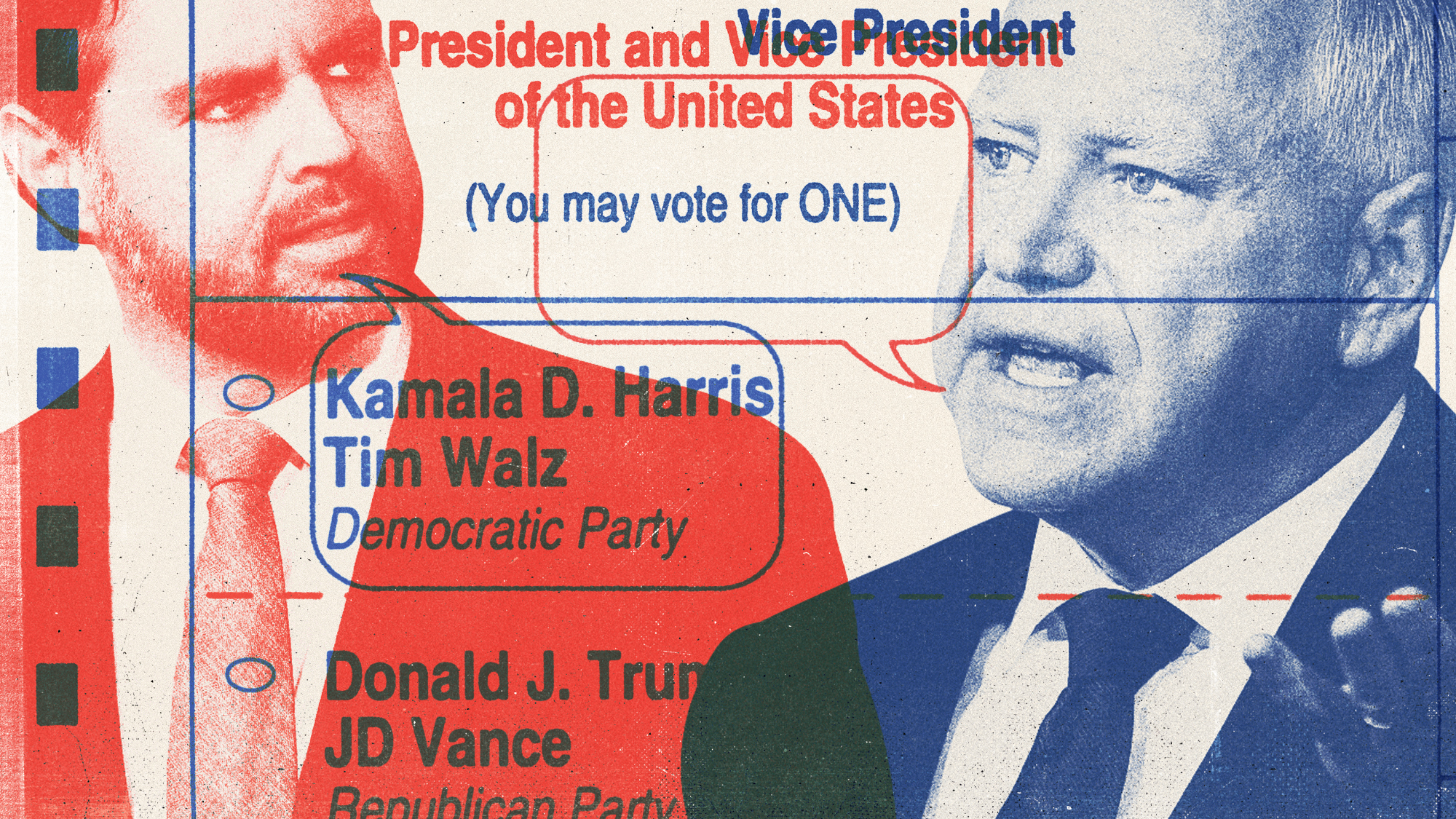

Democrats vs. Republicans: who are the billionaires backing?

Democrats vs. Republicans: who are the billionaires backing?The Explainer Younger tech titans join 'boys' club throwing money and support' behind President Trump, while older plutocrats quietly rebuke new administration

-

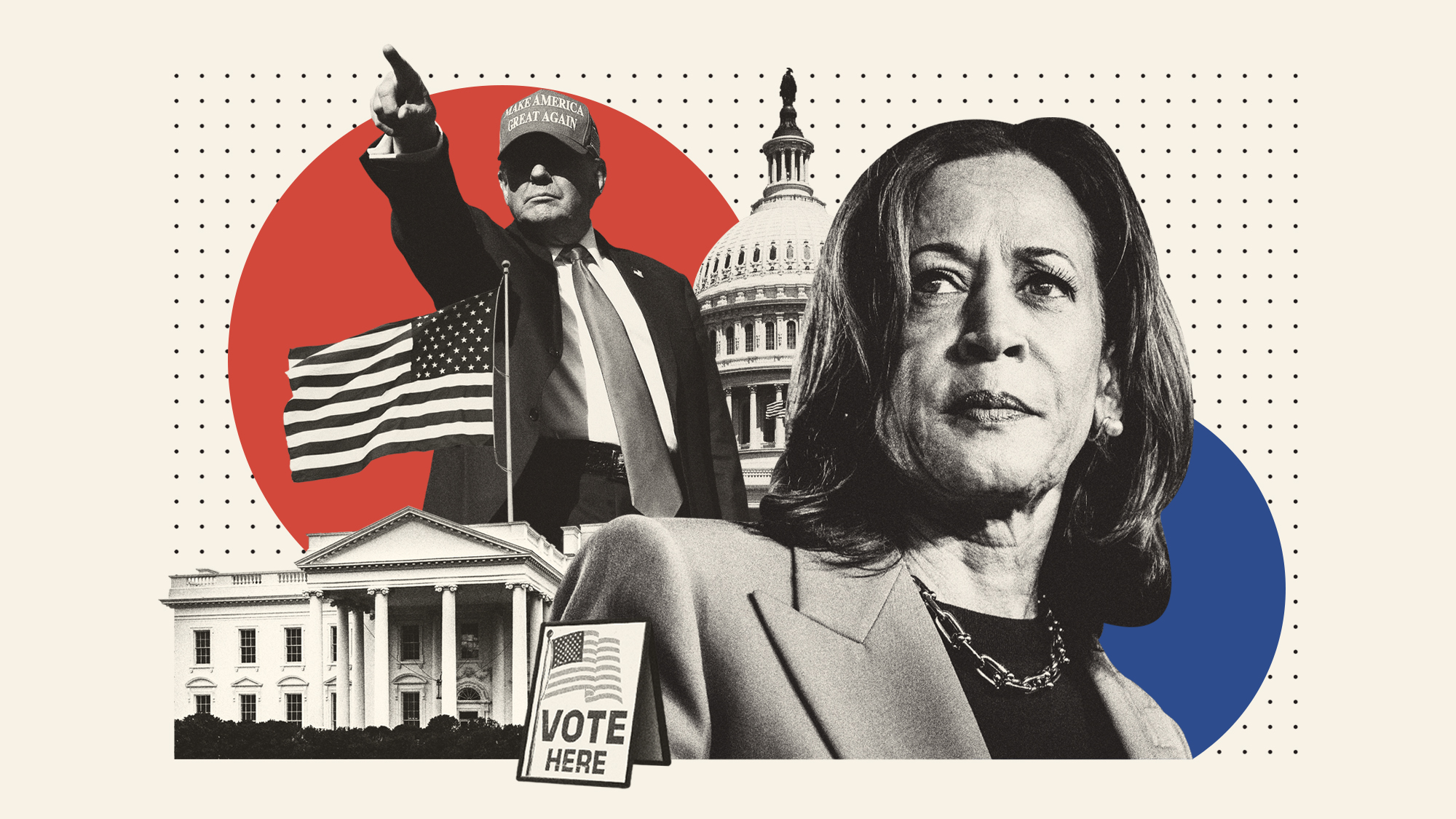

US election: where things stand with one week to go

US election: where things stand with one week to goThe Explainer Harris' lead in the polls has been narrowing in Trump's favour, but her campaign remains 'cautiously optimistic'

-

Is Trump okay?

Is Trump okay?Today's Big Question Former president's mental fitness and alleged cognitive decline firmly back in the spotlight after 'bizarre' town hall event

-

The life and times of Kamala Harris

The life and times of Kamala HarrisThe Explainer The vice-president is narrowly leading the race to become the next US president. How did she get to where she is now?

-

Will 'weirdly civil' VP debate move dial in US election?

Will 'weirdly civil' VP debate move dial in US election?Today's Big Question 'Diametrically opposed' candidates showed 'a lot of commonality' on some issues, but offered competing visions for America's future and democracy