Important tips for landlords

And more of the week's best financial advice

Here are three of the week's top pieces of financial advice, gathered from around the web:

Important tips for landlords

"Owning rental property is not as simple as handing over the keys to a tenant and sitting back as the money flows in," said Russ Wiles at The Arizona Republic. Yes, rental properties can be lucrative: The average annual return on single-family rentals is 9 percent, according to a UCLA study. But be prepared to keep investing. "Properties don't always pay for themselves," and you'll need some "financial flexibility" to cover maintenance and repairs. Mortgage expenses are often higher on rentals than on owner-occupied homes, so try to purchase a home with at least three bedrooms. Those are often easier to lease than smaller homes. Carefully screen prospective tenants with the help of online tools or a property manager, paying careful attention to their past rental history. Familiarize yourself also with your state's legal obligations for landlords.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Taxes and working from home

If you "live in one state but work remotely for an employer based in another," it could mean a bigger tax bill, said Jeanne Sahadi at CNN. Workers risk being double taxed if they live in one state but work for a company based in one of five states — New York, New Jersey, Delaware, Pennsylvania, and Nebraska — that apply a so-called convenience vs. necessity test to remote workers. If it's determined "that working from home is a matter of convenience for you rather than a necessity for your employer," you could be taxed on income both in the state where you live and in the state where your company is based. The good news: Many states give you a tax credit for any taxes you pay to another jurisdiction.

The cost of long-term care insurance

The long-term care insurance industry is stumbling under "sky-high premium increases," forcing many seniors to "make some unpleasant choices," said Walecia Konrad at CBS News. Today, just a dozen companies offer coverage, down from about 1,000 in 2002, and many policyholders have seen their premiums double in the past two years. What happened? Insurers "underestimated the amount they would pay in claims for runaway nursing-home costs and, because of longer life spans, the length of time they would have to pay them." Given how fast premiums are climbing, policyholders should reassess their coverage selections and reconsider them if their needs have changed. Another option might be hybrid care policies, which can be paired with permanent life insurance policies.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

31 political cartoons for January 2026

31 political cartoons for January 2026Cartoons Editorial cartoonists take on Donald Trump, ICE, the World Economic Forum in Davos, Greenland and more

-

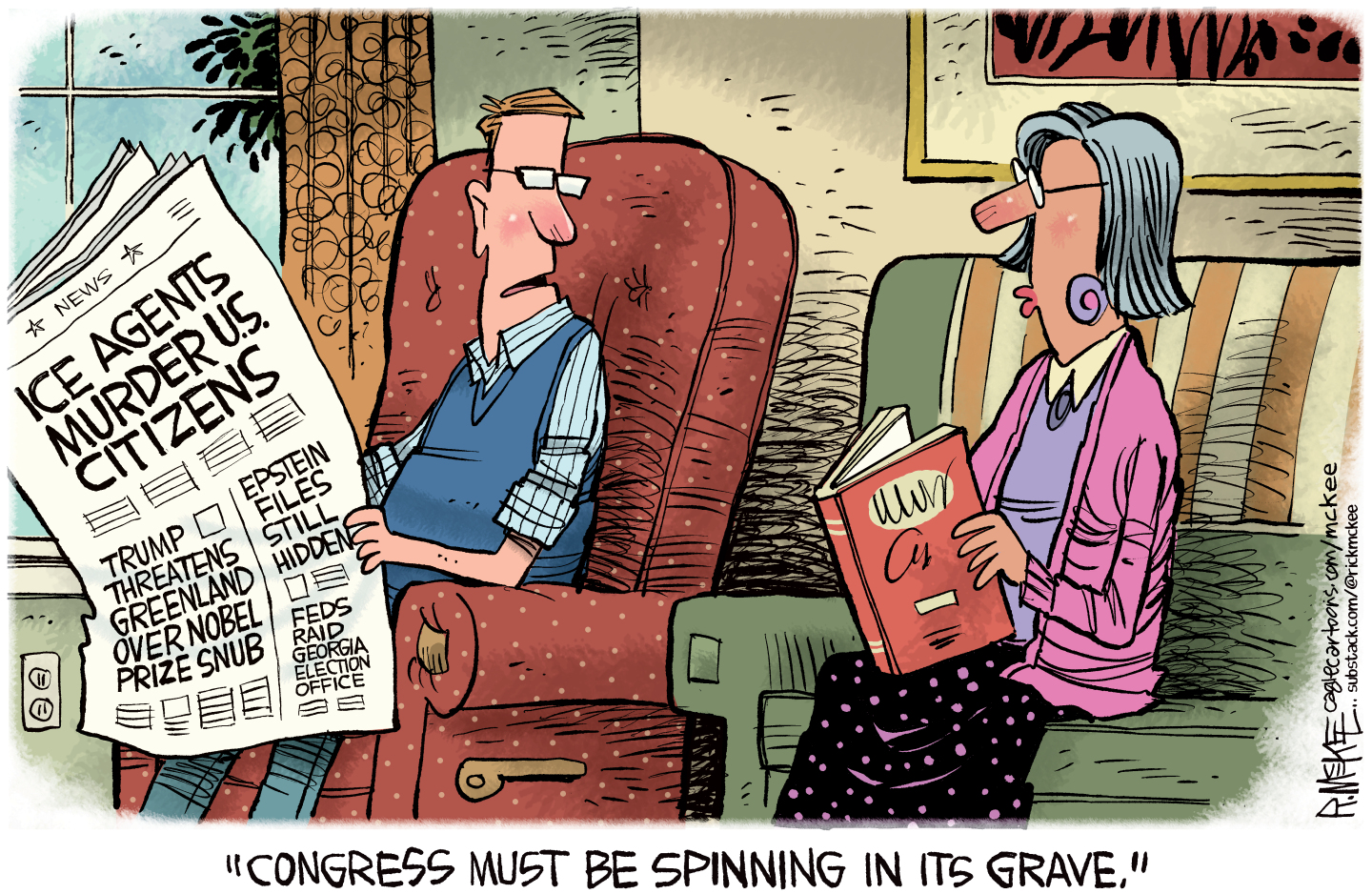

Political cartoons for January 31

Political cartoons for January 31Cartoons Saturday's political cartoons include congressional spin, Obamacare subsidies, and more

-

Syria’s Kurds: abandoned by their US ally

Syria’s Kurds: abandoned by their US allyTalking Point Ahmed al-Sharaa’s lightning offensive against Syrian Kurdistan belies his promise to respect the country’s ethnic minorities

-

The pros and cons of noncompete agreements

The pros and cons of noncompete agreementsThe Explainer The FTC wants to ban companies from binding their employees with noncompete agreements. Who would this benefit, and who would it hurt?

-

What experts are saying about the economy's surprise contraction

What experts are saying about the economy's surprise contractionThe Explainer The sharpest opinions on the debate from around the web

-

The death of cities was greatly exaggerated

The death of cities was greatly exaggeratedThe Explainer Why the pandemic predictions about urban flight were wrong

-

The housing crisis is here

The housing crisis is hereThe Explainer As the pandemic takes its toll, renters face eviction even as buyers are bidding higher

-

How to be an ally to marginalized coworkers

How to be an ally to marginalized coworkersThe Explainer Show up for your colleagues by showing that you see them and their struggles

-

What the stock market knows

What the stock market knowsThe Explainer Publicly traded companies are going to wallop small businesses

-

Can the government save small businesses?

Can the government save small businesses?The Explainer Many are fighting for a fair share of the coronavirus rescue package

-

How the oil crash could turn into a much bigger economic shock

How the oil crash could turn into a much bigger economic shockThe Explainer This could be a huge problem for the entire economy