Wall Street's reefer madness

Weed is the new bitcoin

Weed is the new bitcoin.

While the world of marijuana-related companies trading on U.S. stock exchanges is not large, one of the premiere examples had a roller coaster ride last week.

Tilray, a Canadian-based medical marijuana company, first started publicly trading in the U.S. in mid-July. It bounced around $25 a share through mid-August, then shot up to a peak of $263 on Wednesday — roughly a ten-fold increase in about a month. Things got so crazy the Nasdaq actually halted trades in the stock multiple times that day.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

By Friday afternoon it had settled to around $130 a share. Other marijuana stocks, such as Canopy Growth and GW Pharmaceuticals, also surged recently, but not by nearly the same amount. And the whole ride still leaves Tilray with a market value somewhere in the vicinity of $12 billion — more than Macy's, for context.

It's hard to see this as anything other than Wall Street betting that marijuana will soon be fully, or at least mostly, legal in America. And it's hard to see the specifics of most of these bets as anything other than foolish.

Now, as mentioned, Tilray is based in Canada. The company's website describes its mission as “cultivating and delivering the benefits of medical cannabis safely and reliably." And Canada has actually already legalized recreational marijuana use, though the change doesn't take effect until October. In America, marijuana use is legal to varying degrees in some states, but remains illegal nationally. That means any American company that invests in marijuana runs the risk of bringing down law enforcement's wrath. Tilray and other Canadian firms (like Canopy Growth) have no such problems.

But trace the saga of Tilray's rise, and it's pretty clearly about American enthusiasm.

The big news came last Tuesday, when Tilray announced the U.S. Drug Enforcement Administration had approved its plan to bring a cannabis capsule to the U.S. for a clinical trial at the University of California at San Diego. Brendan Kennedy, the company's CEO, also started doing the media rounds on shows like Jim Cramer's Mad Money on CNBC, promising the moon. He predicted marijuana would become a $100 billion industry. He asserted that you can't really judge marijuana like another agricultural product and that "people will drink cannabis instead of a beer ... they may eat a product in the form of a chocolate bar or an edible or consume a pill." And that the good old-fashioned pastime of just smoking weed will eventually be just 10 percent of all marijuana use.

This kind of argument assumes a massive increase in extremely varied demand as well as a lot of parallel innovation. And Kennedy himself admitted it doesn't hinge on Canada. "It's about all the countries that follow," he told Cramer. With its huge consumer base, that largely means the United States.

But while American marijuana law is certainly in contention, Republicans still control the White House and the presidency. Inveterate drug warrior Jeff Sessions remains attorney general. It's not impossible the country could experience a sea change in state-level and national marijuana laws in the next few years. But it's definitely a long shot.

Now, there's some modest version of Kennedy's story that could come to pass. But as Seeking Alpha pointed out, the full sweep of his vision is very unlikely.

It's also hard to see Tilray specifically as anything other than overvalued. For the moment, it isn't even profitable. Its sales are only projected to hit $41 million in 2018. And the clinical trial that sparked so much excitement involved all of 16 people.

"There is no basis in reality for these valuations," Micah Tapman, the managing director of the marijuana-focused private equity firm CanopyVentures, told CNN. "They are not necessarily bad companies. But the projections are delusional." Even Bruce Linton, the CEO of Canopy Growth, Tilray's fellow cannabis company, threw water on the excitement: "I think it got technically weird," he told CNBC.

Part of it might be that, precisely because there's a general sense that America is on the cusp of a major social change, investors are chomping at the bit. There's a lot of money looking to go into any halfway plausible marijuana business model and not a whole lot of companies to soak up that demand. There are many tiny companies trading on smaller Canadian exchanges, but only Tilray and a few others have been able to break into the bonanza of investment money offered by U.S. trading floors.

Even among its competitors, Tilray stands out as relatively unique, because it trades with options. "This potentially makes Tilray not only much easier to own than some of the other big Canadian growers, but also much easier to short, including via options," Seeking Alpha explained.

Still, the money is flying to everyone. Constellation Brands, which owns Corona, has dropped $4 billion into Canopy Growth on plans to create cannabis-based drinks. Aurora Cannabis, yet another Canadian firm, is reportedly working with none other than Coca-Cola on similar plans. Shares of Cronos group also jumped last week, before settling back down, on word that it was working on studies with the Canadian medical company Aleafia Health to develop cannabis-based treatments for insomnia.

One index of global marijuana stocks, which doesn't even include Tilray, doubled in size just in 2018.

The business possibilities for marijuana are certainly going to improve in the future. Eventually, America will probably get around to legalization. But if you think the knowable scenarios justify ranking one startup company on par with a national retail chain, you're probably smoking something.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

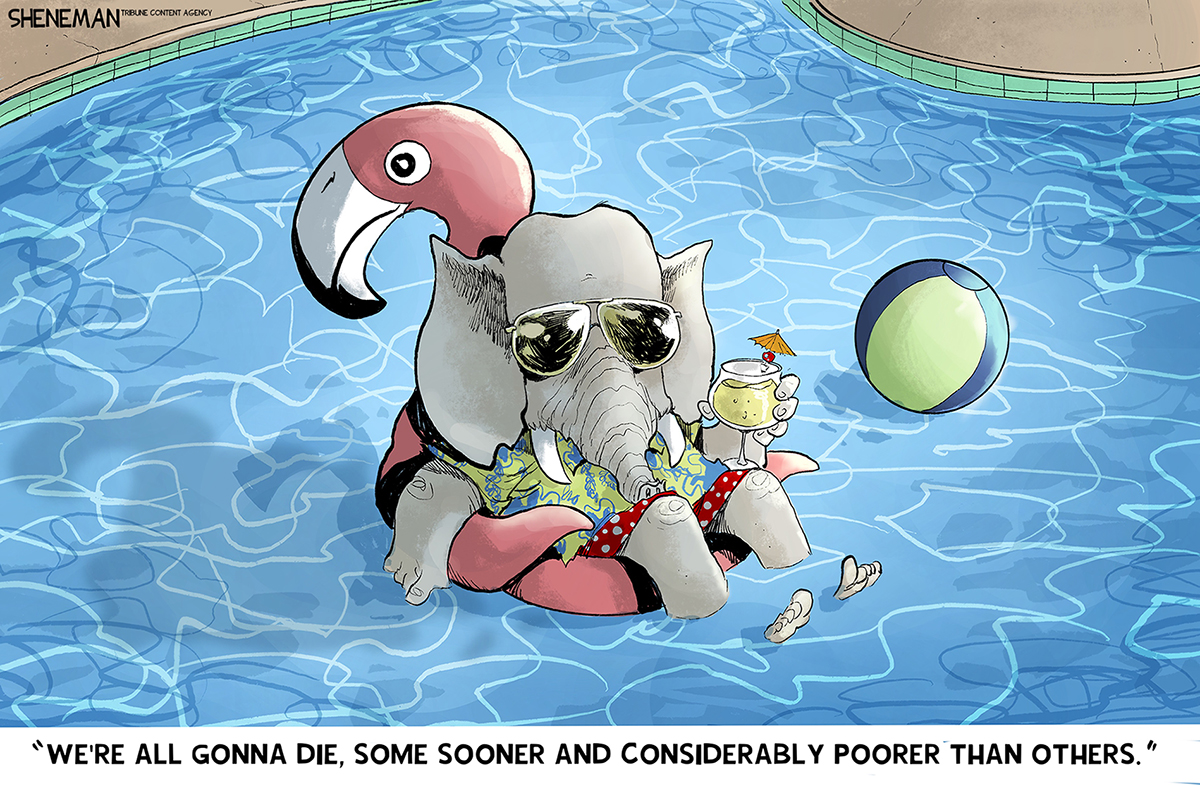

June 7 editorial cartoons

June 7 editorial cartoonsCartoons Saturday's political cartoons include reminders that we are all going to die, and Elon Musk taking a chainsaw to the 'Big, Beautiful, Bill'

-

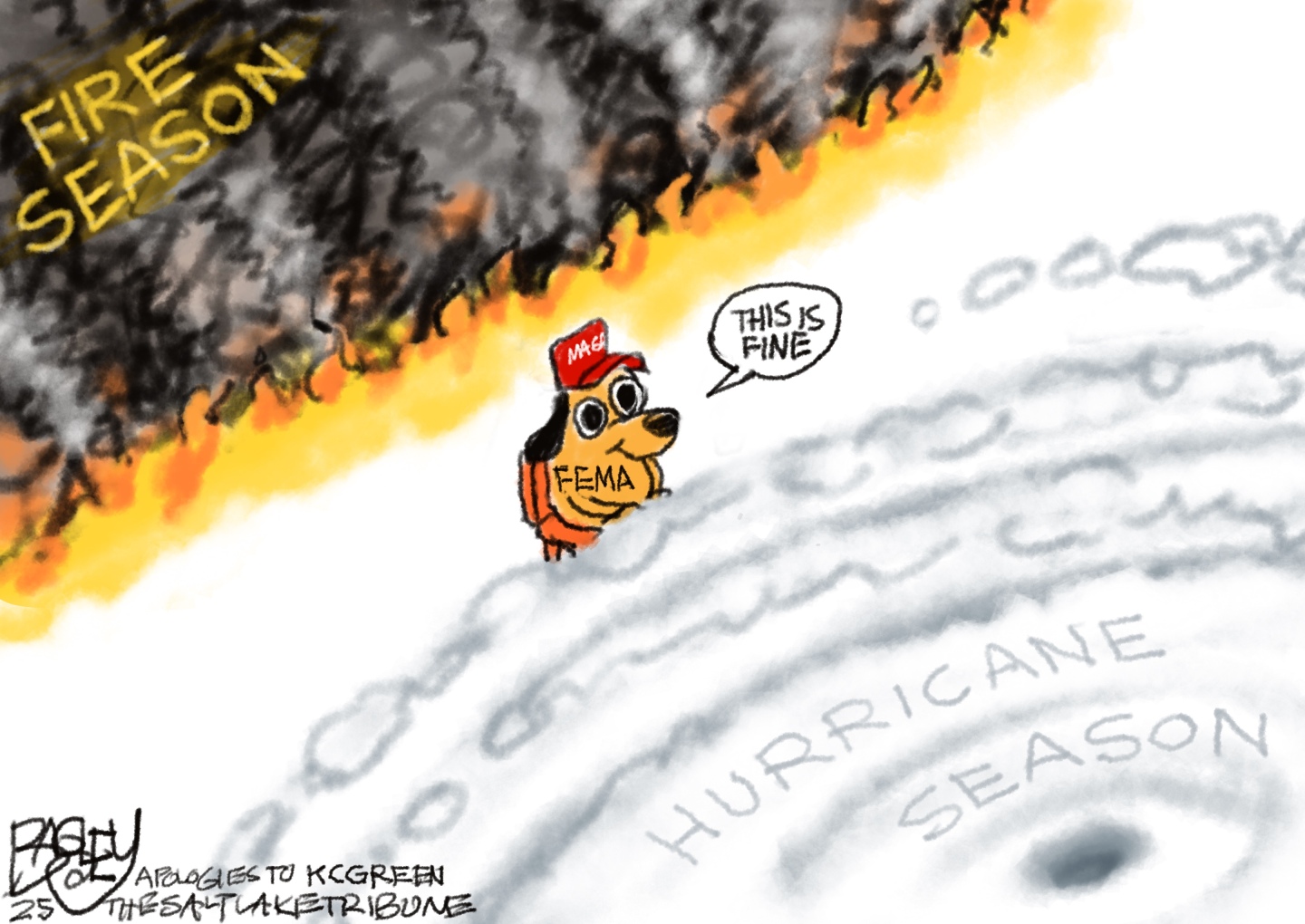

5 naturally disastrous editorial cartoons about FEMA

5 naturally disastrous editorial cartoons about FEMACartoons Political cartoonists take on FEMA, the hurricane season, and the This is Fine meme

-

Amanda Feilding: the serious legacy of the 'Crackpot Countess'

Amanda Feilding: the serious legacy of the 'Crackpot Countess'In the Spotlight Nicknamed 'Lady Mindbender', eccentric aristocrat was a pioneer in the field of psychedelic research

-

The pros and cons of noncompete agreements

The pros and cons of noncompete agreementsThe Explainer The FTC wants to ban companies from binding their employees with noncompete agreements. Who would this benefit, and who would it hurt?

-

What experts are saying about the economy's surprise contraction

What experts are saying about the economy's surprise contractionThe Explainer The sharpest opinions on the debate from around the web

-

The death of cities was greatly exaggerated

The death of cities was greatly exaggeratedThe Explainer Why the pandemic predictions about urban flight were wrong

-

The housing crisis is here

The housing crisis is hereThe Explainer As the pandemic takes its toll, renters face eviction even as buyers are bidding higher

-

How to be an ally to marginalized coworkers

How to be an ally to marginalized coworkersThe Explainer Show up for your colleagues by showing that you see them and their struggles

-

What the stock market knows

What the stock market knowsThe Explainer Publicly traded companies are going to wallop small businesses

-

Can the government save small businesses?

Can the government save small businesses?The Explainer Many are fighting for a fair share of the coronavirus rescue package

-

How the oil crash could turn into a much bigger economic shock

How the oil crash could turn into a much bigger economic shockThe Explainer This could be a huge problem for the entire economy