Big 3 credit-record firms agree to major changes to aid consumers

If you've ever had errors on your credit report, this will come as good news: On Monday, the three companies that assign your credit score — Equifax, Experian, and TransUnion — are announcing a significant overhaul in how they handle disputes in your credit record and unpaid medical bills, The Wall Street Journal reports. The new rules, to be phased in nationally over the next six to 39 months, are in response to a lawsuit filed by New York state.

Currently, if customers say that something is incorrect on their credit report, the credit-reporting firm assigns the complaint a three-digit number, and if the creditor says there's no problem, Equifax, Experian, and TransUnion typically don't change the report. Under the new rules, trained employees will have to investigate claimed discrepancies regardless of what the lender says. And importantly, the new rules will treat unpaid medical bills — often the fault of insurance companies — differently than other debt.

Monday's settlement comes after three years of investigation by the office of New York Attorney General Eric Schneiderman and more than a year of talks with the credit-reporting companies. It marks the biggest change to the industry since 2003. For more details, read the report in The Wall Street Journal.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

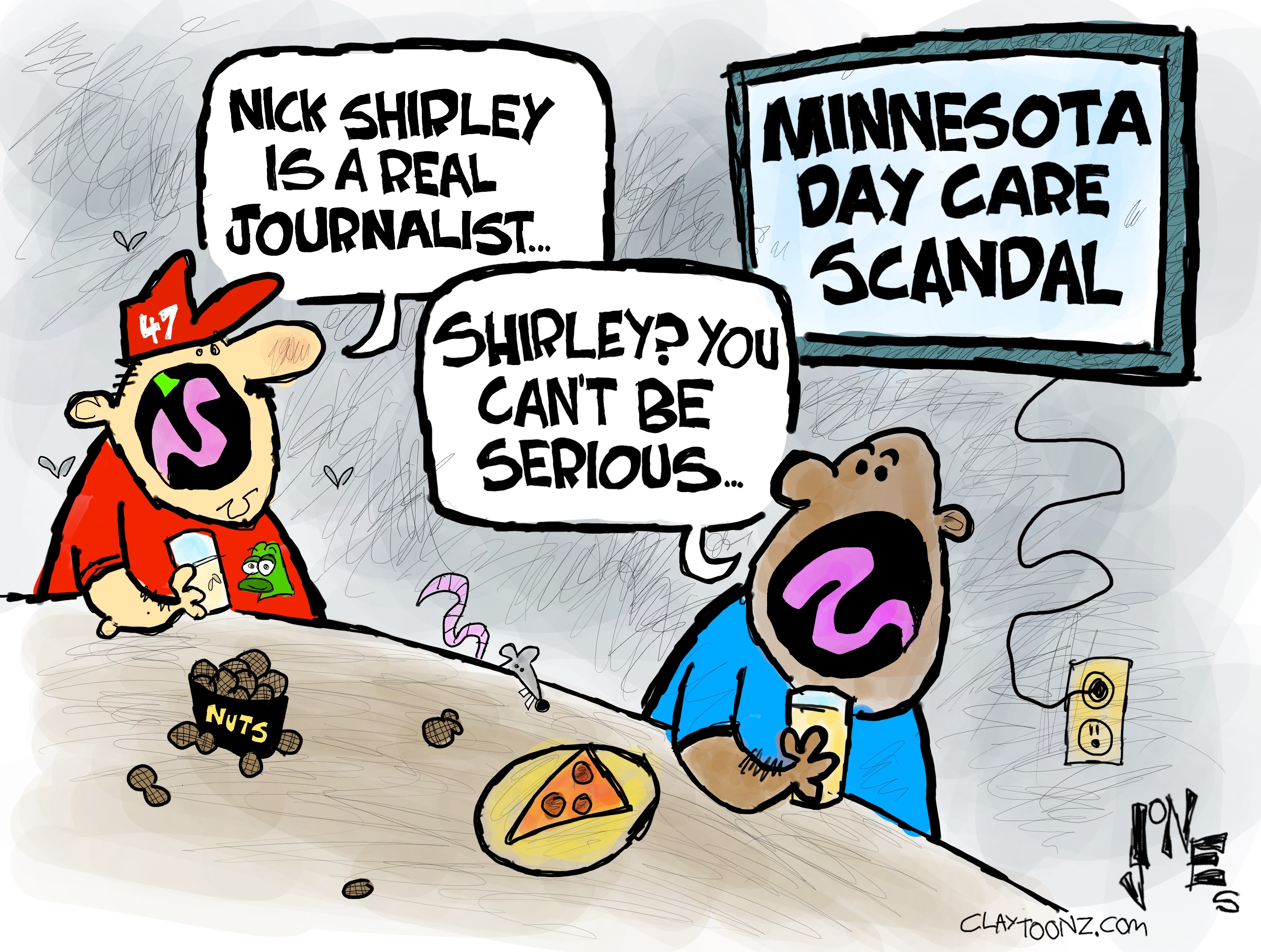

Political cartoons for January 4

Political cartoons for January 4Cartoons Sunday's political cartoons include a resolution to learn a new language, and new names in Hades and on battleships

-

The ultimate films of 2025 by genre

The ultimate films of 2025 by genreThe Week Recommends From comedies to thrillers, documentaries to animations, 2025 featured some unforgettable film moments

-

Political cartoons for January 3

Political cartoons for January 3Cartoons Saturday's political cartoons include citizen journalists, self-reflective AI, and Donald Trump's transparency

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform

-

Unemployment rate ticks up amid fall job losses

Unemployment rate ticks up amid fall job lossesSpeed Read Data released by the Commerce Department indicates ‘one of the weakest American labor markets in years’

-

US mints final penny after 232-year run

US mints final penny after 232-year runSpeed Read Production of the one-cent coin has ended

-

Warner Bros. explores sale amid Paramount bids

Warner Bros. explores sale amid Paramount bidsSpeed Read The media giant, home to HBO and DC Studios, has received interest from multiple buying parties

-

Gold tops $4K per ounce, signaling financial unease

Gold tops $4K per ounce, signaling financial uneaseSpeed Read Investors are worried about President Donald Trump’s trade war

-

Electronic Arts to go private in record $55B deal

Electronic Arts to go private in record $55B dealspeed read The video game giant is behind ‘The Sims’ and ‘Madden NFL’

-

New York court tosses Trump's $500M fraud fine

New York court tosses Trump's $500M fraud fineSpeed Read A divided appeals court threw out a hefty penalty against President Trump for fraudulently inflating his wealth

-

Trump said to seek government stake in Intel

Trump said to seek government stake in IntelSpeed Read The president and Intel CEO Lip-Bu Tan reportedly discussed the proposal at a recent meeting