Jared Kushner finalized $285 million 'bad boy' loan with Deutsche Bank a month before Trump's election

Jared Kushner, President Trump's son-in-law and senior adviser, secured a $285 million loan from Deutsche Bank, Trump's biggest known lender and at the time under investigation for allegedly allowing Russian money laundering, in October 2016, a month before Trump's election, The Washington Post reports. The Kushner loan was part of a refinancing deal for four retail floors of the former New York Times building off Times Square in Manhattan, and Kushner did not list the loan or his personal guarantee for the debt on his financial disclosure form filed with the Office of Government Ethics; a lawyer for Kushner said he was not obligated to disclose the loan.

Kushner purchased the four retail floors of the building for a reported $296 million in October 2015 from the family of an Uzbek-born Israeli billionaire named Lev Leviev, who is a vocal admirer of Russian President Vladimir Putin and once aspired to work with Trump on real estate deals in Moscow. Kushner filled the largely empty floors with retailers, and the October 2016 deal also included an $85 million loan from SL Green Realty, giving Kushner's business $74 million more than he paid for the retail space.

Kushner and his brother, Joshua, are listed as guarantors on the Deutsche Bank loan under what was termed a "nonrecourse carve-out," commonly known as a "bad boy" clause, the Post explains. "The way to look at this is, so long as you're not a 'bad boy' and don't do anything wrong, you have nothing to worry about," James Schwarz, a real estate lawyer who is an expert in such clauses, tells the Post. "To the extent you would do something fraudulent, then you have things to worry about" — namely personally being on the hook for millions of dollars. Separately, Kushner and his mother have a personal line of credit worth up to $25 million from Deutsche Bank, the Post notes.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

In December, Deutsche Bank paid $7.2 billion to settle U.S. charges related to fraud packaging residential mortgages, and in January it paid a $425 million fine to New York State to settle charges that it did not track large money transfers from Russia. The White House told the Post that Kushner "will recuse from any particular matter involving specific parties in which Deutsche Bank is a party." You can read more at The Washington Post.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

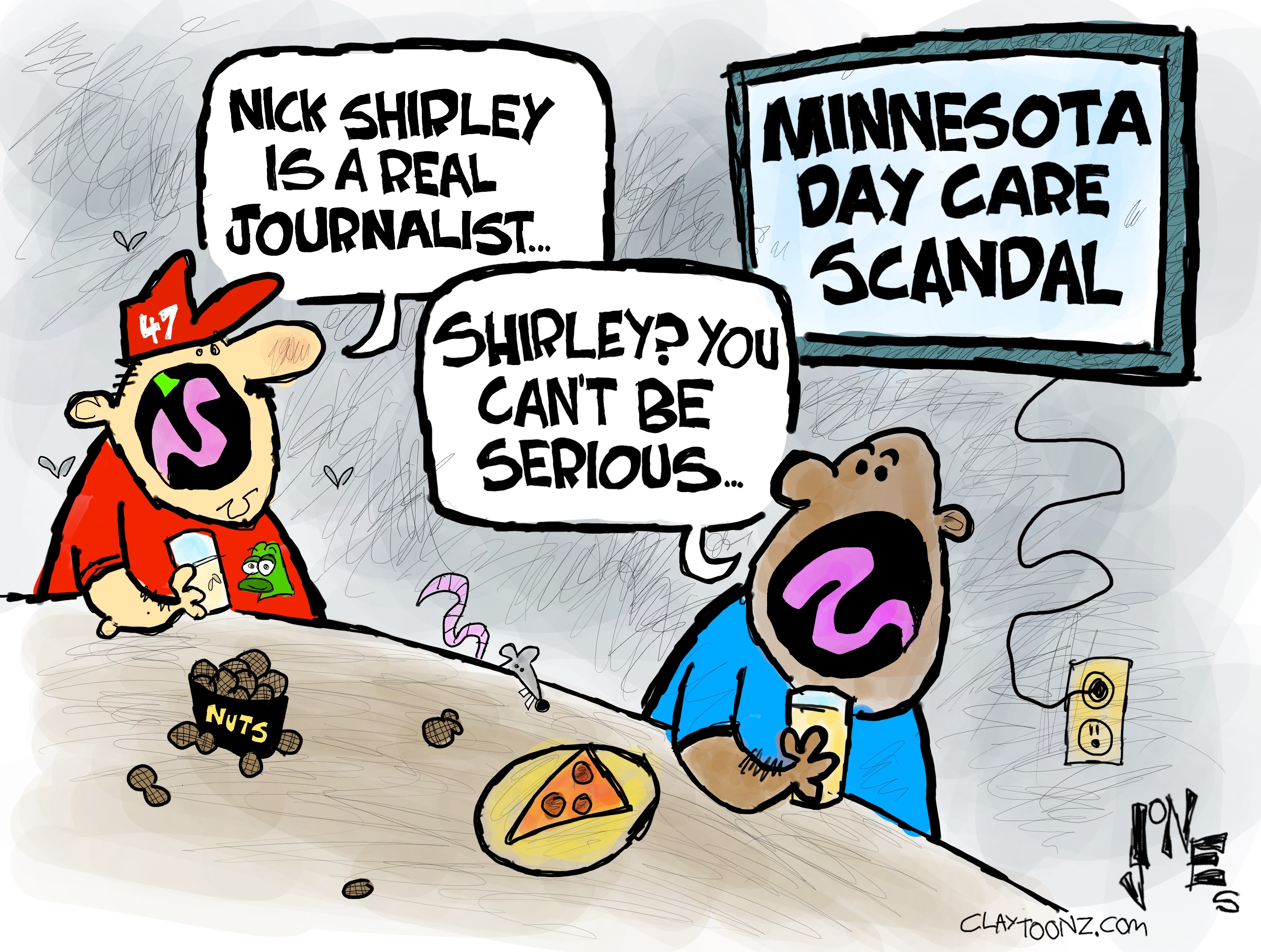

Political cartoons for January 4

Political cartoons for January 4Cartoons Sunday's political cartoons include a resolution to learn a new language, and new names in Hades and on battleships

-

The ultimate films of 2025 by genre

The ultimate films of 2025 by genreThe Week Recommends From comedies to thrillers, documentaries to animations, 2025 featured some unforgettable film moments

-

Political cartoons for January 3

Political cartoons for January 3Cartoons Saturday's political cartoons include citizen journalists, self-reflective AI, and Donald Trump's transparency

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform

-

Unemployment rate ticks up amid fall job losses

Unemployment rate ticks up amid fall job lossesSpeed Read Data released by the Commerce Department indicates ‘one of the weakest American labor markets in years’

-

US mints final penny after 232-year run

US mints final penny after 232-year runSpeed Read Production of the one-cent coin has ended

-

Warner Bros. explores sale amid Paramount bids

Warner Bros. explores sale amid Paramount bidsSpeed Read The media giant, home to HBO and DC Studios, has received interest from multiple buying parties

-

Gold tops $4K per ounce, signaling financial unease

Gold tops $4K per ounce, signaling financial uneaseSpeed Read Investors are worried about President Donald Trump’s trade war

-

Electronic Arts to go private in record $55B deal

Electronic Arts to go private in record $55B dealspeed read The video game giant is behind ‘The Sims’ and ‘Madden NFL’

-

New York court tosses Trump's $500M fraud fine

New York court tosses Trump's $500M fraud fineSpeed Read A divided appeals court threw out a hefty penalty against President Trump for fraudulently inflating his wealth

-

Trump said to seek government stake in Intel

Trump said to seek government stake in IntelSpeed Read The president and Intel CEO Lip-Bu Tan reportedly discussed the proposal at a recent meeting