Help to Buy: has the scheme been a failure?

Spending watchdog finds the programme has pushed up property prices and handed cash to the relatively wealthy

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

More than half of the homebuyers who have used the government-backed Help to Buy scheme could have purchased property without help from the state, the National Audit Office (NAO) has found.

Launched by then-chancellor George Osborne in 2013, the scheme was introduced to “boost home ownership and housing supply by making it easier for people to get mortgages”, PoliticsHome reports.

Under the programme, buyers put down a deposit of as little as 5% on new-build homes worth up to £600,000 and receive an equity loan from the state to cover 40% of the property’s value in London, or 20% elsewhere, says the Financial Times. The remainder is covered by a traditional mortgage.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

However, a report released by the spending watchdog this week has revealed that only 37% of the 211,000 people who have benefited so far from Help to Buy would not have been able to afford a property without the support. Around 4% of buyers handed a state-backed loan had a household income of more than £100,000, and one in five were not first-time buyers.

NAO chief Gareth Davies said: “Help to Buy has increased home ownership and housing supply, particularly for first-time buyers. However, a proportion of participants could have afforded to buy a home without the Government’s help.”

To some critics, the watchdog’s report confirms that the scheme has been a failure. Shadow housing secretary John Healey said the scheme was “poorly targeted and poor value for taxpayers’ money” and should be “tightly targeted on first-time buyers with low and middle incomes”.

The NAO also found that Help to Buy has boosted profits for big property developers including Redrow, Bellway, Taylor Wimpey, Barratt and Persimmon, while having a minimal effect in increasing the supply of homes, The Independent says.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

As the newspaper notes, the chief executive of Persimmon, the largest beneficiary of Help to Buy, “resigned last year after outrage over his £75m bonus, which had been boosted by sales subsidised with public money”.

Fran Boait, executive director of campaigning body Positive Money, said it was “now beyond clear” that “rather than helping those who can’t afford to buy a home, Help To Buy has mainly been a subsidy for a housing bubble, benefiting property developers and existing home owners”.

But the Government insists the programme is a success. In the wake of the NAO report, the Department for Housing, Communities and Local Government issued a statement saying that the more controversial transactions were an “acceptable consequence” of designing the scheme to be widely available.

Housing Minister Kit Malthouse called the scheme “genuinely life-changing for first-time buyers across the country”, providing the chance to get onto the property ladder.

“Not only has it supported more than 170,000 first-time buyers, it has increased home building by nearly 15%, and is set to make a profit for the public. It’s been a win-win,” he added.

However, while the Government is defending the scheme as a whole, Chancellor Philip Hammond has promised some reforms. In last year’s Budget, he announced that Help To Buy will be restricted to first-time buyers from April 2021.

-

Antonia Romeo and Whitehall’s women problem

Antonia Romeo and Whitehall’s women problemThe Explainer Before her appointment as cabinet secretary, commentators said hostile briefings and vetting concerns were evidence of ‘sexist, misogynistic culture’ in No. 10

-

Local elections 2026: where are they and who is expected to win?

Local elections 2026: where are they and who is expected to win?The Explainer Labour is braced for heavy losses and U-turn on postponing some council elections hasn’t helped the party’s prospects

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

The end of leasehold flats

The end of leasehold flatsThe Explainer Government reforms will give homeowners greater control under a move to the commonhold system

-

Why baby boomers and retirees are ditching Florida for Appalachia

Why baby boomers and retirees are ditching Florida for AppalachiaThe Explainer The shift is causing a population spike in many rural Appalachian communities

-

The pros and cons of new-builds

The pros and cons of new-buildsPros and Cons More options for first-time buyers and lower bills are offset by ‘new-build premium’ and the chance of delays

-

How the Grenfell tragedy changed the UK

How the Grenfell tragedy changed the UKfeature Six years on since the government vowed to ‘learn lessons’ has sufficient progress been made?

-

Pros and cons of building on the green belt

Pros and cons of building on the green beltPros and Cons More housing and lower house prices must be weighed against urban sprawl and conservation concerns

-

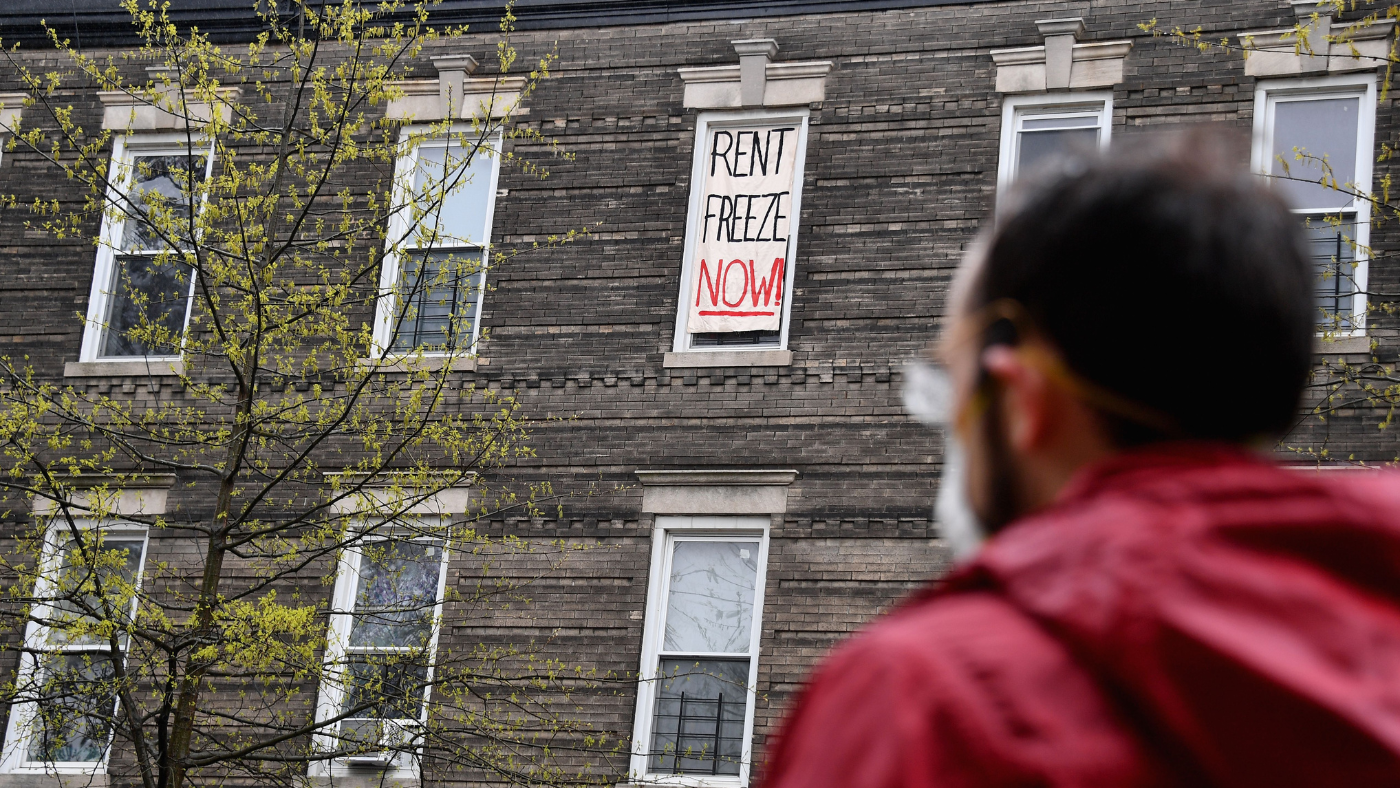

The pros and cons of rent freezes

The pros and cons of rent freezesPros and Cons Proponents say rent controls provide stability for tenants, but critics claim they won’t fix the housing crisis

-

The cooling housing market: what happens next for UK property?

The cooling housing market: what happens next for UK property?In the Spotlight The end of the latest boom is in sight. What kind of landing can we expect?

-

Shared ownership explained: how the home buying scheme works

Shared ownership explained: how the home buying scheme worksPros and Cons Getting on the property ladder is being made more affordable – but there are downsides