Are we headed for dotcom bubble 2.0?

Flotations of loss-making firms hit 2000 levels amid warning signs bubble could be about to burst

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The proportion of unprofitable companies floating on US exchanges has reached record levels, stoking fears the market could be headed for another dotcom bubble burst.

According to analysis by the Warrington College of Business at the University of Florida, 81% of the 134 firms listed publicly in America in 2018 were loss-making businesses and almost a third were tech stocks.

Harry Brennan in The Daily Telegraph writes that “the only time the percentage of publicly launching companies that made no profits at all was equally as high was in 2000, when 380 initial product offerings (IPOs) were recorded – the height of the dotcom bubble”.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

At that time investors poured money into start-up internet companies, betting on rapid growth and hopes of cashing in when their shares went public.

“Most of the dot-coms which listed on stock exchanges had done little more than consume vast amounts of investor cash and showed little prospect of achieving a profit” writes John Colley, a professor at Warwick Business School, on The Conversation.

“Traditional metrics of performance were overlooked and big spending was seen as a sign of rapid progress”, he adds, and when it turned out that many were failing to turn a profit, investment subsequently dried up and businesses collapsed.

Fast forward nearly two decades and 2019 “has been hailed the year of the tech ‘unicorn’ IPO,” says Brennan, “as private technology businesses valued at more than $1bn look to make their stock market debuts”.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

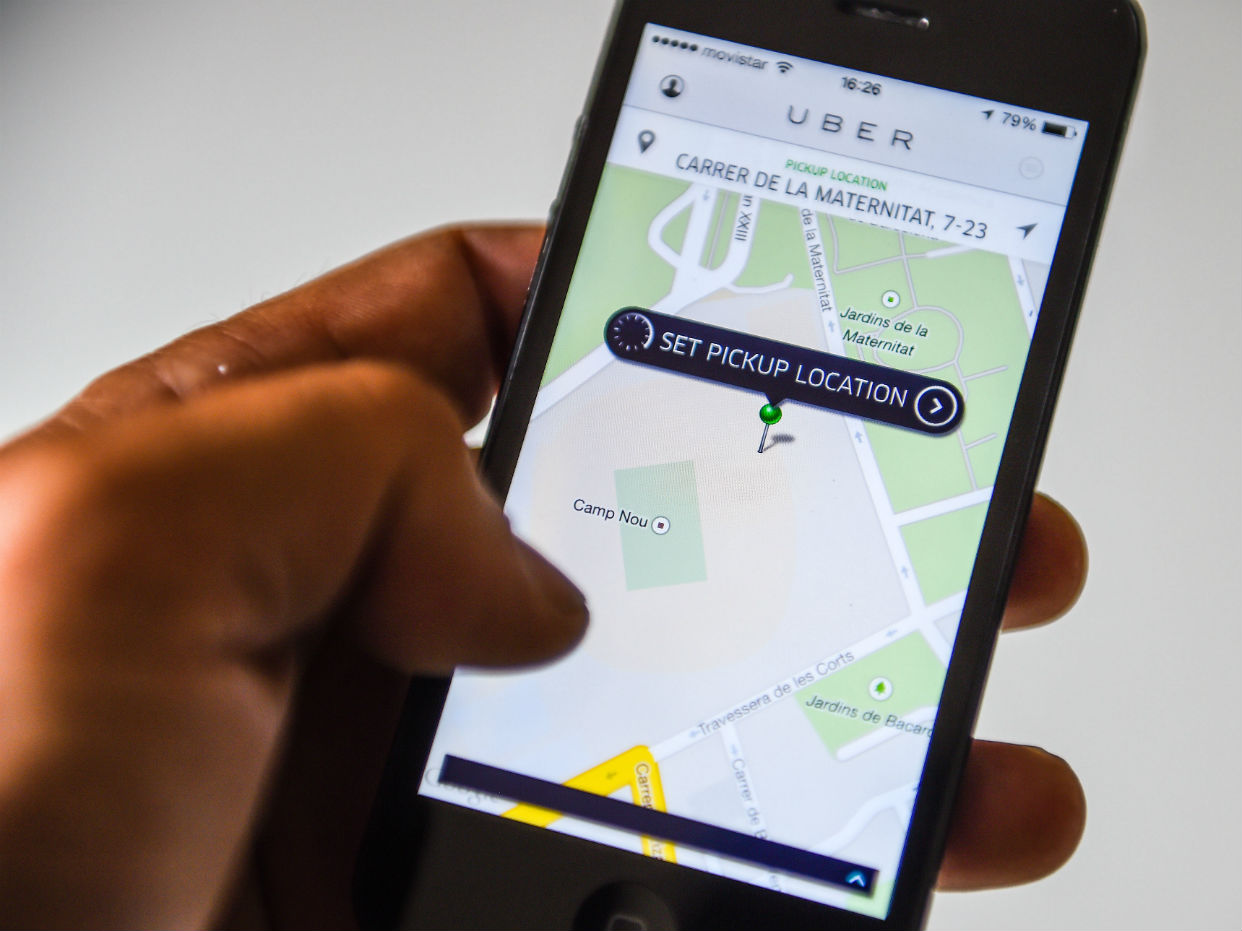

Ride-hailing app Uber was one of the most high-profile, floating for $82bn (£65bn) in April, but then announcing a $1bn loss a month later.

Gregory Perdon, co-chief investment officer of private bank Arbuthnot Latham, has seen worrying parallels between 2019 and 1999.

“In the late 1990s, taxi drivers in New York would tell me which call options they were buying on which tech stocks - it was euphoric back then. I don’t think we are at those levels just yet but, equally, I don't think we are a million miles away,” he says.

In fact, says Matthew Vincent in the Financial Times, “some argue that the only real difference is that the taxi drivers are now the investment, rather than the investors”.

He continues: “As in 1999, there are plenty of people claiming ‘this time, it’s different’. Some point out that the high level of loss-maker IPOs reflects the number of biotech companies raising equity these days - which they must do to fund drug trials. Others note that in recent years, several loss-makers have turned into stock-market darlings”.

An oft-cited example is that of Facebook, which floated in 2012 at $38, falling to $20, before peaking last year at $210.

However, “for sceptics who feel they have seen this movie before, the performance of Lyft in the early days of its quoted life rings a few bells”, says Tom Stevenson in the Daily Telegraph.

Uber’s ride-hailing rival, Lyft, was priced at $72 a share when it debuted in March, jumping to $87 on its first day before falling back to around $63 today. “The pattern of initial pop followed by quick and panicky reassessment is directionally similar to the early trading seen in lastminute.com, the poster child of the dotcom era,” says Stevenson.

Like two decades ago, “traditional metrics have been ignored and user growth taken as a proxy for future profitability. But this requires an enormous leap of faith” writes Professor Colley, meaning “it’s only a matter of time before the app bubble bursts”.

Elliott Goat is a freelance writer at The Week Digital. A winner of The Independent's Wyn Harness Award, he has been a journalist for over a decade with a focus on human rights, disinformation and elections. He is co-founder and director of Brussels-based investigative NGO Unhack Democracy, which works to support electoral integrity across Europe. A Winston Churchill Memorial Trust Fellow focusing on unions and the Future of Work, Elliott is a founding member of the RSA's Good Work Guild and a contributor to the International State Crime Initiative, an interdisciplinary forum for research, reportage and training on state violence and corruption.

-

El Paso airspace closure tied to FAA-Pentagon standoff

El Paso airspace closure tied to FAA-Pentagon standoffSpeed Read The closure in the Texas border city stemmed from disagreements between the Federal Aviation Administration and Pentagon officials over drone-related tests

-

Political cartoons for February 12

Political cartoons for February 12Cartoons Thursday's political cartoons include a Pam Bondi performance, Ghislaine Maxwell on tour, and ICE detention facilities

-

Arcadia: Tom Stoppard’s ‘masterpiece’ makes a ‘triumphant’ return

Arcadia: Tom Stoppard’s ‘masterpiece’ makes a ‘triumphant’ returnThe Week Recommends Carrie Cracknell’s revival at the Old Vic ‘grips like a thriller’

-

How Amazon’s first UK strike could be a sign of things to come

How Amazon’s first UK strike could be a sign of things to comefeature Big Tech is facing increasing pressure from unions as cost-of-living crisis fuels nationwide unrest

-

Uber files: what ‘unprecedented leak’ revealed

Uber files: what ‘unprecedented leak’ revealedSpeed Read Investigation exposes extent of government lobbying by Silicon Valley start-up between 2013 and 2017

-

Uber vehicle fleet to be fully electric by 2040

Uber vehicle fleet to be fully electric by 2040Speed Read Ride-hailing company is setting 2030 target for UK in new plan to tackle climate crisis

-

Uber’s licence renewed for two months in London

Uber’s licence renewed for two months in LondonSpeed Read Ride-hailing app lost its bid to reinstate its full operating licence in the capital

-

Uber reports $5.2 billion loss in Q2

Uber reports $5.2 billion loss in Q2In Depth The ride-hailing giant also revealed its slowest revenue growth ever

-

Uber drivers stage global strike ahead of IPO

Uber drivers stage global strike ahead of IPOSpeed Read Walk-out timed to coincide with Uber’s much-anticipated $100bn stock listing on Friday

-

Why Uber is in court again

Why Uber is in court againSpeed Read Ride-hailing platform fighting to restore London licence

-

York becomes third UK city to ban Uber

York becomes third UK city to ban UberSpeed Read Taxi app suspended over complaints that drivers licensed outside the city are touting for business in York