Where to find the best value in the art market today

It’s been a record-breaking ten years for the art market.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

It’s been an incredible decade for art investors – the top ten highest prices paid for paintings have all come in the last ten years. In 2011, Paul Cezanne’s The Card Players (c.1895) became the most expensive painting in the world when the oil state of Qatar paid around $250m in a private sale. That record was broken again in 2015 with the sale of Interchange (1955) by Willem de Kooning, which sold for about $300m in another private sale.

And then, as everybody by now knows, Leonardo da Vinci’s lost work, Salvator Mundi (c.1500), smashed the record into smithereens when another oil-rich state, Saudi Arabia, bought it for $450.3m before the eyes of the world at Christie’s in New York in November 2017 – five times the previous record set for an Old Master.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

What was truly extraordinary about this sale wasn’t so much the money – it’s that no one could even be sure it was painted by the Florentine master at all. When Salvator Mundi had sold previously in 2005, it went for just $10,000 because it was thought to have been painted by somebody in da Vinci’s studio rather than da Vinci himself – and after the 2017 sale, art critics lined up to give their take on why it wasn’t a genuine da Vinci.

The spending of almost half a billion dollars on a suspect painting was exactly the kind of irrationally exuberant, top-of-the-market, contrarian signal you would expect to see before a downturn. Yet that isn’t quite what we got.

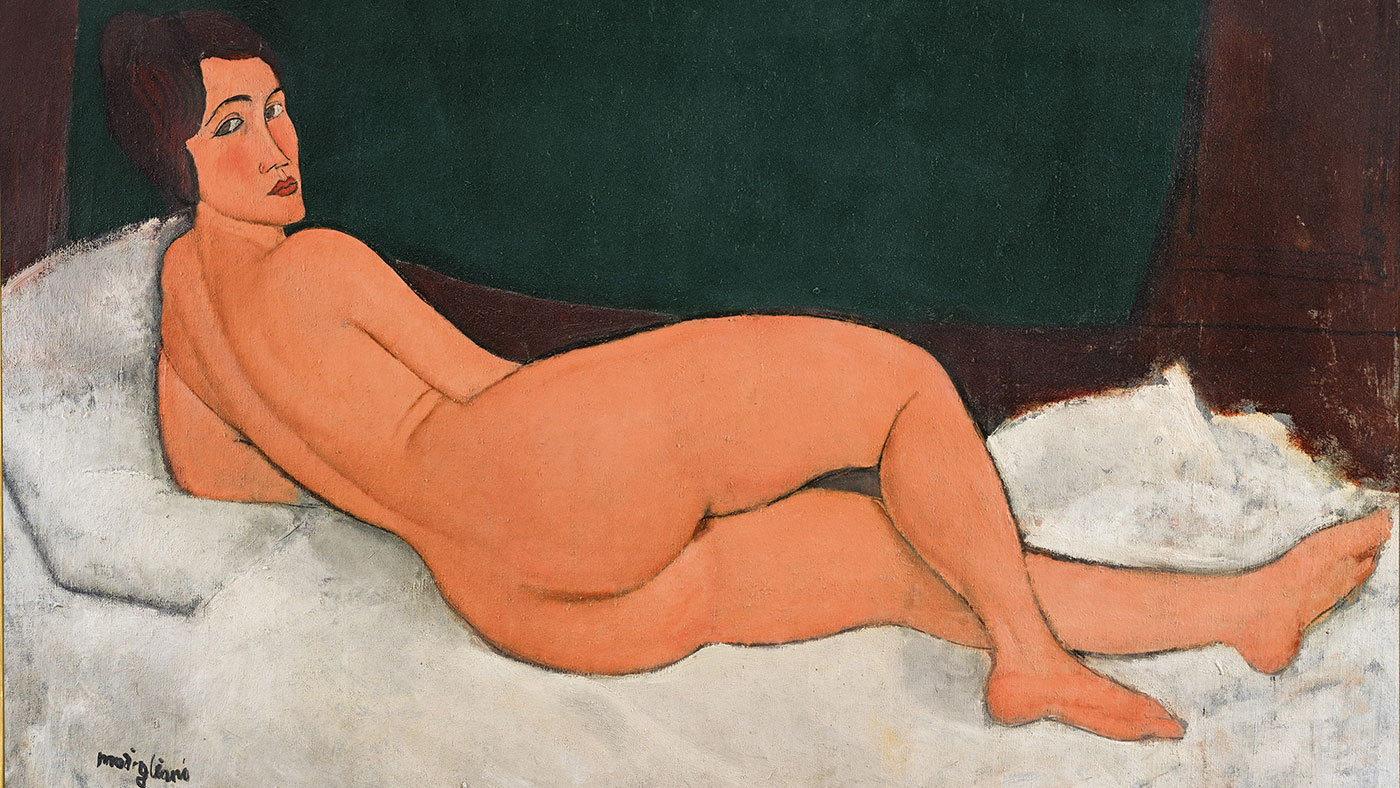

The following May, Amedeo Modigliani’s 1917 Nu couché (sur le côté gauche – pictured below) fetched $157.2m at Sotheby’s in New York. The impressionists weren’t done yet either. Exactly one year after Sotheby’s sold Nu Couché, the New York auction house sold Claude Monet’s Meules (1890) for $110.7m, a record for the artist.

Then, last June, another “lost Master” that had been found in an attic – Judith and Holofernes by Caravaggio – was bound for the auction block. Again, like Salvator Mundi, not everyone was convinced it was the genuine article. The Louvre had already turned its nose up at the painting, but that didn’t stop a private buyer from snapping it up just two days before it was due to be auctioned in Toulouse. We don’t know how much was paid – but presumably more than the $170m upper estimate.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

So, as of last June, there was still plenty of froth in the market. But for how long can a market keep rising when questionable paintings are being sold for hundreds of millions of dollars? Prior to the start of this record-breaking decade, $140m was the most that had ever been spent on a painting: a Jackson Pollock entitled No. 5, 1948 (it sold in 2006). So, if the art market has peaked, you can’t say you weren’t warned.

The next big thing

That said, there’s always the potential to make money from collecting art. And if you are starting out, you probably won’t be in the market for a da Vinci or a Caravaggio (not just yet, anyway). The emerging end of the art market can be an exciting place to get started. Degree shows for graduating art students are fertile hunting grounds. If you get very lucky, you might stumble upon the next David Hockney – and if not, at least you won’t have paid through the nose.

Art fairs are also valuable for spotting undiscovered or emerging talent. Artnet News picked out Alteronce Gumby, Julien Creuzet and Suki Seokyeong Kang as three up-and-coming artists whose work was on display at Frieze London earlier this month. And don’t be afraid to visit the art galleries themselves.

Maddox Gallery in London has, for example, Bradley Theodore on its books. Theodore is an emerging talent, born in the Turks and Caicos Islands, whose murals and paintings are attracting an ever-growing following, with the prices to match.

Investing in female artists

It can pay to look at works by artists who fall outside of the traditional, white-male-dominated art market. Works by female artists – particularly post-war – have been rising in value more rapidly than any other sector in recent years, according to Sotheby’s Mei Moses indices, which track the repeat-sale prices of 60,000 works. From 2012 to 2018, the value of 2,472 repeat sales by 499 women artists rose by 72.9%, and by 87.7% for contemporary female artists alone.

The median compound annual returns for works by Joan Mitchell and Helen Frankenthaler resold at auction between 2014 and 2018 were 14.7% and 10.9%, according to Michael Klein, head of Sotheby’s Mei Moses. For Willem de Kooning and Jackson Pollock, the figures were 7.8% and 6.5% respectively.

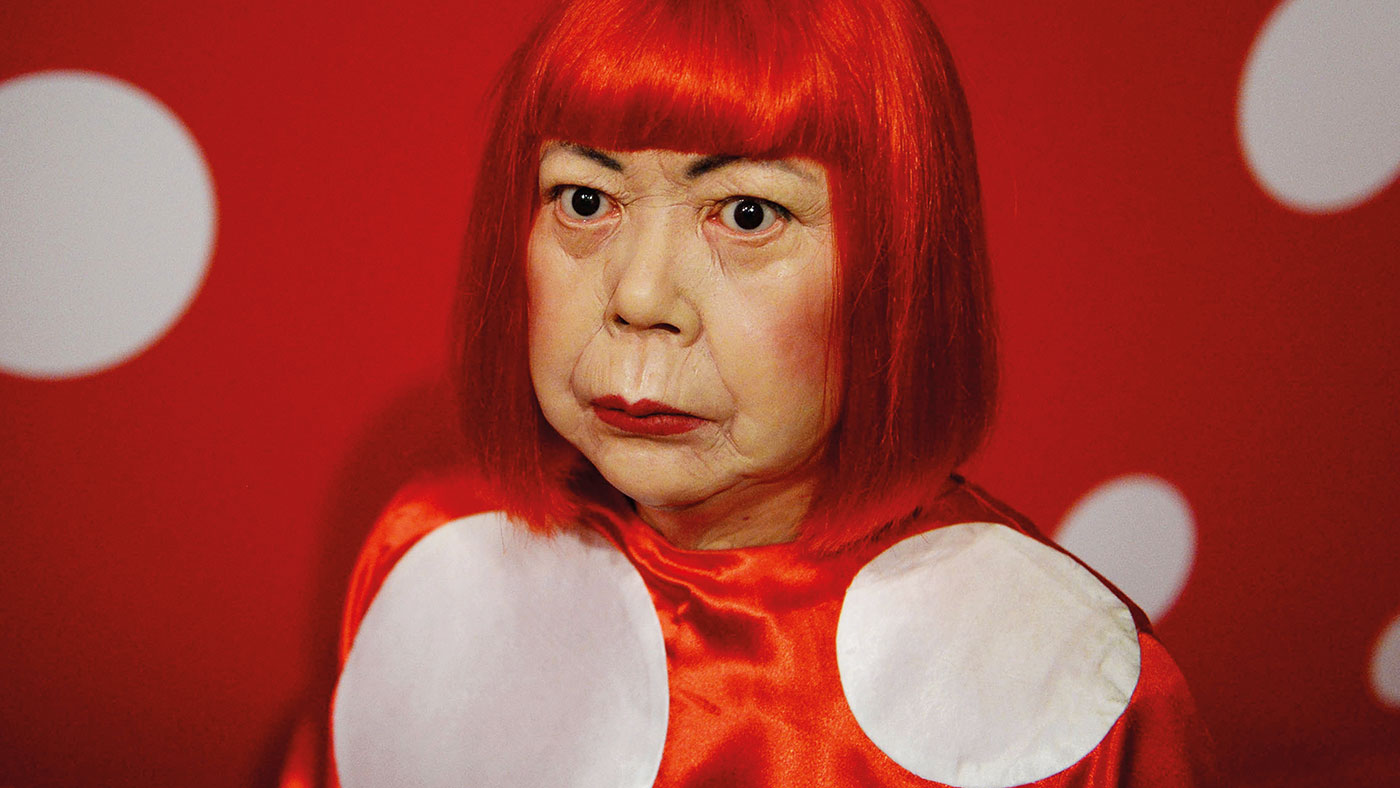

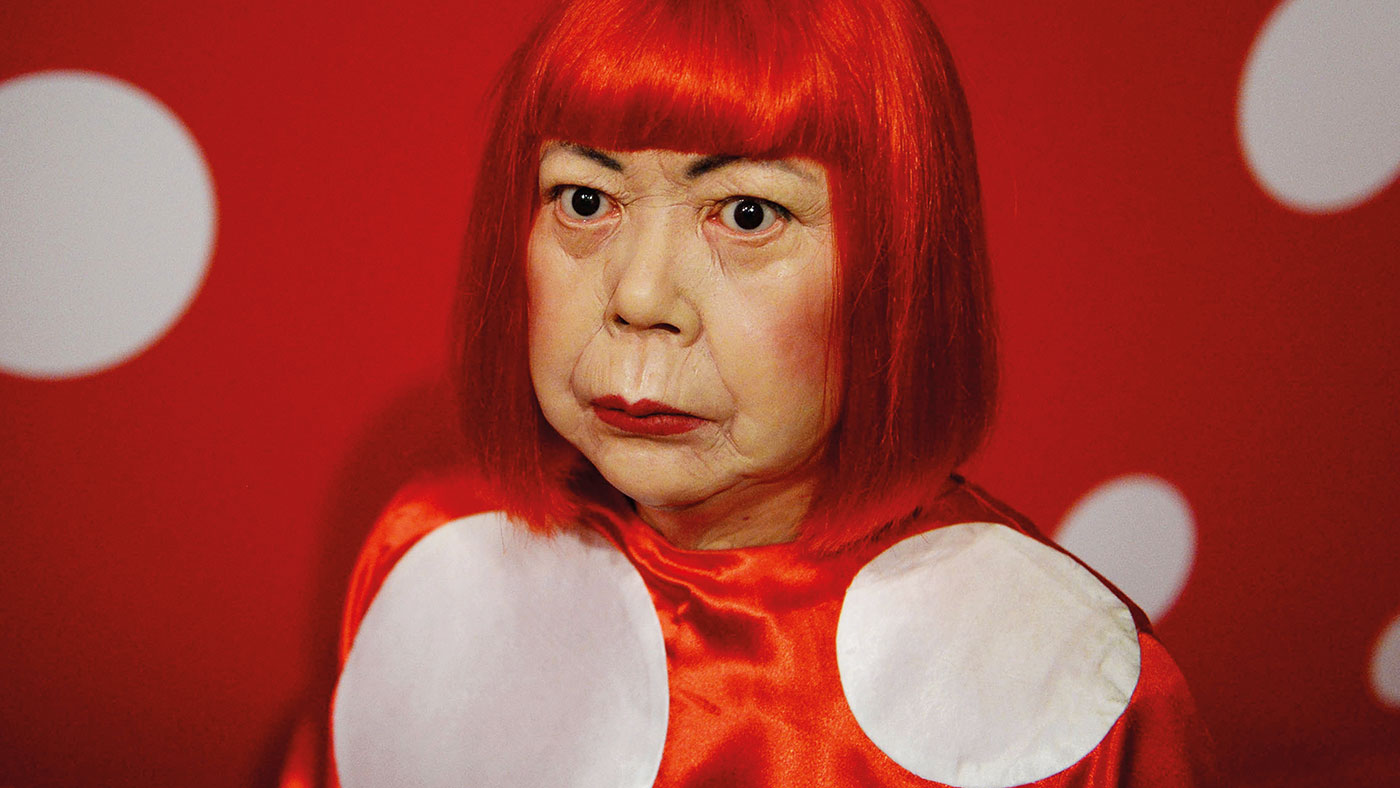

Meanwhile, supply is limited relative to male artists – works by female artists make up just 10% of the market by volume, while a handful of artists (including Japan’s Yayoi Kusama – pictured above) account for almost half of the value of sales by female artists. Given that works by women have been overlooked for so long, and interest in this segment is hotting up, there’s likely to be as-yet untapped potential for profits.

This article was originally published in MoneyWeek

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

Sport on TV guide: Christmas 2022 and New Year listings

Sport on TV guide: Christmas 2022 and New Year listingsSpeed Read Enjoy a feast of sporting action with football, darts, rugby union, racing, NFL and NBA

-

House of the Dragon: what to expect from the Game of Thrones prequel

House of the Dragon: what to expect from the Game of Thrones prequelSpeed Read Ten-part series, set 200 years before GoT, will show the incestuous decline of Targaryen

-

One in 20 young Americans identify as trans or non-binary

One in 20 young Americans identify as trans or non-binarySpeed Read New research suggests that 44% of US adults know someone who is transgender

-

The Turner Prize 2022: a ‘vintage’ shortlist?

The Turner Prize 2022: a ‘vintage’ shortlist?Speed Read All four artists look towards ‘growth, revival and reinvention’ in their work

-

What’s on TV this Christmas? The best holiday television

What’s on TV this Christmas? The best holiday televisionSpeed Read From films and documentaries to musicals for all the family

-

Coco vision: up close to Chanel opticals

Coco vision: up close to Chanel opticalsSpeed Read Parisian luxury house adds opticals to digital offering

-

Abba returns: how the Swedish supergroup and their ‘Abba-tars’ are taking a chance on a reunion

Abba returns: how the Swedish supergroup and their ‘Abba-tars’ are taking a chance on a reunionSpeed Read From next May, digital avatars of the foursome will be performing concerts in east London

-

‘Turning down her smut setting’: how Nigella Lawson is cleaning up her recipes

‘Turning down her smut setting’: how Nigella Lawson is cleaning up her recipesSpeed Read Last week, the TV cook announced she was axing the word ‘slut’ from her recipe for Slut Red Raspberries in Chardonnay Jelly