Saudi Aramco valued at $1.7 trillion in world record IPO

The Saudi government will retain a 98.5% stake in what will be the most valuable public company ever

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Saudi Aramco, Saudi Arabia’s state-owned oil company, has raised $25.6bn (£19.5bn) with an initial public offering of a 1.5% stake in the company, an amount that values the oil giant at $1.7 trillion (£1.3 trillion).

The sum makes the oil behemoth the most valuable company in the world, surpassing tech giants Apple, Google, Microsoft, and Amazon. Its IPO is expected to be the world’s biggest ever, moving ahead of Alibaba’s record $25 billion 2014 filing.

Still, the valuation is less than the Saudi Royal family had initially wanted. Crown Prince Mohammed bin Salman - Saudi Arabia’s de facto ruler - had hoped to push much closer to the $2 trillion mark.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

They may have received more by floating in one of the world’s financial capitals, but sought to avoid the scrutiny that would probably have brought. Shares in Aramco, which was named the world's most profitable company earlier this year, will instead trade on the Riyadh stock market, the Tadawul, from 11 December.

The lower prices has also been put down to the general trend away from fossil fuels internationally, as well as the prospect of a slowing global economy.

–––––––––––––––––––––––––––––––For a round-up of the most important business stories and tips for the week’s best shares - try The Week magazine. Get your first six issues free–––––––––––––––––––––––––––––––

In addition, Iran’s “aerial attacks on Aramco facilities in September highlighted to potential investors the geopolitical risks of operating in the Persian Gulf,” reports The New York Times. “More broadly, the killing of the dissident journalist Jamal Khashoggi by Saudi agents last year has hurt the reputation of Prince Mohammed, and may repel some investors.”

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The IPO is a cornerstone of bin Salman’s attempts to modernise the Saudi economy, and diversify away from its dependence on oil. In theory, the funds raised will be reinvested to this end.

“The amount raised by the IPO itself is relatively contained given the size of the economy and medium-term funding requirement of the transformation plan,” said Monica Malik, chief economist at Abu Dhabi Commercial Bank. “Nevertheless, combined with other areas of funding, we believe that there is meaningful capital in place to progress with the investment plans aimed at diversifying the economy.”

William Gritten is a London-born, New York-based strategist and writer focusing on politics and international affairs.

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day

-

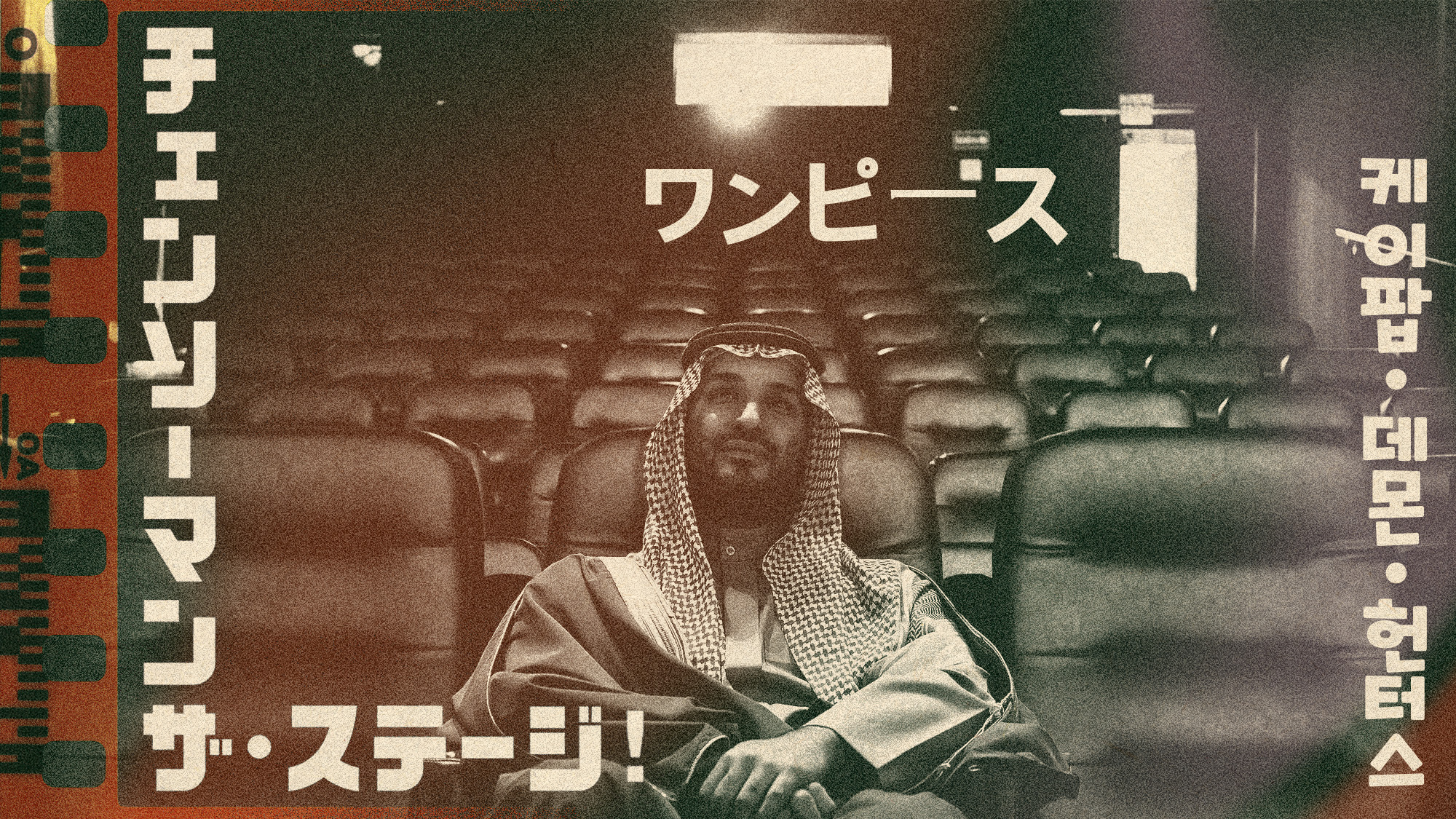

Why Saudi Arabia is muscling in on the world of anime

Why Saudi Arabia is muscling in on the world of animeUnder the Radar The anime industry is the latest focus of the kingdom’s ‘soft power’ portfolio

-

Electronic Arts to go private in record $55B deal

Electronic Arts to go private in record $55B dealspeed read The video game giant is behind ‘The Sims’ and ‘Madden NFL’

-

What Saudi Arabia wants with EA video games

What Saudi Arabia wants with EA video gamesIn the Spotlight The kingdom’s latest investment in gaming is another win for its ‘soft power’ portfolio

-

How might the Israel-Hamas war affect the global economy?

How might the Israel-Hamas war affect the global economy?Today's Big Question Regional escalation could send oil prices and inflation sky-high, sparking a worldwide recession

-

Recent mega-mergers could signal a turning point for the US oil industry

Recent mega-mergers could signal a turning point for the US oil industryTalking Point Both Chevron and Exxon have recently spent billions to acquire smaller oil companies

-

The PGA gets a Saudi makeover

The PGA gets a Saudi makeoverfeature Fans and players are reeling after the league announced a surprise merger with its Saudi-backed rival

-

Has Saudi Arabia lost control of oil prices?

Has Saudi Arabia lost control of oil prices?Today's Big Question Kingdom goes it alone to cut production, risking tension with US and reigniting cooling inflation in Europe

-

Why is Saudi Arabia going it alone on costly oil cuts?

Why is Saudi Arabia going it alone on costly oil cuts?Today's Big Question The unilateral production cuts could hurt its finances while raising gas prices for drivers and OPEC