House price predictions: best time to buy or sell in 2020

Brexit still creating uncertainty but prices set for a Boris-induced spring boost

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

UK house prices are expected to break records in the coming months, as buyer activity surpasses the number of new sellers.

According to Rightmove, the average price of property in the UK jumped 0.8% – or £2,589 – this month, just £40 short of a new record.

The property website attributes the boom to the decisive General Election result and predicts that the growth will continue into spring.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Rightmove director and housing market analyst Miles Shipside told City A.M.: “There is a boom in buyer activity outstripping the rise in the number of new sellers, which we expect to lead to a series of new price records starting next month.”

Spring boom

According to Shipside, the coming months are traditionally the busiest for the property market, meaning “spring buyers are likely to be faced with the highest average asking prices ever seen in Britain”.

He told the London Evening Standard: “Buyers who had been hesitating and waiting for the greater political certainty following the election outcome may be paying a higher price, but they can now jump into the spring market with renewed confidence.”

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

However, he also stressed that it is a “price-sensitive market” with “stretched buyer affordability”, so sellers should be careful not to price their property too highly during this “window of increased activity”.

The paper notes that owing to slow wage growth since the 2008 financial crash and heightened demand for new homes, prices have finally started to slow in London due to affordability limits.

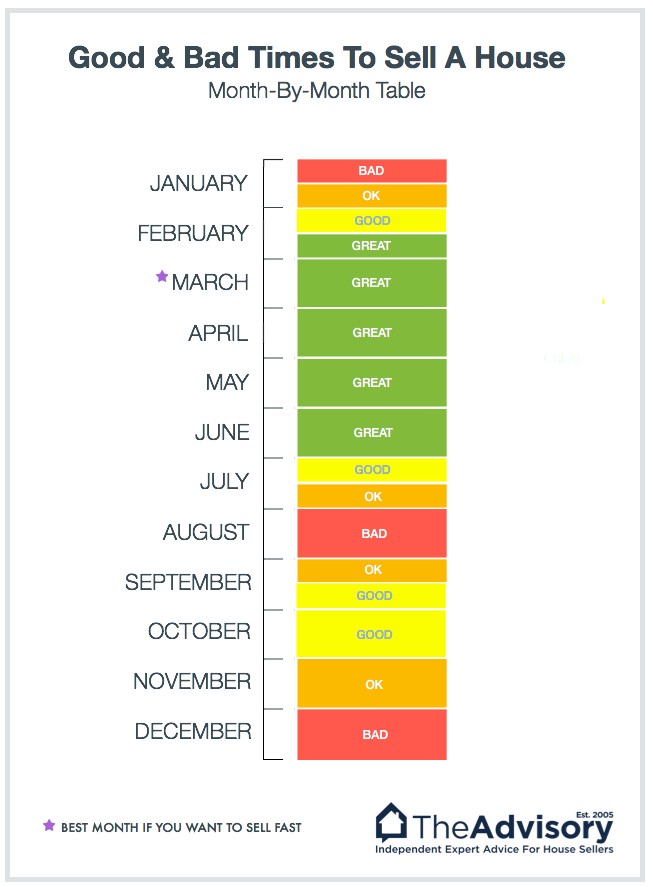

The best months to sell

According to property selling advice service The Advisory, “spring is traditionally said to be the best time to sell your house”.

It ranks mid-February to June as the best months of the year to sell, with early-February, July and October also faring fairly well. January, August and December are usually the worst times of the year to sell, The Advisory says.

The average property sale in March takes 57 days, according to research carried out in conjunction with Rightmove, while October-November sees this increase to 79 days.

One- and two-bed flats and terraces aimed at young and first-time buyers also sell best during January, February and September. “These buyers are often prompted by one last Christmas at home being one too many,” The Advisory suggests.

“They are also back in the market after summer holidays with hopes of getting into their new home in time for Christmas.”

Three- to four-bed family homes sell more efficiently outside of school holidays.

Green signal for HS2

Meanwhile, Prime Minister Boris Johnson has now officially given HS2 the go-ahead, which could cause prices to spike in some areas.

Writing in The Guardian, personal finance writer Virginia Wallis says: “When somewhere stands to benefit from a large-scale improvement in transport links – especially to London - property prices tend to go up.

“If the Crossrail experience is anything to go by – properties within a 10- to 15-minute walk away from an HS2 station will see house prices go up by 30% to 60% more than the prices of property ‘not in an area of immediate impact’.”

This means that properties that stand to benefit from better rail links could see the value of their property rocket in the coming years as HS2 is rolled out.

Wallis says Birmingham residents who have property near the new Curzon Street station or the interchange station near the city’s airport could be sitting on a goldmine.

Brexit deadline

Johnson’s December election result - and his promise to “get Brexit done” - delivered some much-needed stability, resulting in a “Boris boost” over the past few months.

December 2019 saw the highest number of property transactions since before the referendum, with sales up 6.8% year-on-year.

The next “cliff edge” Brexit deadline is on 31 December 2020, when the UK aims to have a trade deal with the EU in place. If not, the “outcome would effectively be the same as a no-deal Brexit”, says the Financial Times. So what might this mean for house prices?

Accountancy firm KPMG believes house prices would fall by around 6% if no deal is agreed. This could drop to 20% in a worst-case scenario, says consumer rights magazine Which?.

In July, the independent Office for Budget Responsibility said that a no-deal scenario could lead to house prices falling by almost 10% by mid-2021.

While it is not clear what will happen in December, we can look back at what has happened with regards to Brexit deadlines in the past.

As Brexit loomed, house prices fell much more sharply than usual in the second half of 2018, something that may be repeated in late 2020 as the December deadline approaches.

However, Which? adds, “the good news, if you’re a homeowner, is that prices have generally recovered over the past few months”.

-

Antonia Romeo and Whitehall’s women problem

Antonia Romeo and Whitehall’s women problemThe Explainer Before her appointment as cabinet secretary, commentators said hostile briefings and vetting concerns were evidence of ‘sexist, misogynistic culture’ in No. 10

-

Local elections 2026: where are they and who is expected to win?

Local elections 2026: where are they and who is expected to win?The Explainer Labour is braced for heavy losses and U-turn on postponing some council elections hasn’t helped the party’s prospects

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

The people who raffle their homes

The people who raffle their homesUnder The Radar Offer the chance to win your house for £2 a ticket? It's simple and can make thousands but it's not stress-free

-

House prices fall at fastest pace since 2009 – and more pain expected

House prices fall at fastest pace since 2009 – and more pain expectedSpeed Read Gloomy forecasts follow 4.6% year-on-year drop as higher interest rates hit the property market

-

The great British food shortage: what’s causing empty supermarket shelves?

The great British food shortage: what’s causing empty supermarket shelves?feature Unseasonal weather, transport issues and energy prices are leading to rationing of fresh produce in UK stores

-

Pros and cons of shared ownership

Pros and cons of shared ownershipPros and Cons Government-backed scheme can help first-time buyers on to the property ladder but has risks

-

Affordability test scrapped: what ‘huge’ mortgage rule change means for buying a house

Affordability test scrapped: what ‘huge’ mortgage rule change means for buying a houseTalking Point Bank of England cuts red tape on mortgage approval process despite soaring inflation

-

Are UK house prices about to crash?

Are UK house prices about to crash?In Depth Higher property taxes and a new mansion tax announced in the Autumn Budget could weigh on house price growth

-

‘Weakest since 2012’: UK house price average falls to £257,406

‘Weakest since 2012’: UK house price average falls to £257,406In Depth Prices down 1.1% year-on-year in February – the first annual decline since June 2020

-

The impact of Russia sanctions on London house prices

The impact of Russia sanctions on London house pricesIn Depth Oligarchs tipped to ‘flee’ the market amid plans to seize properties owned by Russians with Kremlin links