O2 gives up on London listing this year

Telecoms firm Telefonica joins software giant Misys in abandoning plans over Brexit-related market uncertainty

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Three's hopes fade as more buyers emerge for O2

13 May

Any hopes held by Three's parent company Hutchison that it might be able to put its buyout of O2 back on track look likely to be dashed after a number of potential suitors emerged for a rival deal.

The European Commission this week controversially blocked the £10.3bn tie-up, agreed between the two mobile networks a year ago, over concerns that the resultant fall from four to three in the number of operators with ownership of network infrastructure would hurt competition.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Three has made it clear it reserves the right to legally challenge the decision, but Fiona Maharg-Bravo of Reuters points out that "could take months and it may not succeed".

In the meantime, the exclusivity period on the transaction expires at the end of June and O2's Spanish parent, Telefonica, appears keen to strike a deal quickly to reduce its huge debt pile. The Financial Times notes the contract on the original merger contains no break fee and could even be terminated sooner.

Telefonica has said it will carry out a review, but has acknowledged it could seek another buyer or exit its UK arm through a public listing. On the sale side, it seems potential offers will not be in short supply.

Both the FT and Sky News report that private firms including Apax, CVC Capital Partners and US giant KKR could be interested in launching a bid, perhaps led by former EE chief executive Tom Alexander. He is one of the country's best known telecoms entrepreneurs, having founded Virgin Mobile and overseen the formation of EE itself.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Elsewhere, Reuters highlights that Virgin Media's owner, Liberty Global, has publicly stated it will consider making an offer, while Sky might consider an approach as it has already announced it will join the UK mobile market later this year.

One fly in the ointment for Telefonica is that the price tag for a new deal might be lower than that agreed with Three, which had been able to rely on greater future synergies and cost savings.

Will Draper, an analyst at Mirabaud, told the FT that "with lower synergies available, we estimate a price tag of £9bn at best and more likely in the £8.5bn range".

What next after Three-O2 merger blocked?

12 May

There was an awful lot riding on yesterday's decision by the European Commission to block the proposed £10bn buyout of O2 by Three owner Hutchison.

It means the number of infrastructure operators in the UK has been preserved at four, in line with the demand from our own watchdogs and allowing the commission to sidestep a pre-EU referendum crisis on where the balance of regulatory power lies.

But it also stops a major deal that was promised as the first step in a huge investment programme and which had been backed by much of the wider sector in the UK. Many reckon the baby has been thrown out with the bathwater.

However, according to The Times, Three has still not given up on the deal.

"Lawyers will examine the 850-page document published by Brussels yesterday," the paper says. The company may then launch a legal claim, arguing it was treated unfairly on the basis that four-to-three mobile mergers have previously received approval in Germany and Ireland.

It might find a strong basis to dispute the decision, says Christopher Williams in the Daily Telegraph. He argues in particular that it is incorrect to argue that blocking the takeover will preserve competition for so-called virtual operators, saying Three is too small to offer extensive capacity and Vodafone is reluctant to do so because of tight profit margins.

"The combination of O2 and Three would not have removed one of their choices, it would have made one of their choices a more aggressive competitor to [BT-owned] EE because it would have had more capacity," he says.

However, Williams goes on to acknowledge that Three will probably not launch a formal challenge so as not to give the decision the validity of a court verdict while it pursues a similar merger in Italy.

O2 owner Telefonica is also widely reported to be ready to seek a quicker and easier exit of the UK when the exclusivity period for a sale expires on 30 June.

Ultimately this will be positive for the UK, argues Nils Prately in The Guardian. He says the country already has among the lowest mobile prices in the EU, proving that the current model is working, while there is evidence that consolidations elsewhere have increased consumer prices.

A sale of O2 to Virgin Media owner Liberty Global or French telecoms giant Iliad would therefore preserve a positive status quo, he claims.

Pratley also says it was politically impossible for the commission to go against the wishes of UK regulators: "It would have been a nonsense if UK regulators had been left to police a mobile telephony market they had judged to be irreversibly damaged."

O2 bidding war to follow failed £10bn Three buyout

11 May

A bidding war could take place for mobile network O2 after the European Commission blocked its £10bn buyout by Three parent company Hutchison.

The two companies have been trying to win over competition regulators for around a year. A meeting was held on Tuesday, reports the Financial Times, and competition commissioner Margrethe Vestager has confirmed today that permission has been refused.

The tie-up would have created the largest mobile operator in the UK market, but regulators were concerned that reducing the number of mobile operators with direct ownership of infrastructure from four to three would have harmed competition.

Hutchison's promises to "allow a number of companies such as Sky, Virgin Media and Tesco to provide mobile services using its network, as well as freeze prices for consumers and increase investment" failed to sway the watchdog.

Vestager wanted the company to hive off a completely new fourth infrastructure operator and this could "now be seen as the requirement for any future merger in Europe".

Rival media groups are already said to be circling O2, which is owned by Spanish telecoms giant Telefonica. Virgin Media owner Liberty Global has acknowledged it would be "strange if we didn't evaluate that option" in a move that would "create a powerful combination of broadband and mobile network infrastructure", The Daily Telegraph reports.

The Sunday Times also reported that French operator Iliad was "understood to be considering a bid".

The EC's decision will be a talking point on both sides of the EU referendum debate. The Remain camp will be relieved that European officials have seemingly listened to the calls for the deal to be blocked from UK regulators Ofcom and the Competition and Markets Authority.

However, those campaigning to leave will continue to argue the problem is that the decision rests with Brussels and not at home.

Three-O2 merger becomes EU referendum issue after latest intervention

11 April

"The risk, here, is the decision could become increasingly political… from a UK perspective, it already is," Mandeep Singh, a partner at Redburn analysts, told the BBC.

Singh was referring to the apparently diminishing chances that the European Commission will clear Three owner Hutchison's proposed buyout of O2. A final decision will be made by 19 May, after the Hong Kong-based would-be acquirer last week proposed a range of concessions, including selling up to 30 per cent of its network capacity to rivals.

Today, the Competition and Markets Authority said the company's plans do not go far enough as they would not result in a replacement fully-fledged fourth operator with network infrastructure.

"Absent such structural remedies, the only option available to the Commission is prohibition," Alex Chisholm, the authority's chief executive, said in a letter.

Previously, Ofcom, the UK telecommunications watchdog, had taken the unprecedented step of publishing its objections to the deal in a newspaper article, prompting a slightly unedifying public war of words with Hutchison.

The UK watchdogs are resorting to such tactics because these large takeovers are not their jurisdiction: the final verdict rests with the European competition commissioner, Margrethe Vestager, who has been an opponent of similar deals in the past, although similar consolidation has gone through in Austria and Germany.

Analyst Singh reckons the chances of this merger getting the green light are currently 50:50.

If Vestager gives backing to the deal, it will almost certainly be seized on by Brexit campaigners as evidence that the UK's own regulators are powerless in the face of EU bureaucracy.

This might leave some free marketers in the Remain camp in the uneasy position of hoping for a protectionist decision to block the deal to avoid a damaging PR disaster.

"Britain's referendum, it seems, has come to dominate more or less everything," says Jeremy Warner in the Daily Telegraph.

The issue could be more complicated still, he adds, as "Hutchison has been quietly lobbying the UK Treasury over Ofcom's head" and has issued an "unspoken threat" that it may pull out of Britain if the deal is blocked, realising Ofcom's worst fears anyway.

"Small wonder that Ms Vestager has taken to complaining privately that she's between a rock and a hard place," Warner says.

Three owner makes final effort to win approval for O2 merger

07 April

Three's Hong Kong-based parent company, Hutchison, has made its final pitch to European regulators in an effort to win approval for a £10bn merger with O2.

The deal, which would create the largest mobile firm in the UK, ran into opposition from Ofcom, which took the unprecedented step of publicly lobbying for it to be blocked. The final decision rests with the European Commission, an opponent of such tie-ups in the past, which has extended the deadline for its final verdict to mid-May.

The delay follows Hutchison submitting its latest – and last – offer of concessions to ease competition concerns.

The Daily Telegraph says the company has signed a deal with Sky that would see the latter paying around £2bn to take 20 per cent of the capacity on the combined network, while a more tentative agreement with Virgin Media would result in a further ten per cent being ceded. Both would be handed ten-year contracts to allow them to invest in building up market share.

Hutchison has also pledged to sell O2's 50 per cent stake in Tesco Mobile and to continue to invest heavily in its mobile masts infrastructure joint venture with Vodafone until at least 2017, when it may seek to sell to a third party.

There was no word on previously mooted plans to maintain Three and O2 as separate entities if the transaction gets the green light.

This may still not be enough to convince the regulators, who have expressed particular concern about the loss of one of the four UK infrastructure networks, the Financial Times notes. Notably, the plans fell short of offering to sell capacity and masts to help a rival set up a fully fledged replacement fourth operator.

There will also likely be complaints from Vodafone that despite assurances, the investment in its masts business will suffer, says the Telegraph, as Three-O2 will also co-own the second infrastructure joint venture in the UK market, between O2 and BT.

Vodafone could demand that Hutchison pulls out of their venture and pays "billions of pounds in compensation".

-

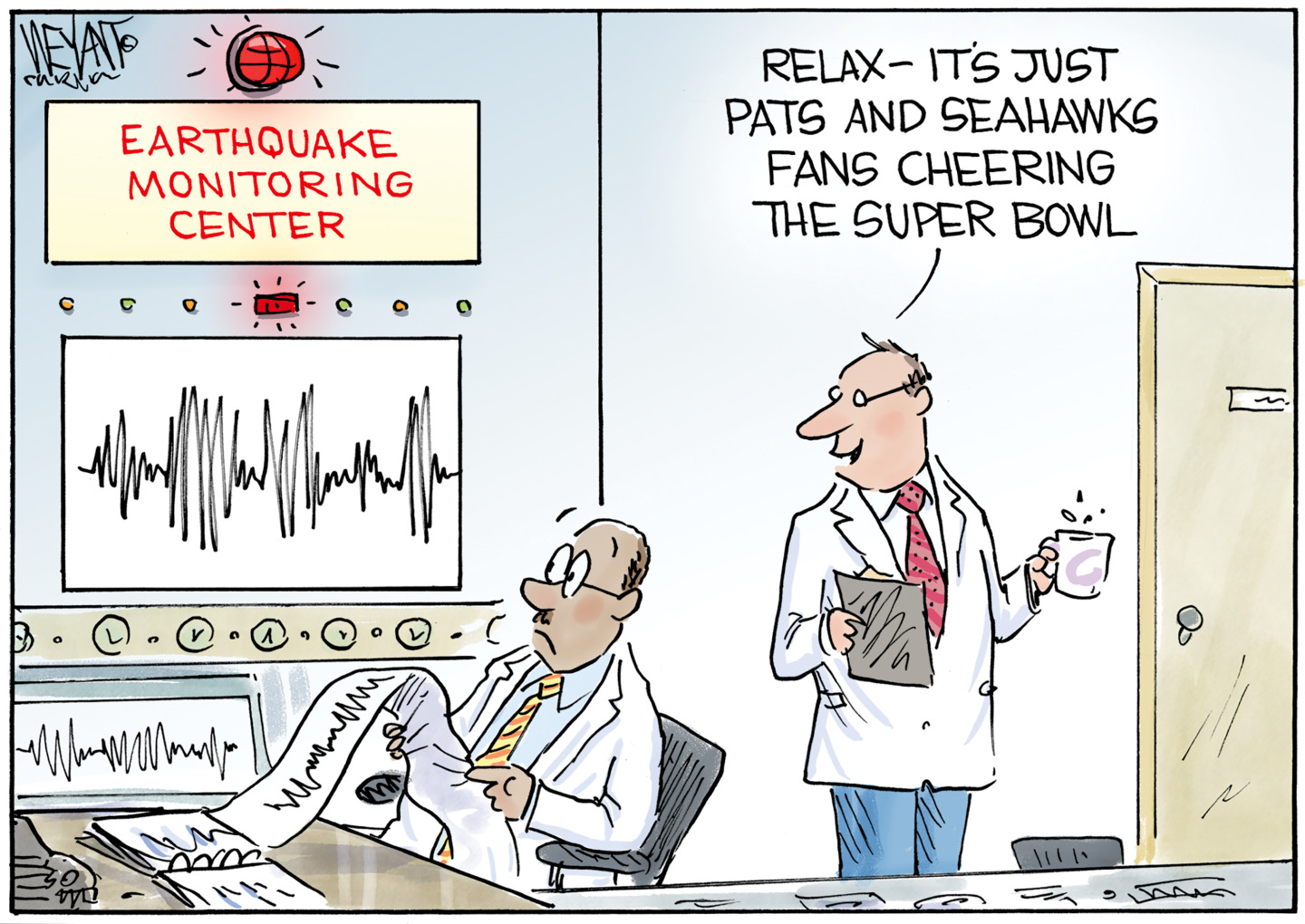

Political cartoons for February 7

Political cartoons for February 7Cartoons Saturday’s political cartoons include an earthquake warning, Washington Post Mortem, and more

-

5 cinematic cartoons about Bezos betting big on 'Melania'

5 cinematic cartoons about Bezos betting big on 'Melania'Cartoons Artists take on a girlboss, a fetching newspaper, and more

-

The fall of the generals: China’s military purge

The fall of the generals: China’s military purgeIn the Spotlight Xi Jinping’s extraordinary removal of senior general proves that no-one is safe from anti-corruption drive that has investigated millions

-

Three owner makes final pitch to win approval for O2 merger

Three owner makes final pitch to win approval for O2 mergerIn Depth Sky and Virgin could take big chunks of network capacity, while enlarged firm would invest in infrastructure

-

Phones 4u collapse: jobs saved after EE agrees to buy shops

Phones 4u collapse: jobs saved after EE agrees to buy shopsIn Depth EE, blamed by Phones 4u for precipitating its downfall, to save the day – with Vodafone