O2 gives up on London listing this year

Telecoms firm Telefonica joins software giant Misys in abandoning plans over Brexit-related market uncertainty

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Three owner proposes keeping O2 separate post-merger

18 March

The owner of the Three mobile network has proposed keeping O2 operationally separate even if their merger is cleared – but it claims the proposal is not related to ongoing wrangling with regulators.

Hong Kong-based Hutchison has been trying to secure EU Commission approval for a deal to merge Three with O2, after the UK watchdog Ofcom publicly called for the deal to be blocked. Talks are ongoing in Brussels and the company has proposed a range of options to appease officials, with rivals circling in the hopes of securing more market share.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Under the new proposal, Hutchison would bring a new investor into Three and continue to operate the business separately from O2, which it would still buy and run as a standalone unit. The Financial Times says it could sell a ten to 20 per cent stake and that this builds on existing plans to sell a £3.1bn interest in the combined entity to five institutional investors.

The move could benefit "operational strategy and focus, regulatory approvals and contractual obligations", said the company, "while preserving financial and operational efficiencies and savings expected from the acquisition of O2".

But it denied that the new plans had anything to do with securing approval to merge the two mobile networks, which Ofcom opposes on the grounds that reducing the UK market from four full infrastructure operators to three will hurt competition.

Frank Sixt, the finance director at Hutchison, said that from a competition perspective, this "wouldn't make a bit of difference" as "authorities would still look at this as one competition unit".

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

So far, Hutchison has proposed selling off as much as 30 per cent of its mobile spectrum to create a large virtual operator that could act as a fourth sector power, with "Tesco and Sky bidding for wholesale capacity deals", according to the Daily Telegraph.

Alternatively, if it is also forced to sell off infrastructure such as pylons, rivals such as Virgin Media could be interested in ramping up their mobile presence more substantially.

Virgin Media to bet big on mobile after Three-O2 merger

14 March

A forced sale of infrastructure and mobile spectrum in the event of a merger of Three and O2 could open the door for a big mobile push by Virgin Media, the company has hinted.

After the latest meeting of representatives from Three owner Hutchison and O2 owner Telefonica with competition regulators in Brussels, also attended by a number of rival operators from the UK and elsewhere, Virgin parent Liberty Global acknowledged it would be interested in stepping in if a selloff is ordered.

So far, Hutchison has only pledged to sell guaranteed capacity on its enlarged network to assuage regulatory concerns that customers would lose out from the drop from four main operators to three.

Tesco, one of the smaller "virtual" operators who buy capacity from the main operators, has also indicated it would be interested in buying spectrum to increase its market share and it said it might buy out O2's £300m stake in their Tesco Mobile joint venture in the process. As well as that, Sky News is already planning a run at the mobile market and could be an interested party.

Virgin, which also rents space for its mobile network, had been exploring a full-on merger with Vodafone, which the Daily Telegraph notes would have created "a powerful combination of fixed line and mobile networks across Europe".

However, in the event that EU officials demand a sale of physical infrastructure such as a masts to create a fourth major network player, the company might opt instead to go it alone. The problem, the Telegraph points out, is that this would involve a subsequent huge investment to bolster capacity – something Hutchison believes is unlikely.

"Any competition concerns can be addressed without blocking the proposed O2-Three transaction. The Commission has previously cleared four to three mobile mergers subject to remedies and Liberty Global has been an effective remedy taker in Austria and Ireland before," Manuel Kohnstamm, spokesman for Liberty Global, said.

"In this particular case, we believe that the Commission's concerns could be resolved by an operator with a viable long term future. Virgin Media and its parent Liberty Global are committed to explore any opportunity with the merging parties."

Three pledges price freeze as 02 merger row goes public

04 February

A fierce battle over whether or not the owner of mobile network Three will get permission to buy its larger rival O2 is being fought on the letters pages of the Financial Times.

Earlier this week, Ofcom chief executive Helen White took the extraordinary step of writing in the newspaper to express a number of concerns over the proposed £10.5bn merger, all but calling openly for the European Commission to block the deal on competition grounds.

Today, Three's parent company, CK Hutchison, has responded in kind.

After pointedly questioning why White "felt the pressing need to go public with her conclusions", Canning Fok, the co-managing director at Hutchison and chairman of Three UK, makes a series of pledges that the company hopes will satisfy objections that reduced competition will increase consumer prices and reduce long-term investment.

Fok sets out three "promises" he says will "guarantee… customers will get more and pay less". The most eye-catching for users is a vow not to "raise the price for consumers of a voice minute, a text or a megabyte in the five years following the merger" and to share cost efficiencies so that "like for like, customers' bills will go down".

Elsewhere, Fok says the combined company will benefit from an investment of £5bn over the next five years, "20 per cent more than would have been invested by the two companies on their own". It will also offer smaller rivals "unprecedented" shared ownership interests in its network capacity to ensure effective competition and "eliminate… the tricks some wholesalers use to disadvantage their wholesale customers".

Whether this will be enough remains to be seen. With evidence that a fall to three operators in Austria led to prices increasing 15 per cent, some analysts reckon the European Union's competition commissioner, Margrethe Vestager, may demand the companies completely sacrifice a chunk of capacity to set up a fully fledged fourth network. "Hutchison is unlikely to agree to go to such lengths," says the Financial Times.

Writing in The Guardian, Nils Pratley says it is a "poor show" that the UK's media watchdog has been "reduced to writing columns in the FT" to try to block the deal because of EU rules that put all decisions on companies operating across European borders in the hands of Brussels.

At a time when the UK is set to vote on its EU membership, he suggests strict barriers are likely to be put up so the decision is not seen as a "slap in the face for Ofcom and a severe blow to the credibility of UK telecoms regulation".

Ofcom chief calls for Europe to block Three-O2 merger

1 February

Ofcom has come out publicly against the takeover by mobile network Three of its larger rival O2, which would create the largest mobile operator in the UK.

A £10.5bn deal agreed last March would see Three's Hong Kong-based owner Hutchison buy O2 from Spanish telecommunications giant Telefonica. The resulting company would control about four in ten mobile connections, either directly or through smaller retail operators that "piggyback" its network.

But now Ofcom's chief executive Sharon White has stepped in, ahead of a preliminary ruling from the European Commission, triggered by a referral from the UK's Competition and Markets Authority in October. Writing in the Financial Times, the former "Treasury enforcer" has outlined opposition to the deal and strongly suggested it should be blocked altogether.

One major concern is that costs for consumers could increase after a deal, which would reduce the number of bandwidth-providing core network operators from four to three. Evidence from countries such as Austria, Germany and Ireland, which have allowed similar deals in the past, show the loss of competition reduces downward pressure on prices, says White.

"Our findings show that average prices are around 10-20 per cent lower in markets with four operators and a disruptive player than in those with only three established networks," she says. "Austria’s regulator says that, since the deal there, overall mobile prices have climbed 15 per cent and by 30 per cent for customers who only make calls and send texts."

Her other worries include the deal complicating the competitive element of the actual infrastructure set up in the UK, where the four main operators have consolidated into two networks of cables and masts, with Three and O2 on opposite sides. She also fears a more powerful operator would limit the power of independent high street retailers to constrain prices.

One solution could be setting up a new fourth network in the UK, says the Ofcom boss, but this would "take time, and considerable investment". #

The FT reports Hutchison could, as a compromise offer, set aside a fixed part of its network to be used by rivals such as Virgin Media and Sky to help them "create a more fully fledged mobile business".

Three's takeover of O2 runs into EU competition hurdle

18 January

Three's £10bn buyout of O2 will be thrown into doubt this month when the European Commission challenges the deal on competition grounds.

According to the Sunday Times, the European competition watchdog will publish, before the end of January, a "statement of objections" to the buyout, which would create the largest mobile network in the UK. It is understood the Commission will demand stringent mitigating measures, including potentially a sale of a portion of the combined network, a move that is being "fiercely" resisted.

Last week, the head of the UK's media regulator, Sharon White, raised a number of concerns over the tie-up during a meeting with EC competition chief Margrethe Vestager. Bloomberg says White is especially worried the loss of competition will hit consumers through the loss of tariffs offering unlimited data downloads or other discount features.

Vestager herself has taken a tough stance on telecommunications mergers in recent years, although her predecessor cleared big buyouts in Austria, Germany and Ireland. A deal last year between TeliaSonera and Telenor, the second and third-biggest mobile operators in Denmark, fell through after she demanded tough concessions to protect customers.

She has dismissed claims by telecoms chiefs that mergers are necessary to guarantee costly upgrades to networks in the face of a mobile internet capacity crunch, saying it is "difficult to find evidence" that consolidation "brings more investment" to the industry. "What we see is that the shareholders get the benefits, not the clients," she said.

Three is owned by Hutchison Whampoa, a Hong Kong-based media giant controlled by tycoon Li Ka-shing, while O2 currently belongs to Telefonica of Spain. Together with Vodafone and soon-to-be BT-owned EE, they are the only companies that provide network bandwidth, with around 100 other firms "piggybacking" on their networks to offer mobile access to customers.

While a merger would create a giant that accounts for around 40 per cent of the market and reduce the number of core operators to three, Hutchison has argued that the comparatively large number of firms offering tariffs to customers will ensure sufficient competition.

-

Switzerland could vote to cap its population

Switzerland could vote to cap its populationUnder the Radar Swiss People’s Party proposes referendum on radical anti-immigration measure to limit residents to 10 million

-

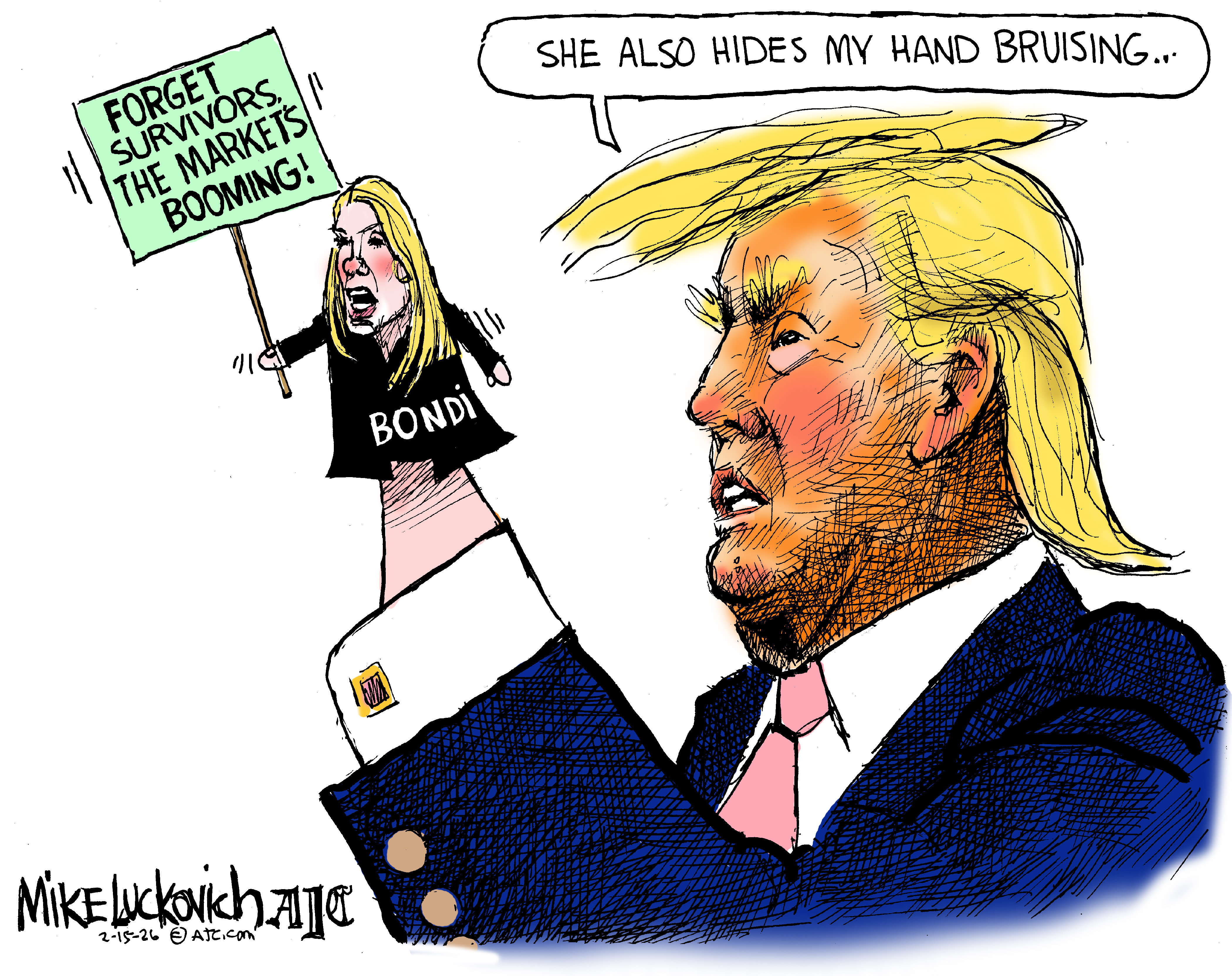

Political cartoons for February 15

Political cartoons for February 15Cartoons Sunday's political cartoons include political ventriloquism, Europe in the middle, and more

-

The broken water companies failing England and Wales

The broken water companies failing England and WalesExplainer With rising bills, deteriorating river health and a lack of investment, regulators face an uphill battle to stabilise the industry

-

Three owner makes final pitch to win approval for O2 merger

Three owner makes final pitch to win approval for O2 mergerIn Depth Sky and Virgin could take big chunks of network capacity, while enlarged firm would invest in infrastructure

-

Phones 4u collapse: jobs saved after EE agrees to buy shops

Phones 4u collapse: jobs saved after EE agrees to buy shopsIn Depth EE, blamed by Phones 4u for precipitating its downfall, to save the day – with Vodafone