SNP pledges to reverse Osborne's tax cut if it wins Holyrood elections

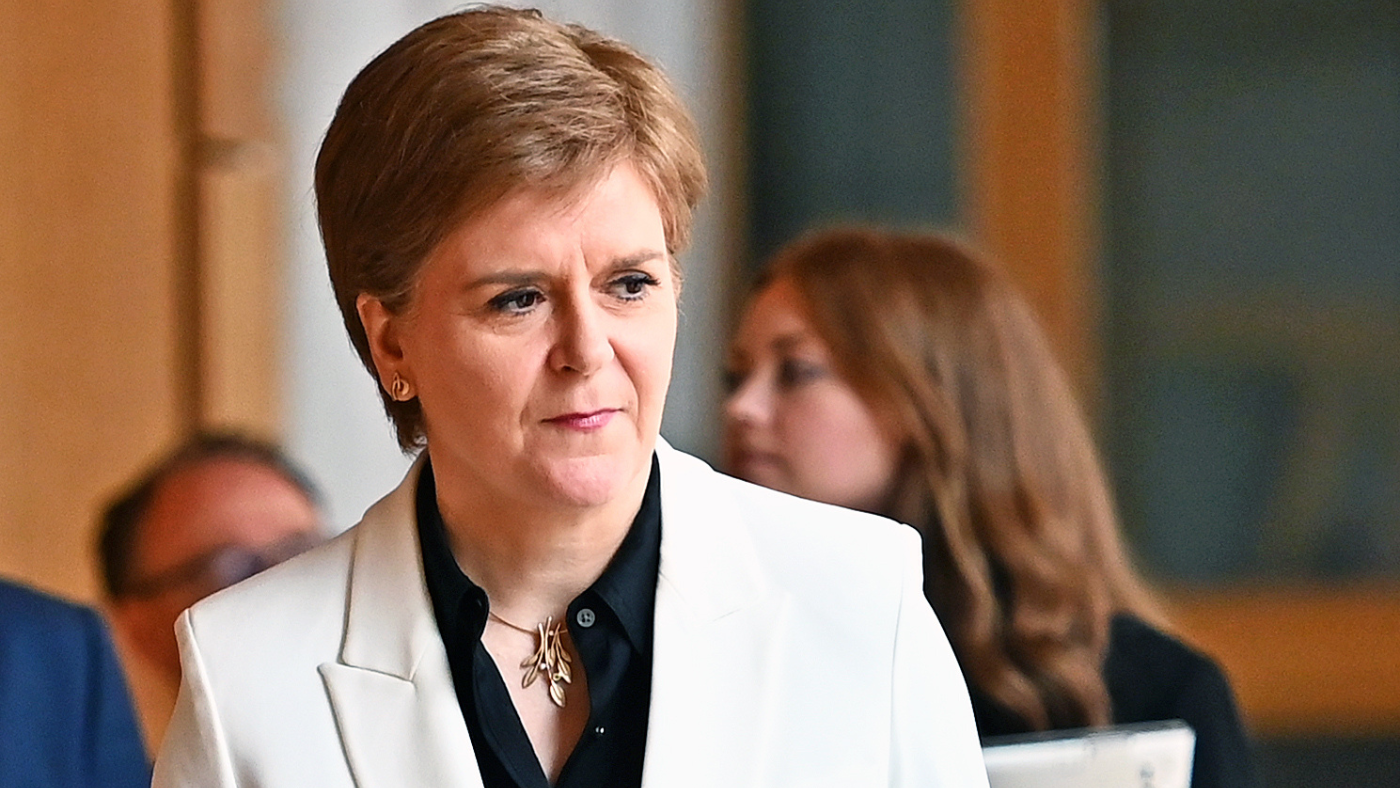

Nicola Sturgeon places party as centre ground option as Scottish Labour tacks left

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Scotland's highest earners will not receive the tax cut laid out in last week's budget if the SNP is returned to power, the party confirmed as it unveiled its tax plans ahead of May's Scottish parliament elections.

Leader Nicola Sturgeon said plans to increase the threshold at which workers start paying the 40p rate from £43,000 to £45,000 would not be implemented by an SNP government, raising an extra £1.2bn for Scottish public services.

She also pledged that the basic rate of tax, which affects more than 85 per cent of the population, would not increase until 2022.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

"We do not believe it is right that those on low incomes are asked to pay for austerity," Sturgeon said.

As part of a raft of new powers promised during the independence referendum in 2014, Holyrood will gain control over rates and bands of income tax from April 2017. It will not have any power to change the personal allowance, which will rise to £11,500 next year under plans unveiled by George Osborne last week.

From this April, the Scottish government has the right to vary income taxes by 10p relative to the UK rate, but it must apply the changes equally across every tax band and it cannot take measures to amend the income levels at which the bands apply.

Under the new laws, it will gain fuller control from next year and the SNP has effectively pledged to keep taxes broadly as they are now.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

However, while a freeze at current levels will "reassure well-off payers, some of whom had been concerned about the SNP rhetoric on social justice and the need for progressive taxation", it will fuel feeling among some left-wing members that the party is being "too cautious", says the Financial Times.

Sensing a possible opportunity to occupy SNP territory, Scottish Labour has tacked left in order to present itself as the truly radical party on taxation. It has already called for an increase across all income tax bands of 1p to fund higher spending, saying a £200-a-year payment could be made to the lowest paid to prevent them losing out.

Party leader Kezia Dugdale said: "Instead of ending austerity in Scotland, this means billions of pounds of Tory cuts passed on to Scotland's public services. Nicola Sturgeon must now tell people where these cuts will fall."

Scottish Labour has also pledged to scrap the current council tax system, which it labels "unfair", and replace it with a new form of local government tax based on property value. Under its system, it says, 80 per cent of households would be better off.

The SNP recently decided to retain council tax based on 25-year-old property valuations despite previous manifesto promises to reform the system, a move which has been condemned by its opponents.

Middle class Scots facing higher tax bill than rest of UK

17 March

Middle class workers in Scotland could soon be paying a higher rate of income tax than their fellow Brits.

In his Budget yesterday, Chancellor George Osborne made further moves to fulfil the Conservatives' tax-cutting manifesto pledges with the announcement of an increase in the higher-rate threshold at which 40 per cent tax becomes due to £45,000, which will see about 585,000 fewer people paying the higher rate from April 2017.

The argument is that the tax now catches swaths of people it was never intended for, including senior teachers and nurses, because the threshold has not kept pace with wage rises. When Nigel Lawson introduced the rate 30 years ago, it applied to one in 20 people, the Daily Telegraph notes. This has since risen to one in six.

But critics say Osborne's plans amount to a tax break for the rich at a time of a squeeze on benefits, including this week's move to cut payments for disabled people deemed fit to undertake some work.

Among the voices of dissent is Scottish first minister Nicola Sturgeon - and from next year, she'll have the power to do something about it.

From April, the Holyrood government can move income taxes by anything up to 10p higher or lower. However, under the final draft of the new Scotland bill, it will be able to vary tax rates and bands freely from next year, although MSPs will have no power over the personal allowance.

This means Sturgeon, should she win May's election, could decide to reverse Osborne's decision north of the border, meaning 372,000 Scottish people earning more than £43,000 would pay collectively £190m more in tax. The Scottish National Party will set out its plans next week, before the election break.

"Let me be absolutely clear today - a large tax cut for ten per cent of the population, those on the highest incomes, at a time when support for the disabled is being cut, at a time when our public services are under pressure, is in my view the wrong choice," Sturgeon told the BBC.

Scottish Labour and Liberal Democrats both also oppose the changes and have called for a 1p tax rise for all but the lowest paid and the reinstatement of the 50p tax for the highest paid. This, says The Guardian, allows the Scottish first minister to "portray herself as the moderate, centrist party leader" by opposing both Osborne's cut and more radical tax rises under her rivals.

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day

-

Bad Bunny’s Super Bowl: A win for unity

Bad Bunny’s Super Bowl: A win for unityFeature The global superstar's halftime show was a celebration for everyone to enjoy

-

The road to a second Scottish independence referendum

The road to a second Scottish independence referendumfeature Nicola Sturgeon launched her latest bid for Scottish independence last week

-

Labour shortages: the ‘most urgent problem’ facing the UK economy right now

Labour shortages: the ‘most urgent problem’ facing the UK economy right nowSpeed Read Britain is currently in the grip of an ‘employment crisis’

-

What Scotland can learn from Irish independence

What Scotland can learn from Irish independencefeature Economists predict Scottish transition would fail to curb increasing interest rates and inequality

-

Will the energy war hurt Europe more than Russia?

Will the energy war hurt Europe more than Russia?Speed Read European Commission proposes a total ban on Russian oil

-

Will Elon Musk manage to take over Twitter?

Will Elon Musk manage to take over Twitter?Speed Read The world’s richest man has launched a hostile takeover bid worth $43bn

-

Shoppers urged not to buy into dodgy Black Friday deals

Shoppers urged not to buy into dodgy Black Friday dealsSpeed Read Consumer watchdog says better prices can be had on most of the so-called bargain offers

-

Ryanair: readying for departure from London

Ryanair: readying for departure from LondonSpeed Read Plans to delist Ryanair from the London Stock Exchange could spell ‘another blow’ to the ‘dwindling’ London market

-

Out of fashion: Asos ‘curse’ has struck again

Out of fashion: Asos ‘curse’ has struck againSpeed Read Share price tumbles following the departure of CEO Nick Beighton