Are Lifetime Isas a threat to auto-enrolment pensions?

Some fear the generous bonus and simplicity will encourage younger savers to abandon traditional options

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

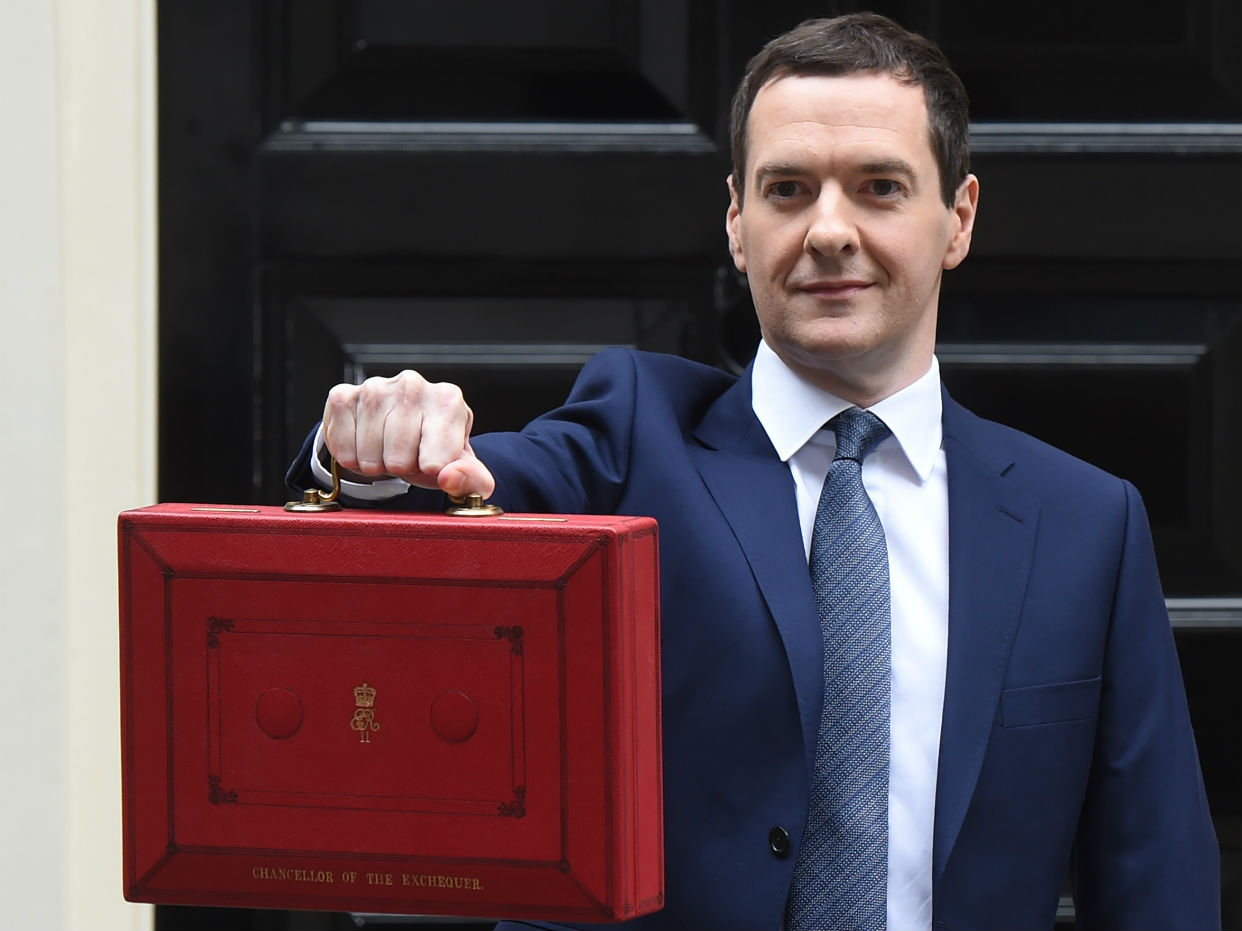

In his Budget Chancellor George Osborne announced the arrival of a new savings vehicle in the Isa family. Launching next year the Lifetime Isa is being seen by some as an alternative to pension saving. This has led to fears it could undermine auto-enrolment, with young savers opting for the familiarity of an Isa rather than the seeming complexity of a pension.

What is a lifetime Isa?

The newest Isa will be available to anyone aged between 18 and 40 and allows you to save up to £4,000 a year, with the money growing free from tax and, if used within the prescribed terms, earning a 25 per cent bonus at the age of 50 to help provide an income in retirement from the age of 60.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Access to the cash you have saved is very limited. You can either use it to buy a house or for your retirement, with access heavily penalised if you withdraw money before you turn 60 unless it is for a house purchase.

Will it affect auto-enrolment?

The big attractions of a government top-up plus the option to spend your savings on a house - and most crucially the simple fact that the money can be easily accessed at any time if the account holder is willing to forfeit the perks - has some experts worried that workers could choose to save into a Lifetime Isa rather than opt for auto-enrolment in to a pension scheme.

An inquiry into auto-enrolment by the Work and Pensions Committee has re-opened to consider what affect the Lifetime Isa (Lisa) will have on workplace pensions.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

"The move follows concerns over a potential conflict between the Treasury strategy of getting people saving with the more flexible Lisa, and the DWP’s auto-enrolment objective of ensuring people have sufficient income in retirement," says Shirin Aguiar in FT Adviser.

Since its introduction in 2012 auto-enrolment has drawn six million people into workplace pensions savings, a considerable step on the road to making the nation better prepared for retirement.

The concern is that employers may encourage workers to save into Lisas as that would mean the employer could dodge having to make pension contributions. Also, employees may not realise that by opting for a Lisa they are missing out on valuable employer contributions to their pension.

Should auto-enrolment include ISAs?

One MP has suggested that a solution to the problem would be to include Lisas in auto-enrolment.

“We ought to consider giving employers the choice of auto-enrolling people on to the Lifetime Isa, which might be a more flexible and attractive solution for people on low wages, the ones generally in auto-enrolment, who are trying to help to save and have the right savings at the right time in their lives,” Conservative MP for Amber Valley Nigel Mills said in the House of Commons.

Including Lisas in auto-enrolment would open a can of worms, though. Would employers make contributions to Lisas? That could mean employers ended up helping pay for their employees houses. Also, the current £4,000 annual limit on Lisa deposits could limit someone’s ability to save sufficiently.

Could Lifetime Isas replace pensions?

There is an argument that Lisas effect on auto-enrolment is irrelevant as the Treasury could be planning to replace traditional pensions with Isas longer term anyway.

"It’s interesting that older savers have not been included in the new Lifetime ISA," says Philip Smith, a pensions partner at PwC, in The Independent. "This may point to a future dual track system, leaving the current pension system in place, but introducing the pension Isa by stealth. Once the market beds down, a change to a fully-fledged pension Isa becomes much easier."

The Treasury has said the Lifetime Isa is designed to complement pensions, but many aren’t convinced.

"The Lifetime ISA is essentially a new pension regime through the backdoor," Patrick Bloomfield, a partner at Hymans Robertson, a pensions and benefits consultancy told the Financial Times. "It is the first step on the path to a pension Isa for all."