Budget 2016: How will the new Lifetime Isa work?

Government will top up savings for purchase of a first home or to provide a retirement income

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

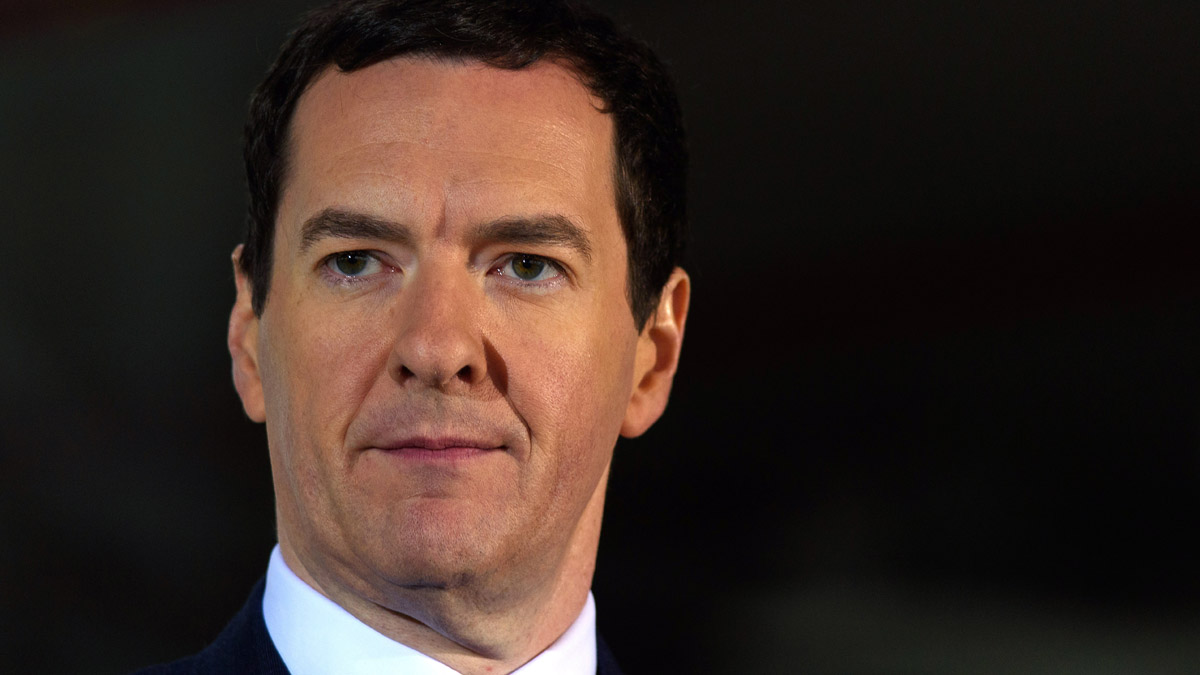

One of the key Budget changes that George Osborne said would the "next generation", from 2017 the newest addition to the burgeoning Isa franchise will be open for business.

What is it?

It's called the Lifetime Isa and is designed to act as either a flexible alternative pension-saving fund or to extend the mechanism of the existing Help to Buy Isa helping first-time buyers get on to the property ladder.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

How will it work?

Much like Help to Buy, the government will give a bonus to savers who put money away and then don't touch it. However, in this case, the amounts available are higher and available over longer terms. If you save £4,000 a year, you're eligible for a top-up of 25 per cent – an extra £1,000.

The Isa is open to the under-40s and the bonuses are accrued until they turn 50. Savers can claim bonuses at any point before or after then to use towards a first house purchase and then claim either the lot or what is left over to help provide an income or lump sum in retirement when they hit the 60.

So will my money be locked away?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

No. As with any other Isa, you'll be able to take the money out for emergencies if you need to, but it will work like other restricted access accounts so you will probably have to pay a fee and you'll lose the government bonus. A consultation will look at the option of following the 401k pension model in the US and allowing people to keep the bonus if they later replace any money they've withdrawn.

How does this affect my other Isas?

In terms of allowances each year, any money put in will count towards your overall limit and so reduce the amount you can place into other Isa accounts. However, the allowances are being increased so you'll have a total allocation of £20,000 to play with by the time this new account is introduced.

One specific crossover is with the Help to Buy Isa, which offers more limited bonuses purely to help people buy a house. Savers can either continue to use this scheme or transfer any money held across to a Lifetime Isa to benefit from the higher bonuses. You can only use one or other of the accounts to go towards a house deposit.

What about couples?

Yep, in the same way as the Help to Buy Isa, a couple can have one account each and both receive the bonuses.

How does it compare to standard pensions?

It's a completely different way of saving for a pension. You're putting money that has already been taxed into the fund and you don't get any of that tax back, but your savings will then grow tax-free and can be withdrawn tax-free in retirement.

Pensions are paid out of gross income before tax is deducted or, if tax has been paid, it is rebated. The income is then taxed in retirement, with the exception of a 25 per cent lump sum that you can take tax-free. Unlike the Isas, once your money is in your pension, you can't touch it before the age of 55 unless you want to incur a massive penalty tax charge.

-

Quiz of The Week: 14 – 20 February

Quiz of The Week: 14 – 20 FebruaryQuiz Have you been paying attention to The Week’s news?

-

The Week Unwrapped: Do the Freemasons have too much sway in the police force?

The Week Unwrapped: Do the Freemasons have too much sway in the police force?Podcast Plus, what does the growing popularity of prediction markets mean for the future? And why are UK film and TV workers struggling?

-

Properties of the week: pretty thatched cottages

Properties of the week: pretty thatched cottagesThe Week Recommends Featuring homes in West Sussex, Dorset and Suffolk

-

How your household budget could look in 2026

How your household budget could look in 2026The Explainer The government is trying to balance the nation’s books but energy bills and the cost of food could impact your finances

-

How the clock change could impact your finances

How the clock change could impact your financesThe Explainer The winter months can be more expensive but there are ways to keep your costs down

-

Six actions to protect your finances before the Autumn Budget

Six actions to protect your finances before the Autumn BudgetIn Depth Reforms to property taxes, pensions and inheritance tax may be on the agenda for the 2025 Autumn Budget. Here is how you can prepare

-

What the 2025 Autumn Budget could mean for your wallet

What the 2025 Autumn Budget could mean for your walletThe Explainer Chancellor Rachel Reeves will reveal her latest plan to balance the nation’s finances in November

-

3 tips to save for a cruise this year

3 tips to save for a cruise this yearThe Explainer The convenience of a cruise doesn't necessarily come cheap without some strategic planning

-

Planning a trip? These are 3 budget-breaking mistakes to avoid.

Planning a trip? These are 3 budget-breaking mistakes to avoid.The Explainer Don't accidentally inflate your travel costs

-

4 tips to save if you're returning to the office

4 tips to save if you're returning to the officeThe Explainer There are ways to protect your budget as you change your daily work routine

-

What the Spring Budget really means for your wallet

What the Spring Budget really means for your walletThe Explainer From tax cuts to child benefit changes, here's how the chancellor's latest fiscal update could affect your finances