Tax havens 'have no economic purpose', say economists

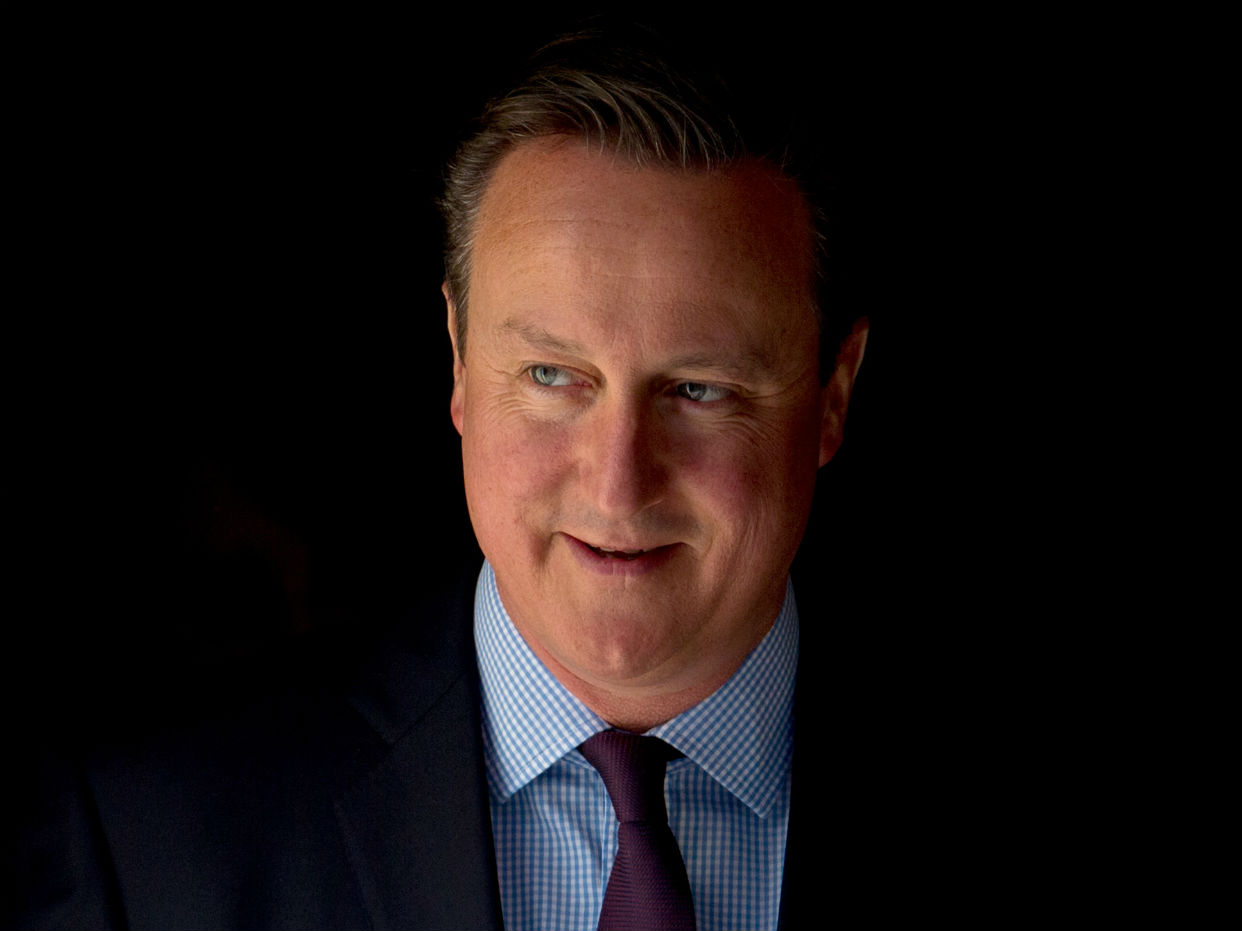

Pressure grows on David Cameron as more than 300 experts call for new measures to end secrecy

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

David Cameron is under mounting pressure ahead of hosting an anti-corruption summit after hundreds of the world's top economists called on the UK to take the lead in tackling tax havens.

A letter signed by 300 economists has derided the low tax jurisdictions as serving "no economic purpose" and called for new measures to prevent them from being used to help the rich and powerful avoid paying their fair share.

It says that poor countries are "the biggest losers from tax havens" and that not doing more has undermined global governments' apparent drive for sustainable development.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

"Tax havens basically allow companies and certain individuals to free-ride on the rest of humanity," signatory Dr Ha-Joon Chang, of the University of Cambridge, told the BBC

The letter also calls for the introduction of new international rules designed to force companies to report taxable activities on a country by country basis, allowing duties to be applied where money is made rather than where it is reported. To help achieve this, they want low-tax havens to be forced to publish details of who owns the companies and assets held there.

The economists, including almost 50 professors from British universities as well as Nobel prize-winner Angus Deaton, say the UK is in a "unique position" to take the lead as it has sovereignty over around a third of the world's tax havens. About half of the companies revealed in the Panama Papers documents are based in British overseas territories.

James Quarmby, a tax lawyer at the international law firm Stephenson Harwood, countered that offshore havens play an important role in international finance and trade. There is "more money laundering going on in New York, Frankfurt and London than any of the [offshore] finance centres", he added.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The Financial Times says supporters of tax havens typically argue "their low tax rates provide stability and simplicity – for example, by preventing investors from multiple jurisdictions from being charged double taxation".

Most refute this, however. The economists' letter states that "territories allowing assets to be hidden in shell companies, or which encourage profits to be booked by companies that do no business there, are distorting the working of the global economy".

The Prime Minister agreed to host this Thursday's summit more than a year ago and intended it to be a general discussion of governance and taxation issues. However, "the event is in danger of simply turning a spotlight on how the British government has failed to persuade its overseas territories to stop harbouring secretly stored cash", says The Guardian.

Tax havens are thought to cost the global economy around £76bn each year.

Tax havens help US companies dodge $340bn bill

14 April

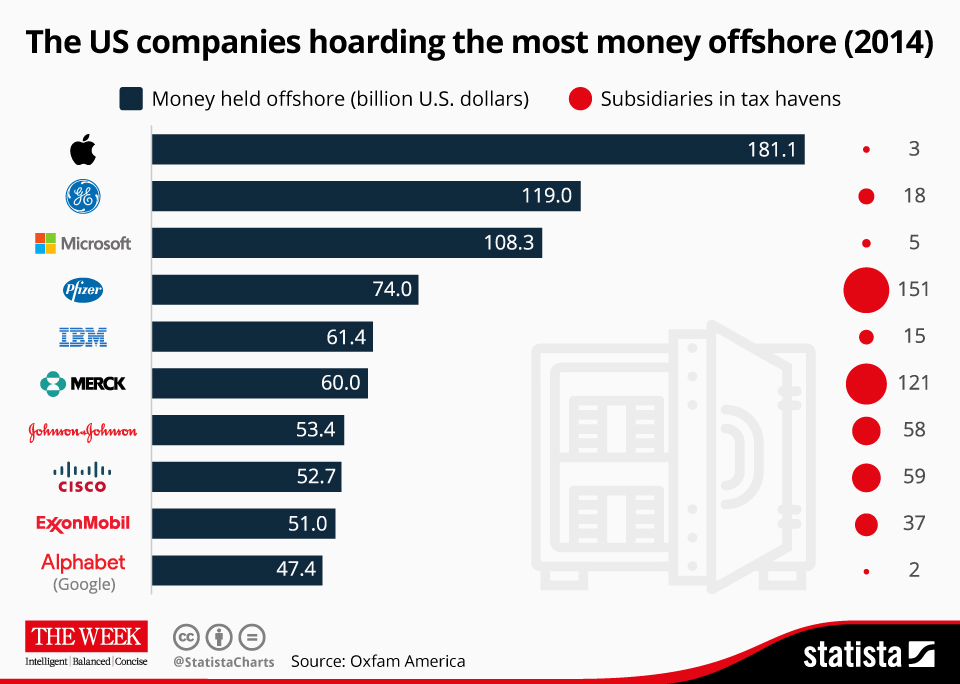

As much as $1.4trn (£1trn) could be held in offshore tax havens by the US's 50 largest companies, Oxfam has claimed.

In a report that follows the explosive Panama Papers revelations into offshore dealings, the charity estimates that an “opaque and secretive network” of 1,608 subsidiaries based offshore is being used to hoard cash and divert profits by companies such as Apple, Walmart and General Electric.

Apple alone has around $181bn (£128bn) held in three offshore entities, The Guardian notes, with GE, Microsoft, Pfizer, Google parent Alphabet and oil company ExxonMobil also in the top ten.

Oxfam believes the money has been used to reduce the global tax bill on $4trn (£2.8trn) of worldwide profits between 2008 and 2014, from the 35 per cent that would apply in the US to around 26.5 per cent. This would mean $340bn (£240bn) in taxes was avoided over six years.

In fact, it says that as much as $110bn (£78bn) a year might be lost to the global economy.

A previous report by Citizens for Tax Justice calculated the US government was missing out on $90bn (£64bn) a year in tax revenue.

Companies avoid taxes by, for example, licensing intellectual property and the like to offshore subsidiaries in low-tax jurisdictions. Payments made under these licences are deducted from profits and so have the effect of shifting earnings overseas.

Very few people defend the practice as anything other than exploiting a loophole to minimise tax bills, although some will claim this is, in effect, part of any big company boss's duty.

In the US, there have been murmurs that tax reforms making such profit-shifting illegal might be proposed, while in the UK, the government announced this week it had signed no transparency arrangements with hundreds of tax havens under its auspices.

New tax rules coming in slowly around the world aim to promote country by country reporting, which campaigners hope will increase the ability of governments to tax profits made in their countries.

"Tax dodging practised by corporations and enabled by federal policymakers contributes to dangerous inequality that is undermining our social fabric and hindering economic growth," Oxfam said.

Infographic by www.statista.com for TheWeek.co.uk.