Who are the Bitcoin billionaires?

The Winklevoss brothers are among a small group of investors who betted big on Bitcoin

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

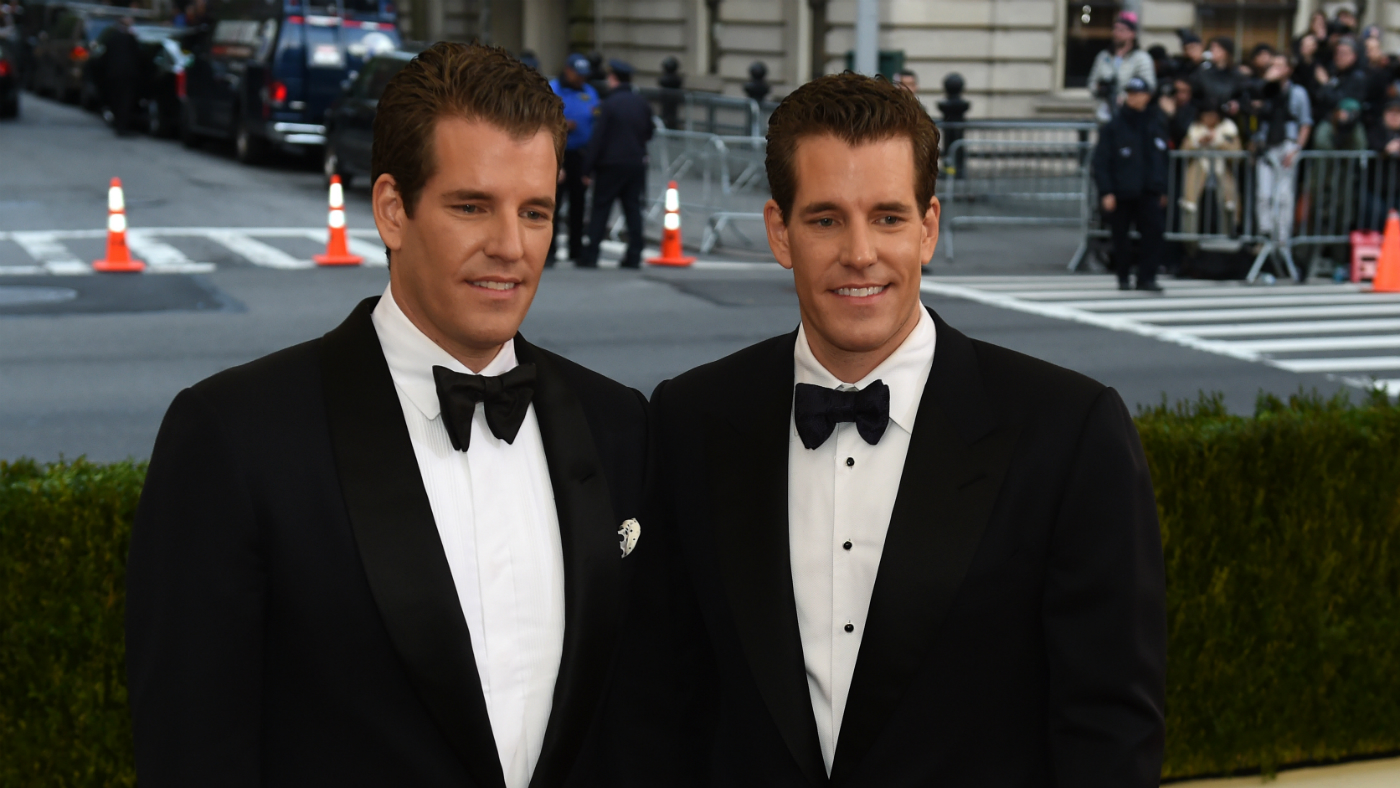

Tyler and Cameron Winklevoss, the brothers who accused Mark Zuckerberg of stealing their idea for Facebook, have reportedly become the first Bitcoin billionaires.

The identical twins made an $11m (£8m) bet on the cryptocurrency four years ago, using part of the $65m (£48m) settlement they received from Zuckerberg in 2009.

They are now worth more than $1bn (£742m) after capitalising on the “astonishing rise” in Bitcoin, The Sunday Telegraph reports.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

“It is believed to be the first billion-dollar return made by a cryptocurrency investor, a landmark moment for the controversial asset,” says the paper.

The brothers, who rowed for the US at the Beijing Olympics, “have re-styled themselves as Bitcoin entrepreneurs, launching their own online exchange and venture capital”, the Telegraph adds.

But journalist and analyst Joseph Young suggests other billionaire Bitcoin holders already exist.

Among them is Satoshi Nakamoto, the cryptocurrency’s mysterious inventor, who is estimated to own 980,000 bitcoins, amassed from mining the cryptocurrency in its early days, Quartz reports.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

With the value of a single Bitcoin currently sitting at over $11,000 (£8,000), Nakamoto appears to have netted a fortune of over $11bn (£8bn).

Prices have risen more than 900% since the beginning of the year, with the total value of Bitcoin in existence surpassing $167bn (£125bn), but analysts remain divided over whether the cryptocurrency is a bubble waiting to burst or a good investment.