Weinstein Company files for bankruptcy

Studio’s board says it has ‘little choice’ after collapse of buyout deal

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The Weinstein Company (TWC) has announced plans to declare bankruptcy, four-and-a-half months after co-founder Harvey Weinstein was fired from the firm over sexual abuse allegations.

TWC employees were among the dozens who came forward with reports of sexual harassment, abuse and exploitation at the hands of the disgraced movie mogul.

Earlier this month, New York attorney general Eric Schneiderman announced that the state would be filing a lawsuit against TWC, charging “vicious and exploitative mistreatment of company employees”, and “egregious” violations of civil and humans rights and business laws.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The fallout from the scandal left the company - behind screen hits including The King’s Speech and Paddington - “struggling to secure its survival in the wake of cancelled projects and the resignation of most of its board”, says the Financial Times.

The collapse of a potential takeover deal has left the studio with “little choice” but to start readying a bankruptcy filing, TWC said in a statement.

A group of investors led by Maria Contreras-Sweet, former head of the US government’s Small Business Administration, had offered to pay around $275m (£196m), while assuming $225m ($160m) of debt.

The investors planned to instate a majority-female board of directors as part of a massive rebranding of the beleaguered studio, says The Hollywood Reporter.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

However, on Sunday evening TWC dismissed the buyout plans as insufficient in a “sharply worded” letter addressed to Contreras-Sweet and fellow investor Ron Burkle, a private equity billionaire.

According to the letter, “an orderly bankruptcy process” is “the only viable option” to maximise the “company’s remaining value”.

-

The broken water companies failing England and Wales

The broken water companies failing England and WalesExplainer With rising bills, deteriorating river health and a lack of investment, regulators face an uphill battle to stabilise the industry

-

A thrilling foodie city in northern Japan

A thrilling foodie city in northern JapanThe Week Recommends The food scene here is ‘unspoilt’ and ‘fun’

-

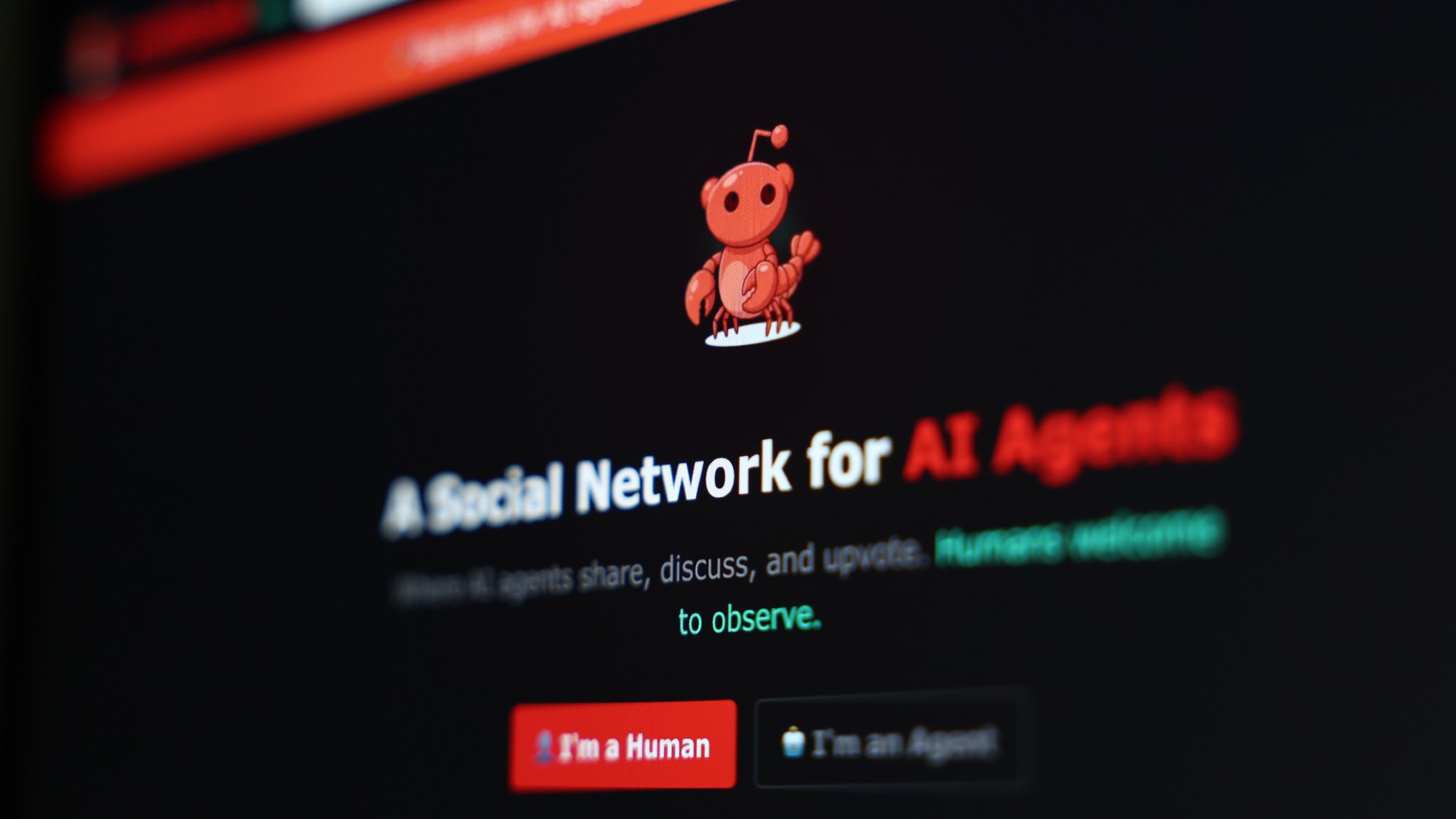

Are AI bots conspiring against us?

Are AI bots conspiring against us?Talking Point Moltbook, the AI social network where humans are banned, may be the tip of the iceberg

-

Labour shortages: the ‘most urgent problem’ facing the UK economy right now

Labour shortages: the ‘most urgent problem’ facing the UK economy right nowSpeed Read Britain is currently in the grip of an ‘employment crisis’

-

Will the energy war hurt Europe more than Russia?

Will the energy war hurt Europe more than Russia?Speed Read European Commission proposes a total ban on Russian oil

-

Will Elon Musk manage to take over Twitter?

Will Elon Musk manage to take over Twitter?Speed Read The world’s richest man has launched a hostile takeover bid worth $43bn

-

Shoppers urged not to buy into dodgy Black Friday deals

Shoppers urged not to buy into dodgy Black Friday dealsSpeed Read Consumer watchdog says better prices can be had on most of the so-called bargain offers

-

Ryanair: readying for departure from London

Ryanair: readying for departure from LondonSpeed Read Plans to delist Ryanair from the London Stock Exchange could spell ‘another blow’ to the ‘dwindling’ London market

-

Out of fashion: Asos ‘curse’ has struck again

Out of fashion: Asos ‘curse’ has struck againSpeed Read Share price tumbles following the departure of CEO Nick Beighton

-

Universal Music’s blockbuster listing: don’t stop me now…

Universal Music’s blockbuster listing: don’t stop me now…Speed Read Investors are betting heavily that the ‘boom in music streaming’, which has transformed Universal’s fortunes, ‘still has a long way to go’

-

EasyJet/Wizz: battle for air supremacy

EasyJet/Wizz: battle for air supremacySpeed Read ‘Wizz’s cheeky takeover bid will have come as a blow to the corporate ego’