‘The week that shook Big Oil’: a turning point for the energy industry?

Big Oil has been forced to listen on climate change. But what difference will it actually make?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

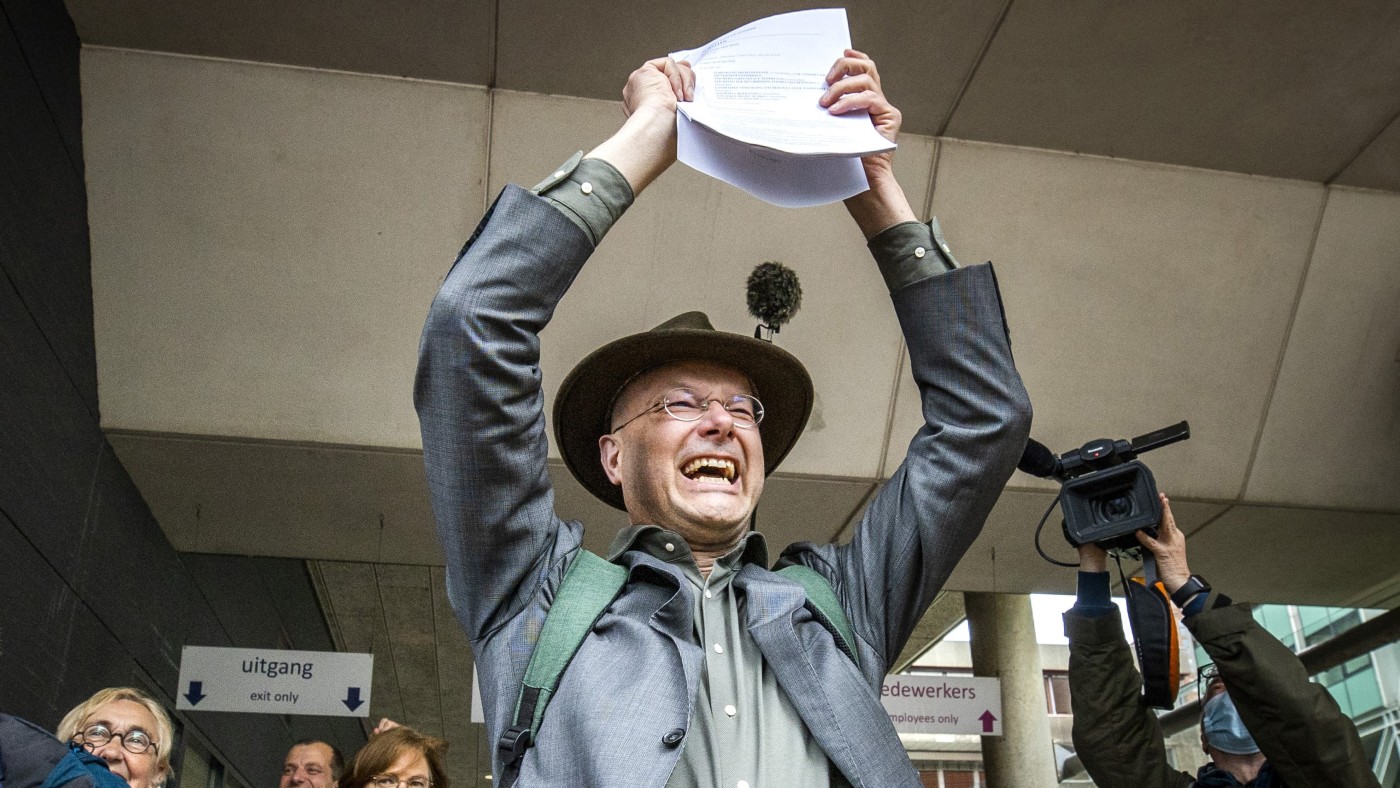

Last Wednesday was “a bad day for Big Oil”, said Julian Lee on Bloomberg – “or a good one, depending on your point of view”. Three of the world’s biggest publicly-traded oil and gas companies – Exxon Mobil, Chevron and Royal Dutch Shell – were dealt stinging blows, with the upshot that “they’re going to have to clean up their acts a lot faster than they were planning”. Exxon shareholders – in the face of stiff opposition from management – voted to appoint at least two “climate-conscious” members to the board. At Chevron, meanwhile, a shareholder rebellion supported activist demands to cut emissions; and a court in The Hague legally obliged Shell to meet a stiff carbon reduction target.

“Environmentalists should think twice before celebrating the week that shook Big Oil,” said Ambrose Evans-Pritchard in The Daily Telegraph. These activist victories “are pregnant with unintended consequences”. Interfering with future crude supply, just as the market tightens because of depleting oil wells, increases “the risk of a violent price spike and a disruptive shock before the world has reduced its economic dependence on oil”.

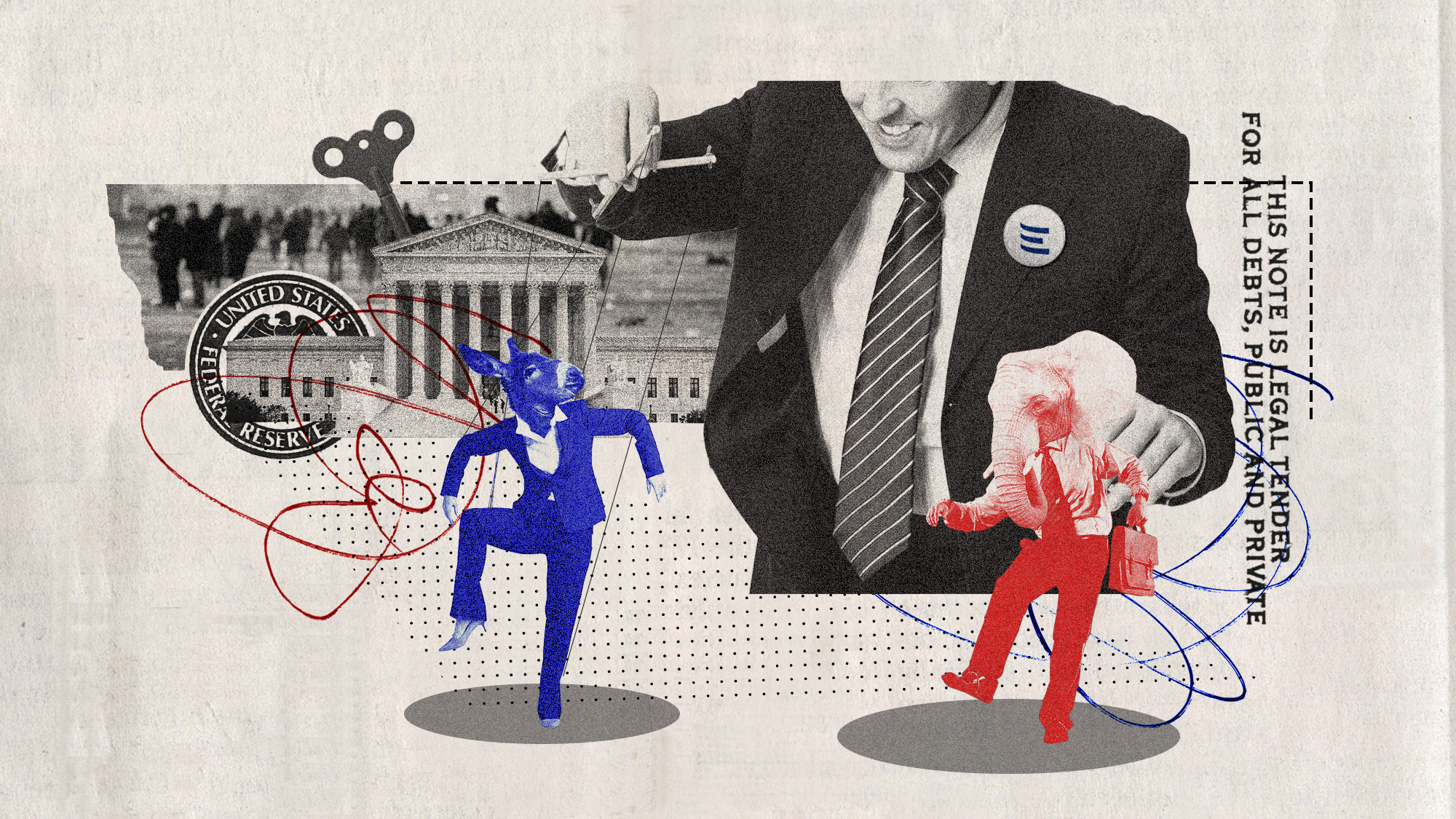

Besides, the assault on well-regulated Western oil and gas companies – the best of which are already committed to net-zero – plays into the hands of Opec, Russia and the world’s “authoritarian rentier petrostates”. Delivering net-zero in practice “requires finer statecraft” than putting “oil executives in the dock, glibly dishing out moral opprobrium”. For real transformation, we need to focus on the demand side – which means focusing on governments and consumers. There is no point in “vilifying the drillers when the essential problem is the rest of us”.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

It’s a moot point whether coming down hard on the oil majors will accelerate “the roll-out of lower-cost renewables”, said Nils Pratley in The Guardian. But one “genuinely new development” – wrought by the upstart green hedge fund, Engine No. 1, at Exxon – is that an “obstinate” oil company “now knows that the make-up of its board can be changed against its will”. This is “a turning point for Big Oil”, said the FT: not least because of evidence of new alliances between activist shareholders and climate campaigners.

What this means for valuations isn’t “immediately apparent”, said George Hay on Reuters Breakingviews. “What is clear, though, is that the days of big oil groups being opaque about their plans to reduce emissions are over.” The one major to emerge well from the upset is BP, which unveiled a detailed plan “to pivot away from fossil fuels” last September and saw its shares punished. That discount should now disappear. CEO Bernard Looney “must be feeling pretty smug”.

The Week Unwrapped podcast: Fuel protest, Danish spying and living to 150

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Political cartoons for February 19

Political cartoons for February 19Cartoons Thursday’s political cartoons include a suspicious package, a piece of the cake, and more

-

The Gallivant: style and charm steps from Camber Sands

The Gallivant: style and charm steps from Camber SandsThe Week Recommends Nestled behind the dunes, this luxury hotel is a great place to hunker down and get cosy

-

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in Iraq

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in IraqThe Week Recommends Charming debut from Hasan Hadi is filled with ‘vivid characters’

-

Why is the world so divided over plastics?

Why is the world so divided over plastics?Today's Big Question UN negotiations on first global plastic treaty are at stake, as fossil fuel companies, petrostates and plastic industry work to resist a legal cap on production

-

Greenpeace, Energy Transfer and the demise of environmental activism

Greenpeace, Energy Transfer and the demise of environmental activismThe Explainer Court order forcing Greenpeace to pay $660m over pipeline protests will have 'chilling' impact on free speech, campaigners warn

-

Cop28: is UAE the right host for the climate summit?

Cop28: is UAE the right host for the climate summit?Today's Big Question Middle East nation is accused of 'pushing for a green world that can still have its oil'

-

Guyana: the epicentre of oil 'arms race'

Guyana: the epicentre of oil 'arms race'Under the Radar The Stabroek oil block is growing the nation's economy - but is hotly contested

-

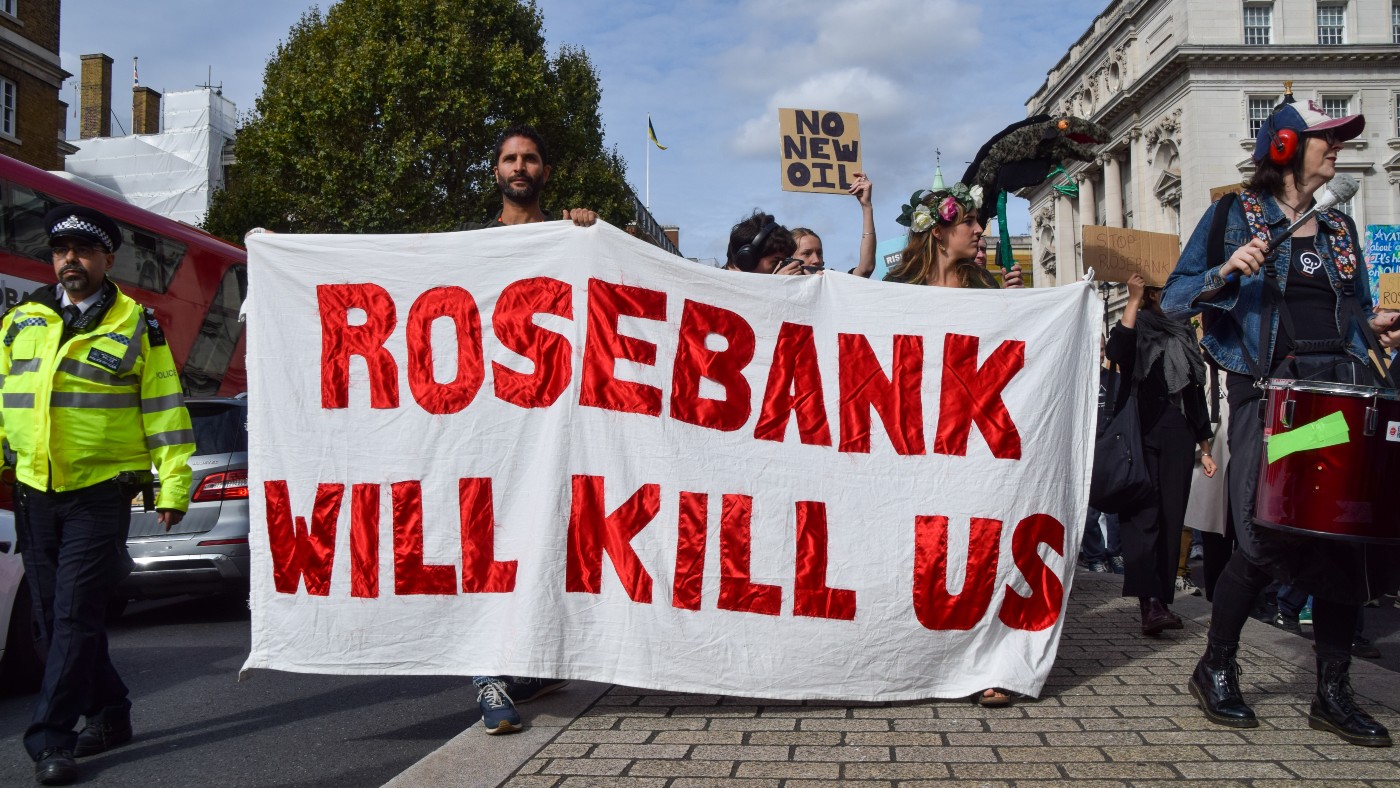

Rosebank oil field: pragmatism over future prospects?

Rosebank oil field: pragmatism over future prospects?Talking Point Green campaigners decry 'morally obscene' opening of new oil fields while trying to cut emissions

-

Could we actually ‘just stop oil’?

Could we actually ‘just stop oil’?In Depth Disrupting sporting events is becoming Just Stop Oil’s ‘signature form of protest’

-

Has the world finally reached ‘peak oil’?

Has the world finally reached ‘peak oil’?Today's Big Question Experts think the shift to clean energy is quickening but one says we should take the forecast with ‘a boulder of salt’

-

Major incident declared after oil leak in Poole

Major incident declared after oil leak in PooleSpeed Read Swimmers in Dorset beauty spot warned not to enter Europe’s largest natural harbour