What the Brexit vote could mean for sterling

Traders brace for huge volatility on European currency markets

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Traders are bracing themselves for huge volatility on European currency markets when they open this morning, after Theresa May’s Brexit withdrawal bill was resoundingly rejected by MPs.

Citigroup’s private banking arms has advised its wealthy investors to avoid trading the pound during what promises to be a highly tumultuous 24 hours for the currency.

Meanwhile, money transfer company TransferWise said it would limit users to moving £10,000 ($12,840) in or out of the United Kingdom today because of the “higher likelihood of exchange rate volatility”.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

“In recent years, traders have been looking at politics, rather than economic data, which means faster trading, and a faster pace of change in the price. That's the volatility traders talk about,” says the BBC.

“What will happen in the days after the vote is very difficult to predict” says CNN, but “the wide range of potential outcomes, and the seriousness of their consequences, presents a major challenge to currency traders.”

Above all money markets demand certainty. Sterling plummeted immediately after Britain voted to leave the EU as investors rightly predicted a prolonged period of political chaos.

“If you think about political uncertainty being bad, the worst outcome is a hard Brexit,” says Jane Foley, foreign exchange strategist at Rabobank Foley, because details of what will happen under those circumstances are so scarce.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

She told The Daily Telegraph investors will “favour any outcome which appears to suggest a hard Brexit is off the table”, such as an extension to Article 50, and a second referendum “could be cautiously welcomed”.

Much will depend on whether Labour leader Jeremy Corbyn wins a motion of no confidence in the government.

“This would also throw up massive uncertainties over Brexit and be a very bearish cocktail for sterling and the UK economy and mean the [Bank of England] would be pushed to the back of the minds of market makers leaving sterling out to dry towards the post Brexit referendum low of 1.200,” says Ross Burland for FX Street.

“At this stage, an extension of Article 50 would likely be called which could temper the bears in due course bringing some support for sterling once again, but a fade on rallies would likely be the state of play for the foreseeable future,” says Burland.

In the short-term, Michael Brown, Senior Analyst at Caxton FX says a heavy defeat “would create further uncertainty and exert more downward pressure on sterling, likely in the region of 3–5% as an immediate reaction to the vote”.

By contrast, should Theresa May’s withdrawal act be voted through at a second attempt, sterling will most likely surge about 5% in value against the US dollar.

Capital Economics predicts that this would see the pound rally to $1.45 by the end of the planned transition deal in December 2020. A Brexit fudge or delay would cause the currency to strengthen to $1.40 by the same date, it says.

Barring the deal passing in Parliament, “perhaps the best-case scenario for the pound would be a delay to the article 50 process”, says Brown.

However, crashing out of the European Union without a deal would send it plummeting by 10% he said, which would see it drop to $1.12, its lowest level in over 30 years.

-

The Week Unwrapped: Do the Freemasons have too much sway in the police force?

The Week Unwrapped: Do the Freemasons have too much sway in the police force?Podcast Plus, what does the growing popularity of prediction markets mean for the future? And why are UK film and TV workers struggling?

-

Properties of the week: pretty thatched cottages

Properties of the week: pretty thatched cottagesThe Week Recommends Featuring homes in West Sussex, Dorset and Suffolk

-

The week’s best photos

The week’s best photosIn Pictures An explosive meal, a carnival of joy, and more

-

How corrupt is the UK?

How corrupt is the UK?The Explainer Decline in standards ‘risks becoming a defining feature of our political culture’ as Britain falls to lowest ever score on global index

-

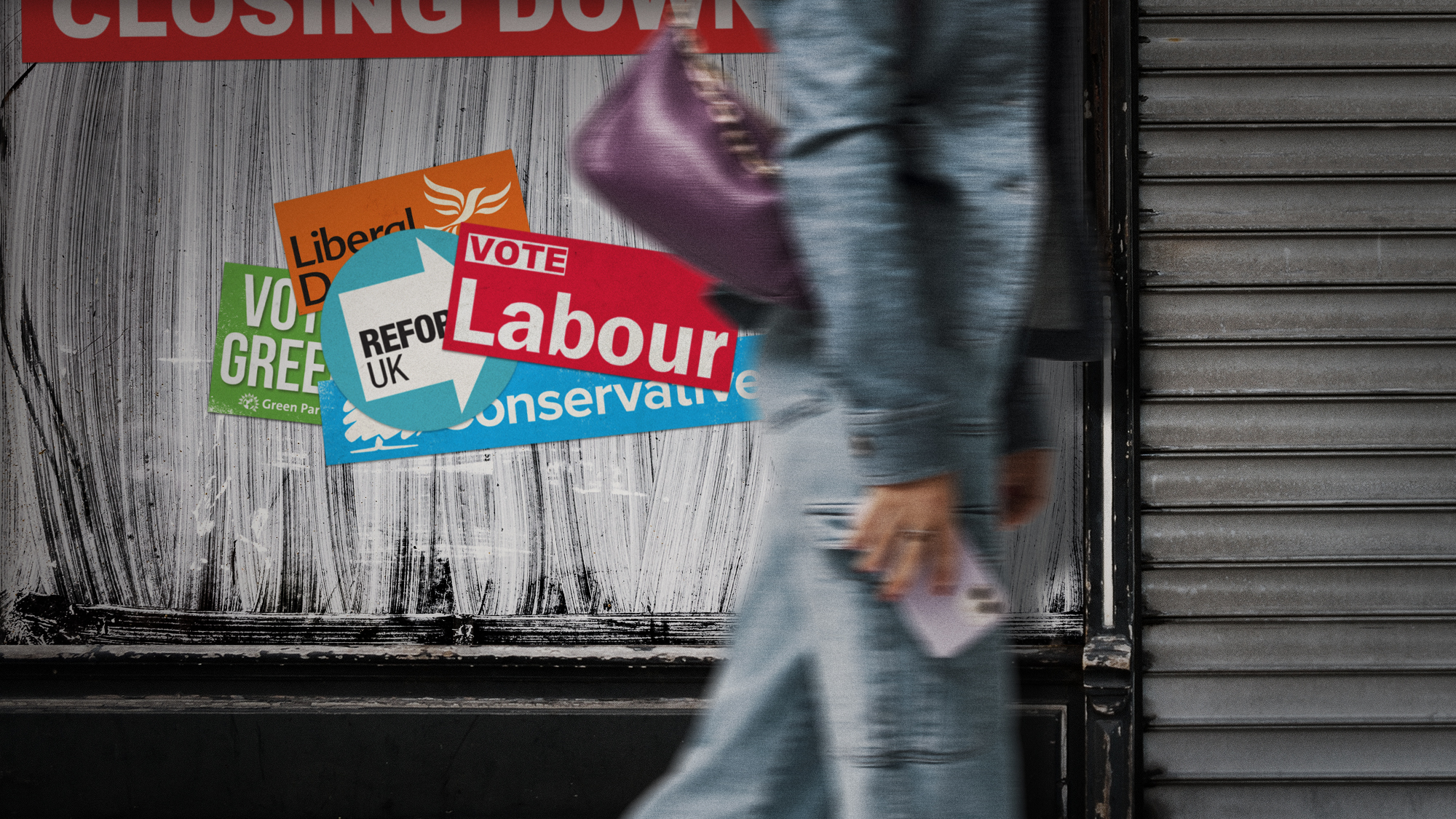

The high street: Britain’s next political battleground?

The high street: Britain’s next political battleground?In the Spotlight Mass closure of shops and influx of organised crime are fuelling voter anger, and offer an opening for Reform UK

-

Biggest political break-ups and make-ups of 2025

Biggest political break-ups and make-ups of 2025The Explainer From Trump and Musk to the UK and the EU, Christmas wouldn’t be Christmas without a round-up of the year’s relationship drama

-

‘The menu’s other highlights smack of the surreal’

‘The menu’s other highlights smack of the surreal’Instant Opinion Opinion, comment and editorials of the day

-

Is a Reform-Tory pact becoming more likely?

Is a Reform-Tory pact becoming more likely?Today’s Big Question Nigel Farage’s party is ahead in the polls but still falls well short of a Commons majority, while Conservatives are still losing MPs to Reform

-

Trump ties $20B Argentina bailout to Milei votes

Trump ties $20B Argentina bailout to Milei votesspeed read Trump will boost Argentina’s economy — if the country’s right-wing president wins upcoming elections

-

Taking the low road: why the SNP is still standing strong

Taking the low road: why the SNP is still standing strongTalking Point Party is on track for a fifth consecutive victory in May’s Holyrood election, despite controversies and plummeting support

-

Is Britain turning into ‘Trump’s America’?

Is Britain turning into ‘Trump’s America’?Today’s Big Question Direction of UK politics reflects influence and funding from across the pond