Why Elizabeth Warren should have voted for John McCain

The Massachusetts Democrat recently blasted Obama for failing to help struggling homeowners. A certain Republican candidate had a plan for that...

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

In a recent interview, Sen. Elizabeth Warren (D-Mass.) accused the Obama administration of siding with the wealthiest 0.1 percent of Americans over the 99.9 percent. "They protected Wall Street," Warren told Salon. "Not families who were losing their homes. Not people who lost their jobs. Not young people who were struggling to get an education. And it happened over and over and over."

You read that right. Warren didn't accuse the Bush administration of this bad behavior. It's the Obama administration whom Warren accuses of giving Main Street the stiff-arm by only bailing out bankers. Of course, Warren still publicly supports President Obama and likely voted for him twice. But if she really wishes Washington would have done more to help battered homeowners back in 2009, maybe she should have pulled a different lever back in 2008.

In the closing days of the presidential campaign, Republican nominee John McCain offered a $300 billion plan to buy bad mortgages and replace them with government-backed loans at reduced home values. McCain said during his Oct. 9 debate with then–Sen. Obama that the proposal would enable millions of Americans to "make those payments and stay in their homes."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

McCain wasn't the only Republican or conservative recommending big federal help for housing. Economist Glenn Hubbard, who may have been McCain's pick for Treasury secretary or future Federal Reserve chairman, devised a $240 billion plan — the cost split equally between Washington and lenders — where homeowners with government-backed mortgages could have refinanced into a new mortgage at low rates, saving as many as 30 million borrowers some $80 billion a year for the duration of their mortgages. Economist Martin Feldstein, also a possible McCain Fed pick, recommended a $350 billion plan to reduce mortgage principal for 11 million homeowners who owed a lot more than their homes were worth. Of course, the Tea Party might have complained about the spending — if there had been a Tea Party under McCain. But there probably wouldn't have been. No Obama means no ObamaCare to energize the GOP offshoot. And with a Republican in the White House, opposition to government action wouldn't have fused with opposition to a Democratic president to create such a loud new voice in McCain's own party.

To be fair, it's not like Team Obama has done nothing for homeowners. Some 3 million homeowners, including nearly a million underwater borrowers, have been able to refinance their mortgages under the administration's Home Affordable Refinance Program, according to The Wall Street Journal. But that's not a whole lot of homeowner help when you consider the terrible magnitude of the American housing collapse. U.S. housing wealth fell by more than $7 trillion as home prices fell by 30 percent and 4 million Americans lost their homes. It was even worse for low-income homeowners, who saw their net worth fall from $30,000 to nearly zero, as documented by economists Atif Mian and Amit Sufi in their book House of Debt. And homeownership rates, after peaking in 2006, are back to where they were in the middle 1990s.

It's not that the Obama White House didn't flirt with the idea of doing far more. Former Treasury Secretary Timothy Geithner writes in his account of the crisis, Stress Test, that he examined much larger programs, including principal reduction, but was "troubled by their limited bang for buck." In the end, Geithner explains, he figured helping the economy was the best way to help the housing market, even once telling Warren that directly.

But it looks like Geithner was wrong. In their book, economists Mian and Sufi argue that the housing crash did far more economic damage than the early 2000s technology stock crash because those housing wealth losses were concentrated among middle- and working-class Americans, who then stopped spending. Their research suggests principal forgiveness of underwater mortgage debt in 2009 would have sharply boosted consumer spending and drastically reduced foreclosures.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Maybe the Great Recession would have only been the Pretty Bad Recession if the 2008 election had turned out differently.

James Pethokoukis is the DeWitt Wallace Fellow at the American Enterprise Institute where he runs the AEIdeas blog. He has also written for The New York Times, National Review, Commentary, The Weekly Standard, and other places.

-

The broken water companies failing England and Wales

The broken water companies failing England and WalesExplainer With rising bills, deteriorating river health and a lack of investment, regulators face an uphill battle to stabilise the industry

-

A thrilling foodie city in northern Japan

A thrilling foodie city in northern JapanThe Week Recommends The food scene here is ‘unspoilt’ and ‘fun’

-

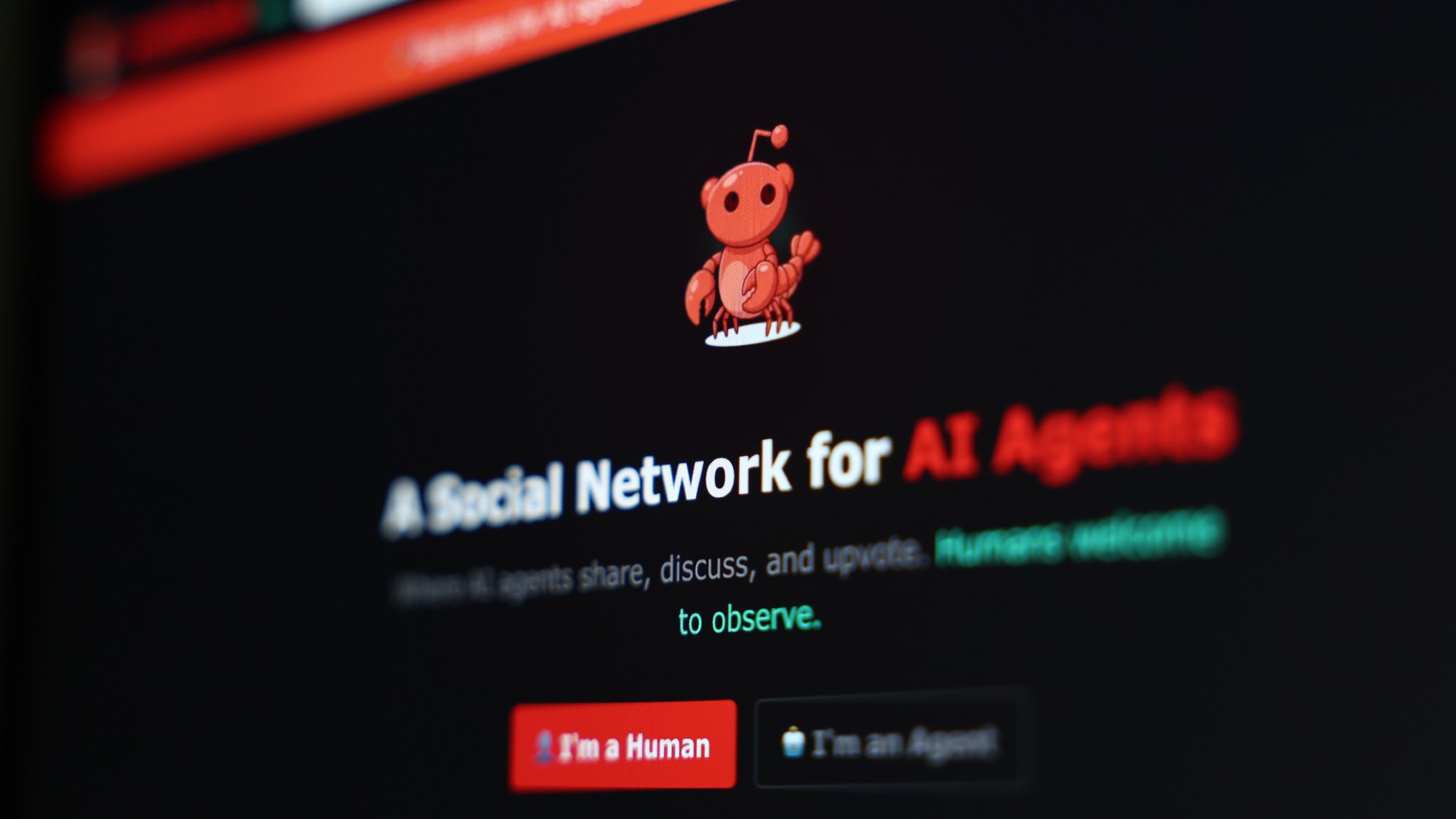

Are AI bots conspiring against us?

Are AI bots conspiring against us?Talking Point Moltbook, the AI social network where humans are banned, may be the tip of the iceberg

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred