A radical proposal to make coins useful again

Forget ditching the penny: Let's multiply every coin value by 10

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Like most people these days, I've got a jar on my desk at home with something like 20 bucks in change in it. I'd very much like to have that money, of course, but it's just too much of a hassle to go through it very often. So it just sits there, accumulating my daily coin harvest, until it gets so heavy it threatens to collapse my desk. Then I go through it and enjoy a nice windfall of a few months' pocket change. That's U.S. coin policy: A very inefficient and metal-intensive beer money program.

However, this week I got to thinking: When I lived in South Africa, I used to carry around change all the time. I didn't have the visceral reaction to paying in cash that I do here. Why is that? Two reasons, I suspect. First, South Africa has a value-added tax which is included in the total price, so you didn't usually get weird totals like 3.47 that we do with our obnoxious sales tax. But more importantly, in South Africa coins were worth something.

That's the key issue. Here in the U.S., you've got to carry around pounds of metal to have enough money to buy anything you might conceivably want. But if value is sufficiently concentrated, then coins work as money; they have for thousands of years. It's time to make our coins worth something again.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Every so often there's an internet outrage burst over the existence of pennies. Here's a representative example from CGP Grey:

And he makes a good case! The problem is that ditching the penny doesn't go far enough. The problem isn't just pennies, it's every U.S. coin. Even the quarter doesn't earn its weight, if my coin jar is any indication.

Here's my solution: multiply the face value of every U.S. coin by 10. A penny will be worth 10 cents, a nickel 50 cents, a dime one dollar, a quarter $2.50, and a dollar coin 10 bucks. (We could also reinvent the half-dollar, which is barely produced now, as a nice $5 coin.)

This will have several beneficial effects: first, it will make change real money again. The whole point of having money is to facilitate the process of exchange, but studies have shown that people tend not to spend even the vaunted dollar coin. It's no surprise, given that we've been training people for decades to think of change as worthless. And multiplying by 10 sounds like a lot, but if anything, it isn't going far enough — the BLS inflation calculator only goes back to 1913, but even so, one dollar from that time was worth the equivalent of $23.87 today! The one-cent coin was the smallest then, and people still somehow survived. Rounding to the nearest tenth of a dollar in cash transactions today will be no problem.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

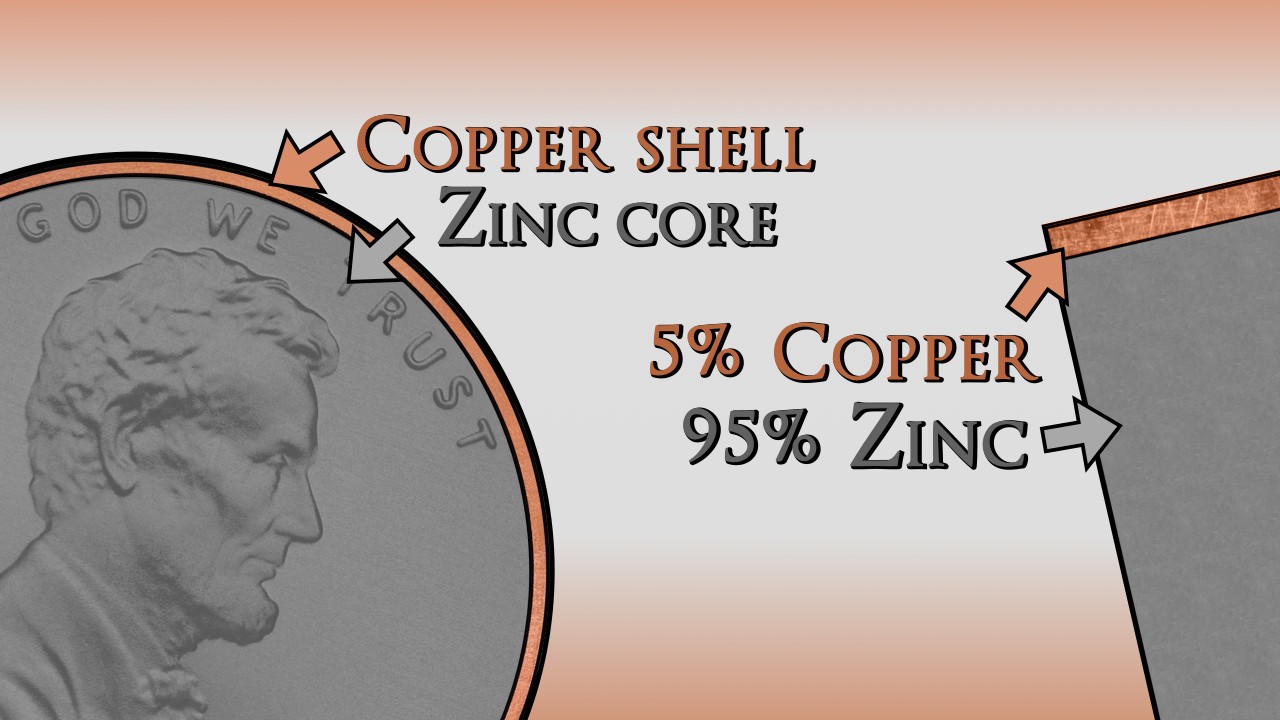

Second, it will be easy to accomplish. We won't have to have a big fight with the zinc lobby or Abraham Lincoln fans over whether to stop production of a particular coin, or rebuild all the vending machines around differently-shaped coins. Instead, we just alter the mint plates slightly with new numbers. (Making U.S. money more coin-based would also save the government a bit of money, since coins last much, much longer than paper money.)

Third — and this might be the most contentious part of this proposal — changing coins could be a nice piece of badly-needed economic stimulus. Effectively, we'd be printing up a bunch of new money and handing it to whoever has coins on hand. We'd have to think carefully about the details, but the idea would be to allow people who have old coins to hand them in for fresh new versions worth 10 times as much. Vending machines can be easily reprogrammed to help soak up the old currency (which will be exactly the same size and weight as the new stuff), and banks could be required to exchange for the new versions for a few years. To keep them from being swamped and to ease the effect, we could say banks don't have to exchange more than $50 worth of new currency per person per day, or something similar.

Now, this wouldn't be exactly fair, since coin-hoarders would get the biggest benefit, but distributionally it would be practically saintly compared to, say, quantitative easing. Some people will make out like bandits, to be sure, but I doubt they would be owners of large asset portfolios.

How much money are we talking about? According to the Federal Reserve, as of 2010 there was about $40 billion worth of coins in circulation, which constituted 4.3 percent of the U.S. currency stock. We'd be increasing that by $360 billion at a stroke, which would actually be a pretty powerful economic stimulus. Indeed, it might cause a bit of moderate inflationary pressure, as all the coin hoarders with soup tureens full of pennies went on spending sprees. However, that would be exactly the kind of situation the Federal Reserve is equipped to handle. I doubt any inflationary pressure would be sustained long, but if so, it would be a godsend to the Fed, which has been stuck at the zero lower bound and mostly below its inflation target since the financial crisis. Indeed, there is a very strong case that a bit higher inflation target is wise economic policy for the future.

In any case, this is the kind of bold economic idea that this nation so desperately needs. Coin reform now!

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

5 cinematic cartoons about Bezos betting big on 'Melania'

5 cinematic cartoons about Bezos betting big on 'Melania'Cartoons Artists take on a girlboss, a fetching newspaper, and more

-

The fall of the generals: China’s military purge

The fall of the generals: China’s military purgeIn the Spotlight Xi Jinping’s extraordinary removal of senior general proves that no-one is safe from anti-corruption drive that has investigated millions

-

Why the Gorton and Denton by-election is a ‘Frankenstein’s monster’

Why the Gorton and Denton by-election is a ‘Frankenstein’s monster’Talking Point Reform and the Greens have the Labour seat in their sights, but the constituency’s complex demographics make messaging tricky

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred