Debt collectors are gorging themselves on student loans

And until DC gets its act together, they can't be stopped

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The cost of college is skyrocketing. The labor market is atrocious. Employers demand a college degree for pretty much any job these days. Yes, at this point, it has become commonplace to note the crushing burden of college debt (the total amount of which is now something like $1.2 trillion). But there's another side to this story that hasn't gotten as much play: the implications for debt collection.

Debt delinquency exploded during the financial crisis, but has since steadily decreased for every type of debt — except that of students. Because the bankruptcy code is badly skewed when it comes to student loans, total debt collection has risen steadily. Students are now the fuel for one of America's more predatory agencies, which is saying a lot.

Here's how it happened, and what we might do about it.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

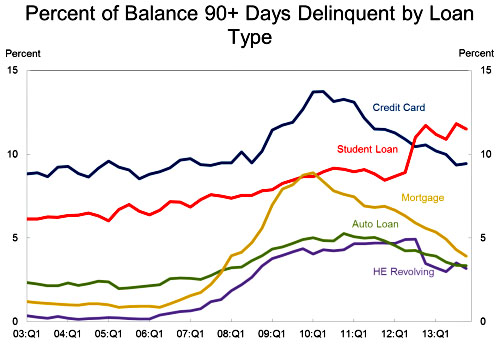

Kevin Drum posted these two amazing charts recently from the New York Fed report on household debt. Here is the percent of each kind of debt that is delinquent. Just look at what's happening to student debt compared to the others:

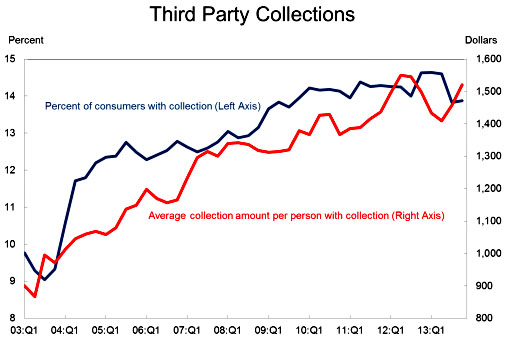

And here's total debt collection:

Look at the first chart: Delinquency has fallen sharply since 2009 for everything but student debt. Now, look at the second: Total collection is actually up overall, a trend that must be driven in part by the similar increase in student debt.

This jibes with the fact that student debt is treated much more harshly than almost any other kind in the bankruptcy code. It's nearly impossible to discharge during a typical bankruptcy proceeding — it took one guy 10 years in court to get his law school loans partially discharged in such a situation. And student debt can follow people to the grave and beyond, making it closer to indentured servitude than a regular loan. (Though at least we aren't putting broke students into our shiny new system of debtor's prisons — yet.) There's no reason for this discrepancy, of course, it's just a dumb policy from decades ago that now can't be changed because of Congressional gridlock.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

That horrible policy, plus the ever-increasing pile of student debt, plus a college degree's outsized role in landing a good job, has created a golden opportunity for amoral collection agencies to make vast sums hounding people who tried their luck with college and didn't make it, for whatever reason.

There has been a bit of progress here and there on this problem. Last year the federal government announced it would stop actively incentivizing atrocious behavior on the part of collectors it employs, and Kirsten Gillibrand has a bill which would allow students to refinance their debt at 4 percent interest if they've got a higher rate.

These are positive developments, but there's really no reason we shouldn't be considering some more fundamental changes to the education finance system. Student loan debt obviously ought to be dischargeable in bankruptcy, just for starters, and we ought to put pressure on the rankings and prestige systems that cause colleges to jack up prices for no obvious benefit to the student. And shoot, why not try mass debt forgiveness, so long as we're thinking boldly? If Wall Street got a do-over after the financial crisis, seems fair for America's struggling students.

Furthermore, why use debt to finance education subsidies in the first place? As with many policy objectives, America has traditionally pushed education subsides through loans and tax incentives, because that allows us to pretend like we aren't spending money when we really are. We should be wary of schools using subsidies to just hike prices and hire a slew of pointless administrators, but to the extent that education is subsidized, we ought to be doing it with straight cash transfers rather than loans, which would be clearer, fairer, and avoid crippling graduates with debt.

In any case, all that is almost certainly impossible for the time being. But as we've seen, debt collection isn't going away, and if any sort of reform ever becomes politically feasible, we ought to aim high rather than tinkering around the edges.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

‘Those rights don’t exist to protect criminals’

‘Those rights don’t exist to protect criminals’Instant Opinion Opinion, comment and editorials of the day

-

Key Bangladesh election returns old guard to power

Key Bangladesh election returns old guard to powerSpeed Read The Bangladesh Nationalist Party claimed a decisive victory

-

Judge blocks Hegseth from punishing Kelly over video

Judge blocks Hegseth from punishing Kelly over videoSpeed Read Defense Secretary Pete Hegseth pushed for the senator to be demoted over a video in which he reminds military officials they should refuse illegal orders

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred