Is Wall Street literally writing America's laws now?

Citigroup reportedly helped draft more than 80 percent of a House finance bill

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

A bill called the Swaps Regulatory Improvement Act recently sailed through the House Financial Services Committee. But when The New York Times went through emails from a lobbyist to the congressmen who wrote it, the paper discovered an unofficial co-author: Citigroup.

It turns out that recommendations from Citigroup made up 70 of the bill's 85 lines, with two important paragraphs copied almost verbatim — save for two words that were changed to make them plural, according to the Times.

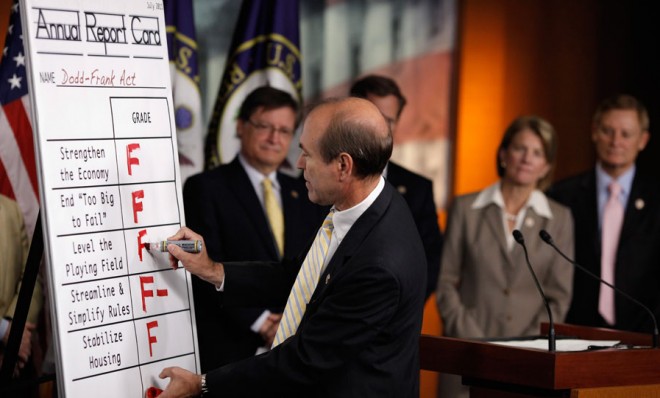

The bill takes aim at the 2010 Dodd-Frank Act, the financial regulatory reform bill that was meant to prevent a repetition of the 2008 financial crisis. The specific provision in question forbids banks from trading certain derivatives that critics say were instrumental in causing the crisis. Under Dodd-Frank, those derivatives would have to be moved to affiliates that weren't FDIC-insured, lessening the chance they would be the recipients of government bailouts.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Erika Eichelberger at Mother Jones also compared the Citigroup draft of the bill with the final House version and found them "practically identical." She noted that Citigroup has long played a role in relaxing financial regulations, including the 1999 repeal of the Glass-Steagall Act, which once prevented commercial banks from engaging in the same activities as investment brokerages.

Citigroup was the "bank that administered the coup de grace to Glass-Steagall," Marcus Stanley, policy director at Americans for Financial Reform, told Mother Jones.

Citigroup defended its lobbying efforts in a blog post on its website. Ed Skyler, head of global public affairs, wrote that the provision "does absolutely nothing to create a safer financial system." Instead, he wrote, it would "create undue costs and burdens on U.S. financial firms," which will force them to "simply do business elsewhere."

Skyler also noted that the bill was bipartisan, which is true. The majority of congressmen who supported the legislation were Republicans, but it was co-sponsored by Rep. Sean Patrick Maloney (D-N.Y.), who, the Times reported, recently held a fundraiser in Washington, D.C., in which corporate executives and lobbyists paid up to $2,500 to have dinner with him.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

While there has been a notable lack of bipartisanship in Congress in recent years, it appears that both Democrats and Republicans are more than open to Wall Street's money. As Sen. Dick Durbin (D-Ill.) once said of Congress, banks "frankly own the place."

"Democrats can’t be trusted to control Wall Street," Robert Reich, former secretary of labor under President Clinton, said at Salon. "If there were ever an issue ripe for a third party, the Street would be it."

Even those who supported the bill said the close relationship between the banks and lawmakers was unseemly.

"It’s appalling, it’s disgusting, it’s wasteful and it opens the possibility of conflicts of interest and corruption," Rep. Jim Himes (D-Conn.), a former Goldman Sachs banker and member of the House Financial Services Committee who backed the bill, told the Times. "It’s unfortunately the world we live in."

Keith Wagstaff is a staff writer at TheWeek.com covering politics and current events. He has previously written for such publications as TIME, Details, VICE, and the Village Voice.

-

Local elections 2026: where are they and who is expected to win?

Local elections 2026: where are they and who is expected to win?The Explainer Labour is braced for heavy losses and U-turn on postponing some council elections hasn’t helped the party’s prospects

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred