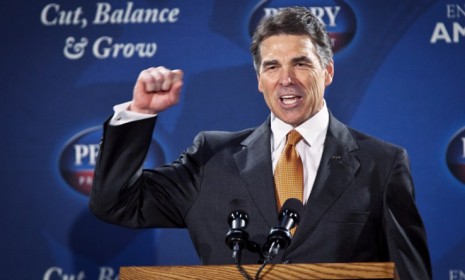

Rick Perry's flat-tax plan: 'Bold' or 'regressive'?

The Texas governor unveils an optional 20-percent tax rate to boost the economy — and his presidential campaign

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

In a bid to jumpstart his stalled presidential campaign, Texas Gov. Rick Perry unveiled a "bold" tax plan on Tuesday, promising that it would give the economy a much-needed lift. Perry, speaking at a South Carolina plastics factory, proposed a flat, 20 percent tax to dramatically simplify the tax code, allowing people to fill out their returns on a postcard. To prevent the plan from raising taxes on poor and middle-class Americans — most of whom pay less than 20 percent in income taxes — Perry said anyone now paying a lower rate could opt to stick with the current system. Still, critics derided Perry's plan as "regressive." Would a flat tax really be good for America?

Absolutely not — this is a sop to the rich: All Perry is doing is slashing income and investment taxes for the rich, says Jonathan Bernstein at The Washington Post. And "the genius" of the plan is that it also frees them tax-time paperwork, while the rest of us are stuck with the complicated old system. Working class taxes won't change — and the poor will actually pay more if the Earned Income Tax Credit is repealed. "It's hard to believe that's a winner, even among Republican primary voters."

"Rick Perry's 'flat tax' — not so flat after all"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Perry is onto something here: This could be a "game changer" for Perry's campaign, and for taxpayers, says Ed Morrissey at Hot Air. Perry is pushing exemptions for a family of four to $50,000, which should keep "Democrats from demagoguing it as an attack on the middle class." And slashing the corporate tax rate to 20 percent, as Perry proposes, would keep Congress from stifling business. The only problem is letting individuals opt out — "we have enough problems with one system, let alone two."

"Conference call: Perry's economic plan"

Love it or hate it, Perry's plan won't pass: Many conservatives think Perry's flat tax is "cool," says Jay Newton-Small at TIME. But "fiscal critics already have their red pens out," and they don't like what they see. The non-partisan Tax Policy Center said a similar plan proposed by John McCain in 2008 would have added $7 trillion to the deficit over a decade. Regardless, Perry's plan may already have served its true purpose, by making his rival Mitt Romney look "timid" by comparison.

"Rick Perry's flat tax curveball"

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred