Issue of the week: Facebook’s private offering

Facebook's deal with Goldman Sachs is a prelude to an initial public offering that would most likely take pace next year.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

It feels like “a profoundly unfriendly move for a company with 500 million friends,” said Roben Farzad in Bloomberg Businessweek. In a blatant example of “insider capitalism,” Facebook, the social-networking giant launched seven years ago in a Harvard dorm room, last week agreed to sell a $450 million stake in itself to investment bank Goldman Sachs, and a $50 million stake to Russian investment group Digital Sky Technologies, in a transaction that values the entire company at $50 billion. In addition, Goldman agreed to place $1.5 billion of shares with some of its most favored clients. Goldman wants to structure the deal to enable Facebook “to remain below the 500-investor threshold that would force it to make an array of Securities and Exchange Commission disclosures. A special Goldman fund with numerous client investors, the legal thinking goes, could be counted as a single investor.” But whether or not the SEC approves that plan, an initial public offering is likely next year. With demand among Goldman clients likely to be high, few of Facebook’s users will have a chance to buy in.

It’s a great deal for Goldman, though, said Gregory Zuckerman and Liz Rappaport in The Wall Street Journal. The firm’s clients will pay a 4 percent fee to purchase Facebook shares, plus 5 percent of any gains. Goldman also has the inside track to manage Facebook’s IPO, which is likely to generate a fee of $100 million or more for the firm. “More revenue could come from managing assets of Facebook executives.” Investors, for their part, will be buying into a profitable enterprise, said Jason Zweig, also in the Journal. Documents circulated to potential investors show that the company is “closing in on $500 million in annual profit” on revenue of about $2 billion. But can Facebook grow fast enough to justify a valuation of 25 times current revenue? One experienced mutual-fund manager says Facebook would have to grow “at least as successfully as any company in history” to generate even a market return for investors. That’s a tall order.

Facebook insiders seem to think so, said Duff McDonald in Fortune.com. It’s likely that the new investors will be buying shares from the company’s ground-floor investors—including venture capital firm Accel Partners and early backer Peter Thiel, and possibly founder and CEO Mark Zuckerberg. What would prompt these well-informed insiders to sell unless they suspected that “the era of stupendous growth was over”? Remember, though, that when Microsoft bought a piece of Facebook in 2007 at a price that valued the whole company at $15 billion, critics derided that valuation as “astronomical,” said Felix Salmon in Reuters.com. A company whose valuation has more than tripled in three-plus years might not be such a foolish bet after all.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

The broken water companies failing England and Wales

The broken water companies failing England and WalesExplainer With rising bills, deteriorating river health and a lack of investment, regulators face an uphill battle to stabilise the industry

-

A thrilling foodie city in northern Japan

A thrilling foodie city in northern JapanThe Week Recommends The food scene here is ‘unspoilt’ and ‘fun’

-

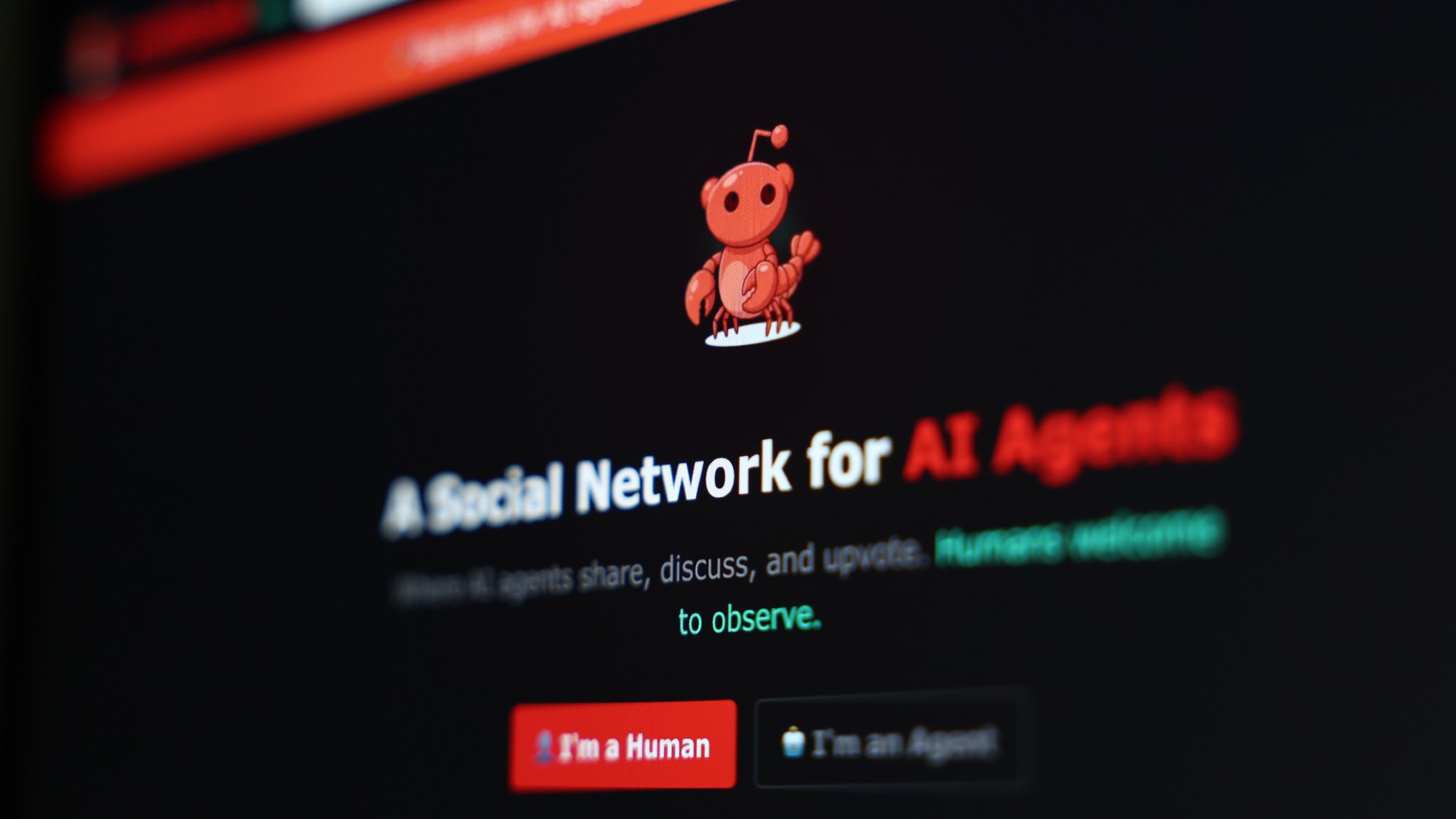

Are AI bots conspiring against us?

Are AI bots conspiring against us?Talking Point Moltbook, the AI social network where humans are banned, may be the tip of the iceberg

-

Issue of the week: Facebook’s 1 billion friends

feature Facebook reached a milestone with 1 billion active users, but it hasn’t been able to translate those users into giant profits.

-

Issue of the week: Why Facebook’s IPO fizzled

feature Facebook’s flaws are much clearer now that the hype has died down.

-

Issue of the week: The rise of the ‘brogrammer’

feature Writing software code is now dominated by “bros” who bring a frat-house atmosphere to the tech industry.

-

Issue of the week: Is Apple’s stock a bubble?

feature Since overtaking Exxon-Mobil as the world’s biggest company in January, the tech giant has gone stratospheric.

-

Issue of the week: High-tech burnout

feature Tech workers are beginning to object to the grueling hours and outsize expectations that are characteristic of start-up companies.

-

Issue of the week: The rise of the technocrats

feature Two U.S.-trained economists and longtime European Union bureaucrats have replaced the prime ministers of Greece and Italy.

-

Issue of the week: Has innovation dried up?

feature Outside of computers, the past few decades have produced no great technological innovations, and the true breakthroughs in medicine and biotechnology have slowed.

-

Issue of the week: Facebook’s stealth attack on Google

feature Facebook admitted that it hired a high-powered public-relations firm to mount a clandestine campaign against Google.