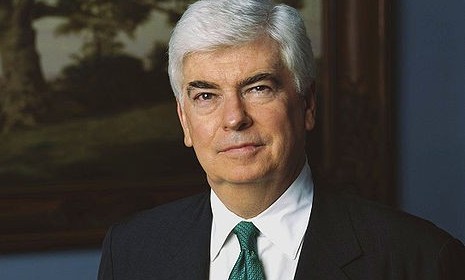

Chris Dodd vs. Wall Street

Senator Dodd has finally unveiled his financial reform package — and it's harder on banks that expected. Will Wall Street squelch the bill?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

In a move that sets the stage for a showdown between Washington and Wall Street, Senate Banking Committee Chairman Christopher Dodd said on Tuesday that Congress should address financial reform before adjourning March 26 for its two-week Easter recess. A day earlier, Dodd unveiled a much-anticipated reform proposal that was tougher on Wall Street than some lawmakers expected. With many Republicans opposed, saying more regulation will give foreign banks advantages over American firms, and some Democrats complaining Dodd's bill doesn't go far enough, will Wall Street be able to use its muscle to kill the bill? (Watch a CBS report on Chris Dodd's financial reform plan)

Banks will fight — and they stand a good chance of winning: Wall Street firms "are going to dig in" on many of Dodd's reforms, says the Roosevelt Institute's Rob Johnson, as quoted in USA Today. Expect them to fight especially hard against his proposal to police derivatives — these arcane financial instruments exist in "an unregulated black hole," but they make banks tons of money.

"Dodd's 2nd shot at financial reform still leaves loopholes"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Banks don't like it? All the more reason to pass this bill: If Wall Street hates Dodd's bill, says David Weidner in MarketWatch, "it can't be all bad." Financial firms wil try to use campaign donations — this is an election year, after all — to sway Congress. But the whole economy will be safer and more stable if Congress musters the courage to break up the biggest banks and restrict risky financial activities.

Dodd's bill is no solution: "Financial reform is still necessary," say the editors of The Wall Street Journal, but it would be a mistake to rush passing Christopher Dodd's proposals. Republicans, who have good ideas on making the system stronger, were shut out by Dodd and other Democrats. After this fall's midterm elections, the GOP will be in a better position to make sure reform is "done right."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Finally, Congress is close to "workable" reform: Christopher Dodd's plan isn't perfect, say the editors of The Economist, but it "deals with the most important weaknesses" exposed by the financial crisis by granting "regulators new powers to impose an orderly shut-down of failing firms and to sniff out and squelch the risks that brought on the financial crisis."