Geithner’s plan to detoxify the banking system

U.S. Treasury Secretary Timothy Geithner unveiled a detailed program to rescue the nation’s banks, offering low-interest government loans to entice private investors to buy the billions in “toxic” securities now p

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

What happened

U.S. Treasury Secretary Timothy Geithner this week unveiled a detailed program to rescue the nation’s banks, offering low-interest government loans to entice private investors to buy the billions in “toxic” securities now paralyzing the nation’s financial system. The program will provide strong incentives to hedge funds and other investors willing to gamble on banks’ troubled assets, which banks have been largely unwilling to sell at prevailing, steeply discounted, prices. The government will provide up to $100 billion in direct loans and will leverage loan guarantees and other public and private financing to produce as much as $1 trillion in purchasing power. Estimates of how much toxic debt is held by financial institutions range from $1 trillion to $2 trillion. Most of this debt consists of securities based on thousands of individual mortgages; some economists think these securities may prove to be good investments, especially if the economy recovers in a year or two.

Geithner’s plan will limit investors’ prospective losses, with taxpayers assuming a major share of risk in the asset purchases. “There is no doubt the government is taking risk,” Geithner said. But he said the plan would enable undercapitalized banks to raise private capital, so they could stop relying on bailouts from the federal treasury.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

What the editorials said

“This isn’t the worst idea the federal government has ever had,” said The Wall Street Journal. “Mr. Geithner’s bet is that the banks will judge they are better off disposing of the bad assets, even if it means taking losses.” That may be true for the strongest banks. But badly weakened institutions, such as Citigroup, may fear that “big losses will weaken them further,” and may be unwilling to sell off their toxic securities. The banks, though, are running out of options for getting rid of their bad debt. “Might as well get on with it.”

Geithner is betting that the banks will cooperate, said the Baltimore Sun. A more surefire solution would be to temporarily nationalize the most troubled banks and sell off their poisoned assets, “but a president described by some critics as a socialist isn’t going to approve a government takeover.” Instead, we now all have to worry “what will happen if Geithner’s plan fails.”

What the columnists said

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

If it fails, it will be because Geithner and the administration’s entire economic team has “excessively close ties to Wall Street,” said Paul Krugman in The New York Times. By now, Obama should have “taken temporary control of truly insolvent banks.” That’s how we cleaned up the savings-and-loan mess in the 1980s. This plan, however, merely provides “an indirect, disguised way to subsidize purchases of bad assets.” Far from instilling confidence, it “fills me with a sense of despair.”

“Geez, and I was feeling rather encouraged,” said Steven Pearlstein in The Washington Post. In addition to avoiding the pitfalls of “wholesale nationalization” of the banks—imagine “535 members of Congress suddenly sitting on their boards of directors”—this cleverly designed plan provides ample incentive for hedge funds and other investors to get the troubled securities off bank balance sheets. True, the risks fall disproportionately on taxpayers, but that’s inevitable at a time when private investors are skittish.

When big investors see the terms of this scheme, said Martin Wolf in the Financial Times, that skittishness will disappear. But imagine the public reaction when hedge funds swoop down on this “vulture fund” and wind up making huge profits with the government’s help. Taxpayers will conclude that this bailout plan “is a racket run for the benefit of Wall Street.” Heaven help any official who proposes a government bailout after that.

What next?

The first asset purchases in the program will come in several weeks. Given its financial complexity and the vast amount of debt, it could be years before the plan is deemed a success or a failure. The White House is clearly hoping for a patient public. In his press conference this week, President Obama repeatedly emphasized the long term in dealing with the economic crisis and the nation’s other challenges. “I’m a big believer in persistence,” Obama said. “What I am confident about is that we’re moving in the right direction.”

-

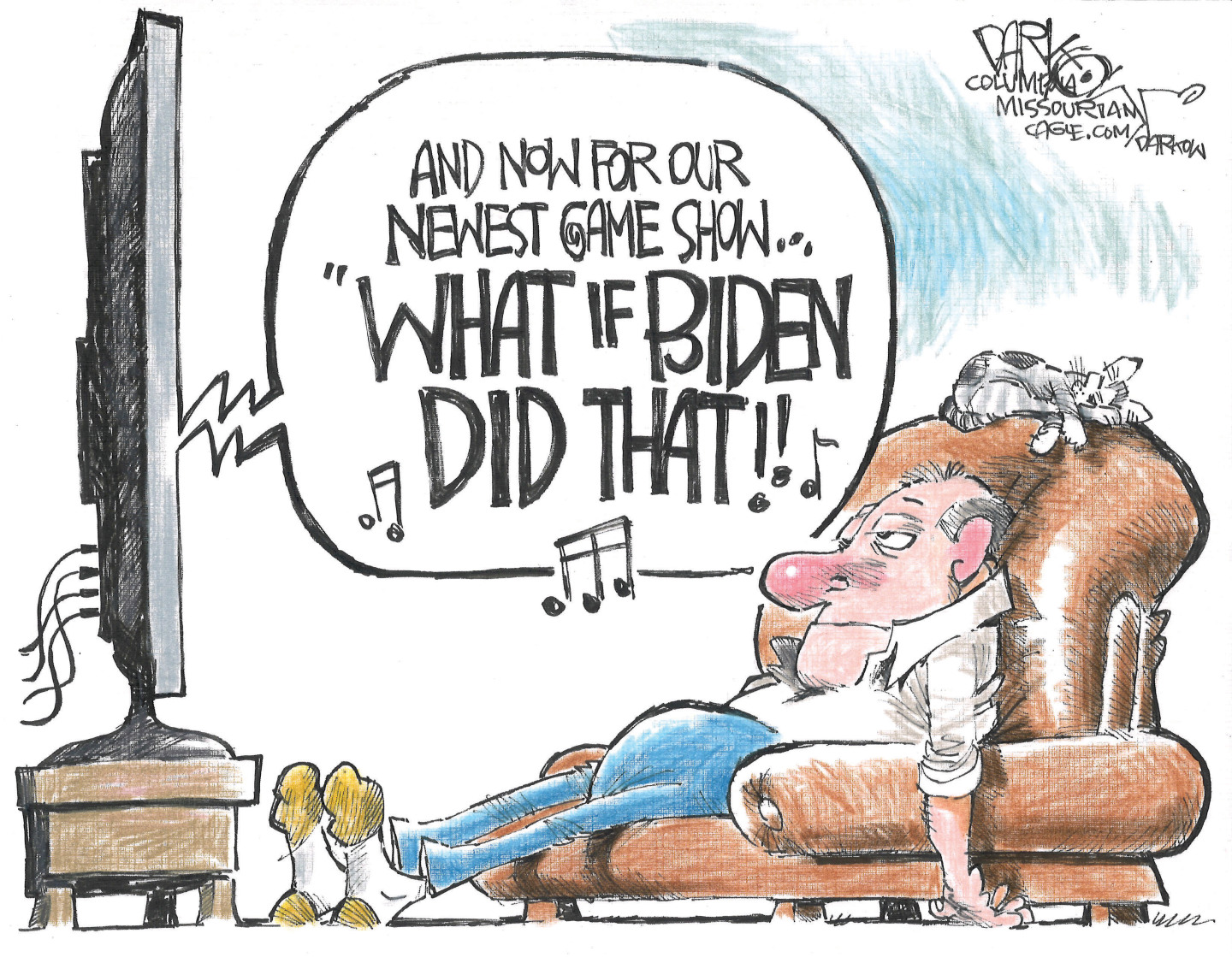

Political cartoons for February 13

Political cartoons for February 13Cartoons Friday's political cartoons include rank hypocrisy, name-dropping Trump, and EPA repeals

-

Palantir's growing influence in the British state

Palantir's growing influence in the British stateThe Explainer Despite winning a £240m MoD contract, the tech company’s links to Peter Mandelson and the UK’s over-reliance on US tech have caused widespread concern

-

Quiz of The Week: 7 – 13 February

Quiz of The Week: 7 – 13 FebruaryQuiz Have you been paying attention to The Week’s news?

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred