529 college savings plans are everything that is wrong with American policy

They're awful and don't work — and we can't get rid of them

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

President Obama suffered a minor political setback this week, when a proposal to end the 529 college savings tax credit, unveiled during the recent State of the Union address, sparked a backlash. He has now dropped the proposal.

On one level, it's no big deal, since it's only a small policy, letting people build college savings accounts without being taxed. It's also vanishingly unlikely he could have gotten anything through Congress. But on another, it's an extremely frustrating example of the limitations of American political discourse.

So, let's be clear: the 529 tax credit is a piece of utter trash policy. Few people use it, those who do are mostly wealthy and don't even save very much, its effectiveness varies wildly based on when you start investing, and tax breaks on savings are a lousy way to subsidize higher education in the first place. The fact that we can't even consider getting rid of this steaming garbage pile — and there are dozens like it in the tax code — does not bode well for the American system.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

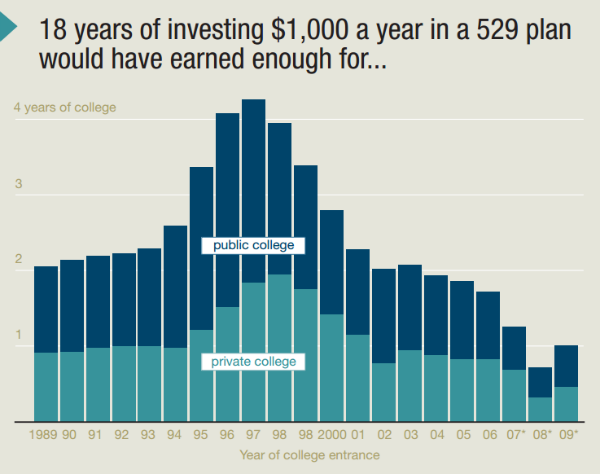

The think tank Ed Sector has a paper laying out most of the big problems with 529s. Like a 401(k), the money is usually invested in a mutual fund. But since the money is saved for a relatively short period and needed at the exact moment your child enters college (unlike a retirement account, which is typically saved over 40 years and can be delayed), 529s are highly vulnerable to market fluctuations. If your daughter started school in 1997, and you had been saving $1,000 per year for the previous 18 years, your 529 would have covered four years of public school. But if she started in 2008, your 529 would have covered less than one year.

Worse, stock market collapses are usually correlated with general economic weakness, when cash-strapped state governments often jack up college tuition. If your kid graduated in 2000, account growth of 236 percent would easily cover tuition increase of 13.6 percent at public school. But if your kid graduated in 2010, account growth of a measly 14 percent would not have touched a tuition increase of 19 percent.

In other words, 529s work best when they're least needed, and fall to pieces when they're needed most.

Like most tax expenditures, they also funnel most of their benefits to the rich. In Kansas in 2007, 81 percent of 529 benefits went to families making more than $100,000, and 37 percent to those making over $250,000 — the top one percent of families there. They don’t just break down at the worst possible time, they’re also pay out benefits inversely to need.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Similar to 401(k)s, people aren't saving nearly enough. The average account has enough to pay for about one year of public school. It's a safe assumption that the poorer the account holder, the less they have in it. Also like 401(k)s, 529s have spawned a cottage industry of swindlers who trick people into investing into high-fee accounts.

Finally, there is a fundamental problem with subsidizing these sorts of purchases with individual savings benefits: colleges may just raise prices to capture them, creating a vicious cycle of price gouging and desperate saving. The howls of outrage from centrist upper-middle-class commentators that greeted Obama's announcement often featured arguments that making $150,000 is not that much because college is so expensive. Funny how that works out!

The U.S. tax code is punched through with dozens of these kind of tax expenditures: the mortgage interest deduction, lower rates on capital gains, the carried interest loophole, retirement credits, and so on. Even the ones that are designed to promote social goods like health insurance are horribly inefficient.

Effectively, these are programs to distribute money to the rich that purchase political cover by cutting the upper middle class in on a tiny fraction of the goodies (the poor, of course, get essentially nothing). But as we've seen, even small and exceptionally terrible policies like 529s are politically untouchable. The prospects for meaningful tax reform are dim indeed.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

The Week Unwrapped: Do the Freemasons have too much sway in the police force?

The Week Unwrapped: Do the Freemasons have too much sway in the police force?Podcast Plus, what does the growing popularity of prediction markets mean for the future? And why are UK film and TV workers struggling?

-

Properties of the week: pretty thatched cottages

Properties of the week: pretty thatched cottagesThe Week Recommends Featuring homes in West Sussex, Dorset and Suffolk

-

The week’s best photos

The week’s best photosIn Pictures An explosive meal, a carnival of joy, and more

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred