In praise of taxes

On Tax Day, a reminder that taxes are about way more than the federal budget

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Once again, it's April 15: Tax Day. Most of us will grumble about the government raiding our pocketbooks, and some of us will defend taxes as investments in public goods and services. What we will have in common is thinking of taxes as revenue raisers that fill the government's coffers.

But that isn't the only purpose taxes can serve. Precisely because people tend to try to avoid paying them, taxes can be used to structure the economy and direct how money flows through it in different ways. Tax something and you'll get less of it, as the old observation goes.

Cigarette taxes are an obvious example. As a society, we'd like people to avoid getting lung cancer, so we apply an extra tax to cigarettes to discourage smoking. Similarly, if we passed a carbon tax, it would help ward off climate change by discouraging fossil fuel emissions, and driving people to use and develop clean energy. In an ideal world, both these taxes would raise zero revenue. Conversely, we make charitable donations tax-free, while churches and other organizations also enjoy tax-free status, because we think this facilitates socially valuable activity and we want more of it.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Policymakers certainly realize taxes can serve this function, but they tend to view it as a secondary quirk. But what if the economy-shaping uses of taxes are every bit as important as the revenue-raising ones?

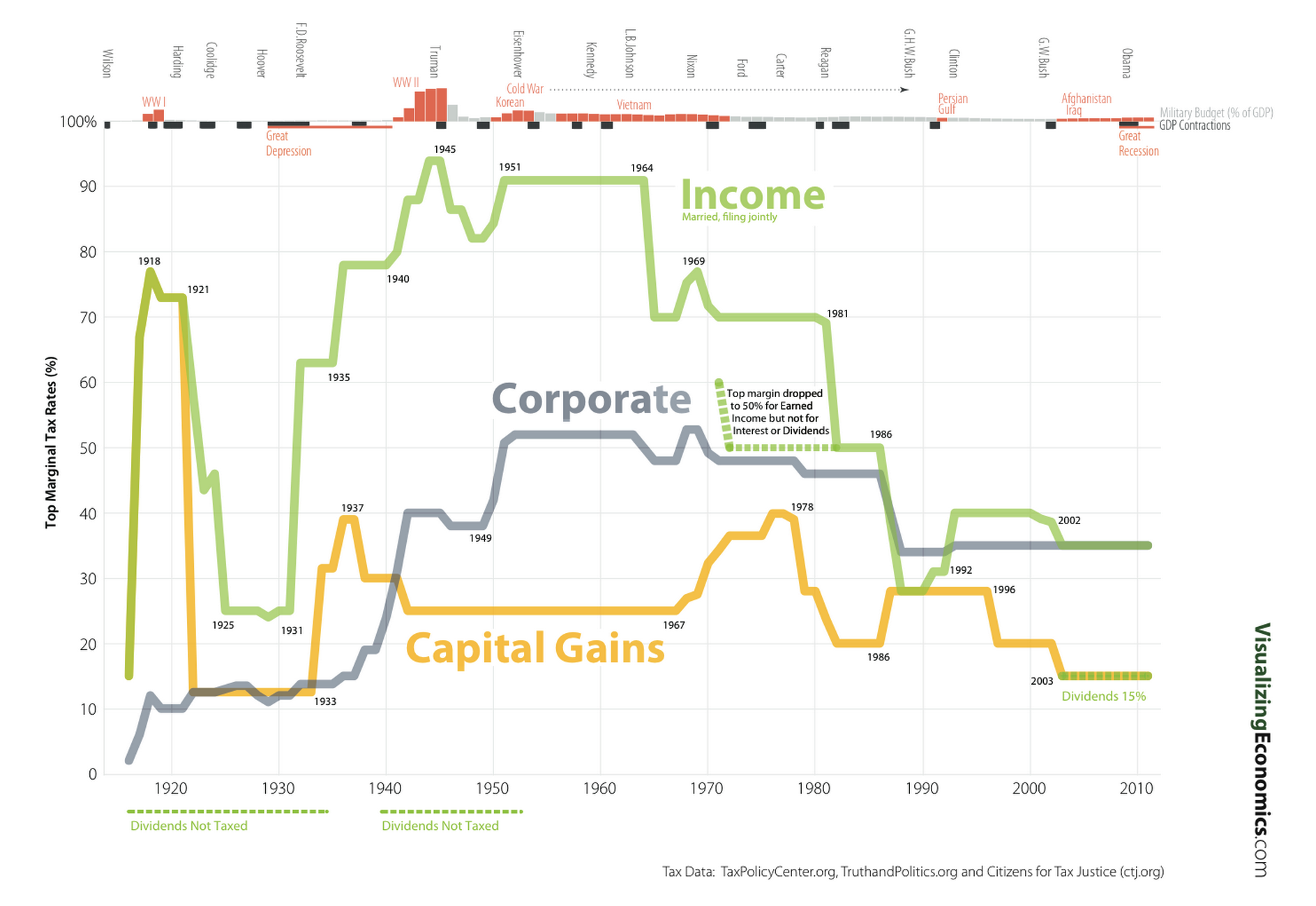

Consider the income tax. Criticisms of hiking high-end income tax rates to combat inequality tend to come in two flavors. First, that it's a purely aesthetic exercise, and does nothing to boost incomes for people lower down the ladder. And second, that it hurts growth by discouraging meritocratic striving. Both these arguments must contend with the fact that from roughly 1930 to 1980, the top marginal income tax rate bounced around between 70 and 90 percent. Today, it's just under 40 percent. Yet it was the 1930-1980 era that saw the recovery from the Great Depression, followed by periods of economic growth and full employment that put the post-1980 era to shame.

What was going on? Part of it was certainly that, with those sorts of high marginal tax rates, there was just no point in increasing pay to elite earners past a certain threshold. (Remember, in our progressive system of tax brackets, the higher rates only hit the income you earn above a certain amount.) But that money was still sitting with the companies; it had to go somewhere. And arguably, where it often went was into the pockets of everyday workers in the form of better pay and benefits. That, in turn, meant purchasing power was more distributed throughout the economy, which laid a broader and more robust foundation for growth.

But wait, don't firms just pay CEOs and upper management with stocks and dividends and such instead? And hasn't capital income been the biggest recent contributor to growing inequality? Yes and yes! But if you look at the historical data — courtesy of Visualizing Economics — you'll see that capital gains tax rates also dropped to historic lows after 1980. Moreover, we cut the corporate income tax rate even more drastically since mid-century. That's important, because the money in a firm has to pass through the corporate income tax before it becomes a dividend or can be realized as a capital gain. (Hence the "double taxation" charge.) And the way a firm lowers its corporate income tax liability is by plowing more revenue back into new investments, new jobs, and higher pay.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Think of these taxes as a system of levees, dikes, and dams that force money to flow through the economy in a particular pattern. When they were strong and well-built, prosperity was broadly shared. But after the 1970s we dismantled them, and entered the era of stagnating wages, spiking inequality, high unemployment, and jobless recoveries.

This framework also provides some rules of thumb for future tax reform. First, reducing the number of brackets and flattening the income tax is exactly the wrong way to go. We should clear out the rats' nest of loopholes. And since those loopholes effectively eliminate income liability for nearly half the American population, income taxes should just not kick in in until you're roughly halfway up the income ladder. But then we should add a few more brackets, so we can ease people in gradually, then ramp up marginal rates back to where they were historically.

We should also clear the loopholes out of the corporate income tax, but lowering the rate is a bad idea. In fact, we should probably raise it, again back to the mid-century norm. It would do the primary work of driving corporate revenue back into investment and jobs, so it might not be necessary to hike capital gains taxes back up — there is a genuine need to encourage long-term capital investment and growth.

A better option might be to simply treat all capital gains income as regular income: taxed lightly, if at all, at modest levels, but taxed at rapidly increasing severity when very large streams of it go to single individuals or households. That would encourage ownership of capital to be spread more broadly and equitably among Americans. Instituting a wealth tax or a land value tax would increase that downward distributive pressure even more.

The last, and possibly most important, thing to remember is that this isn't just about economics. The distribution of incomes, jobs, and capital affects society on every level — social, political, and moral. Rampant inequality and an income ladder spiraling into the heavens results in fractured communities; warps our political system; degrades our perspective, empathy, and moral capacity; transforms life into a grinding treadmill of perpetual striving even for the well-off; and pretty much makes society worse in just about every conceivable respect.

Just like a carbon tax could ward off climate change, a well-designed tax system could ward off oligarchy and social decay. So when you file your taxes this year, remember: It's about way more than revenue.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.