Everything you know about Ronald Reagan and the national debt is wrong

And here's why that matters

The standard historical narrative about President Ronald Reagan's budgets goes like this: He slashed taxes for the rich, spent a ton of money on the military, and the national debt exploded.

Now, that is a fair description of his policies. But it turns out Reagan may have gotten a bad rap on the debt charge.

In fact, the major culprit was another, often overlooked player: interest payments. Just why exactly this happened is extremely interesting, and also carries very important lessons for budgetary and monetary policy today. Put short, the conventional wisdom about debt and monetary policy is almost entirely wrong.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

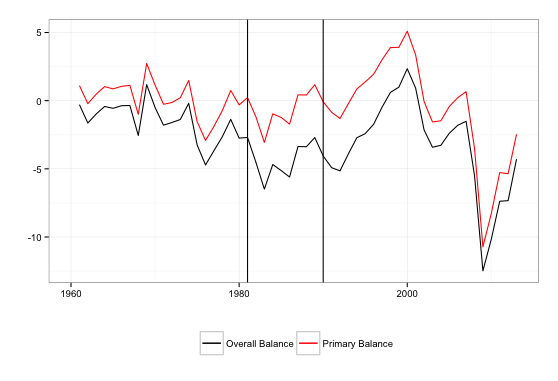

This new perspective on the budgets of the Reagan years comes from the economist J.W. Mason, and it is the product of a fairly simple analysis. All Mason did was carefully examine what fraction of the budget was being spent on interest payments. In his chart below, the "primary balance" line refers to all government spending except interest payments, while the "overall balance" does include those payments. The bigger the gap, the more is being spent on interest:

Notice the gap opening up about 1980, then gradually narrowing through the Clinton years. What gives? This was the Volcker disinflation, when the Federal Reserve created a severe recession to restrain aggregate demand and therefore inflation, which in the late 1970s was running into double digits. The central bank did this by jacking up its benchmark interest rate target to nearly 20 percent. This made financing very expensive, and so dramatically cut purchases of homes and cars, thus slowing the economy.

But because the interest rates paid on government bonds are tied to the Fed's benchmark rate, the amount the government was paying in interest to bondholders also skyrocketed. So as one can see in the chart, Reagan's tax cuts and spending did increase deficits somewhat, but not nearly as much as interest payments did. Without them, the budget would have been into surplus by the end of his term!

That's not to vindicate Reagan's budgets or tax cuts, which remain pretty lousy policy, not least because they ushered in an era of middle class stagnation. Instead, this ought to be a reminder that fiscal policy (what the government does with spending and taxation) and monetary policy (what it does with the money supply) are inextricably intertwined — and the conventional understanding of the linkage is backwards.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

In the aftermath of the financial crisis, there was an explosion in government borrowing, caused not by monetary policy this time, but by a surge in safety net spending and a collapse in tax revenues. In response, debt and inflation paranoiacs have made two arguments. First, that interest rates should be hiked, because low rates could tempt governments to borrow too much, and second, that austerity should be imposed, because the "debt vigilantes" could stop buying the debt of "irresponsible" countries at any moment, causing interest rates to spike through the roof.

Both arguments are nonsense under current conditions — there has been neither excessive borrowing nor any whiff of the bond vigilantes. But more importantly, their underlying causal framework is backwards. As Mason writes:

By increasing the debt service burden of existing debt (and perhaps also by decreasing nominal incomes), high interest rates have been among the main drivers of rising debt, both public and private. A concern about rising debt burdens is an argument for hiking later, not sooner. [J.W. Mason]

Similarly, bondholders will not create a spike in interest rates; they will instead reap the benefits of more interest if the Fed chooses to raise rates.

So when centrist types argue for austerity or greater interest rates as some kind of self-evident proposition, remember Reagan's bum rap. Remember, too, that the whole point of all this budget and monetary policy is to facilitate the business of human life, and not the other way around.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

‘No Other Choice,’ ‘Dead Man’s Wire,’ and ‘Father Mother Sister Brother’

‘No Other Choice,’ ‘Dead Man’s Wire,’ and ‘Father Mother Sister Brother’Feature A victim of downsizing turns murderous, an angry Indiana man takes a lender hostage, and a portrait of family by way of three awkward gatherings

-

Political cartoons for January 11

Political cartoons for January 11Cartoons Sunday’s political cartoons include green energy, a simple plan, and more

-

The launch of the world’s first weight-loss pill

The launch of the world’s first weight-loss pillSpeed Read Novo Nordisk and Eli Lilly have been racing to release the first GLP-1 pill

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred