Don't freak out about Britain's plummeting pound

Take a deep breath.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

In the wake of last week's historic Brexit vote, the British pound dropped like a rock against both the U.S. dollar and the euro. Global financial markets were also in a tizzy: "Brexit panic wipes $2 trillion off world markets" blared The Guardian. "The small-minded burghers of rural England have managed to destroy trillions of dollars of value globally," raged financial journalist Felix Salmon.

Take a deep breath. Because here we are not even a week later, and stock markets around the world are rallying. The FTSE 100 — the index of the 100 companies on the London Stock Exchange — has recovered all the value it lost after the Brexit vote, and then some.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

So what happened here? And what lessons can we draw from the hyperventilating?

If there's a panic among buyers and sellers on financial markets — for whatever reason — share prices can drop dramatically and all at once. The panic across the world's stock markets that hit after the Brexit vote caused a cumulative drop in prices of roughly $2 trillion. Now, if all the purchases on stock markets were money that went to actual companies so they could pay for actual jobs and actual infrastructure and actual capital goods, a $2 trillion drop would be a huge problem. But only a small fraction of the purchases on stock markets actually fund new investment. The vast majority of them are just stock buyers and sellers giving each other money. So while it's not impossible for financial markets to affect the real economy, the link between the two are awfully hazy.

So financial markets are strange and mercurial beasts prone to irrational herd behavior. They can falter for no good reason and recover just as quickly. And it barely matters for the actual economy, despite what you hear on the evening news or CNBC.

But what about the fall in the value of the pound, which is still near a three-decade low?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

On an individual level, if you're a Londoner who travels or does business abroad, this lousy new exchange rate is a problem. Your pounds won't buy as many dollars or euros as they did last week. But for most Britons, international business and travel just aren't big parts of their lives. (Or parts of their lives at all.) At their individual level, the drop in the pound is no big deal, since these people accomplish all of their economic activity in pounds and pounds alone.

More broadly, stronger currencies aren't ipso facto good. For instance, the drop in the pound will make it more expensive for people with pounds to buy goods and services denominated in other currencies. But it will make it less expensive for people with other currencies to buy goods and services denominated in pounds. So British imports will go down, but British exports will go up. That could help close the country's trade deficit. And since trade deficits are a drag on aggregate demand — and thus on job creation — that could be a net plus.

Ultimately, if Brexit does damage the British economy, it won't be with something sudden and dramatic like a stock market panic or a currency crash. It will be something more subtle that grinds down the real British economy over a long period of time. Without access to Europe's single market, Britons may not be able to buy as many of the goods and services that make their lives meaningfully better; businesses may open up shop in Britain less often, and create fewer jobs; fewer people with the skills and drive to create new good and services may come to Britain.

There's a flip side, too. Goods and services produced in Britain will stay in Britain, making people's lives there better and wealthier. It means demand in Britain will employ people in Britain, rather than elsewhere. All of which could help the U.K. grow and increase jobs and wages.

Market economies are super complex, dynamic, and adaptable. Economist JW Mason looked back over British history since the 1970s and found other equivalent falls in the pound. Each time, the British economy managed to just keep on chugging. Indeed, Britain remains an incredibly wealthy country, with an economy worth $46,297 per person. So the question of free trade's value comes down to what concrete wealth and benefits people in a given country only acquire with unfettered trading with people in other countries. Economists have been trying to nail down an answer to this question forever. So far their efforts haven't yielded anything definitive.

Look again at the people who really do have a reason to complain over stock market panics and currency crashes: They're people who travel, do business abroad, and have lots of wealth holdings and stock portfolios. In short, they're exactly the sorts of people who voted for Remain the most: upper-class, well-educated citizens of the world, largely ensconced in London. They complained about Brexit's effect on stock and currency markets because those effects hit their pocketbooks.

But just because those effects are bad for them doesn't make those effects evidence that Brexit itself is bad. In fact, by shouting from the rooftops that Brexit has destroyed the currency and the stock markets, Remain voters were probably just reinforcing why Leave voters thought they were so out-of-touch to begin with.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’the week recommends The pasta you know and love. But ever so much better.

-

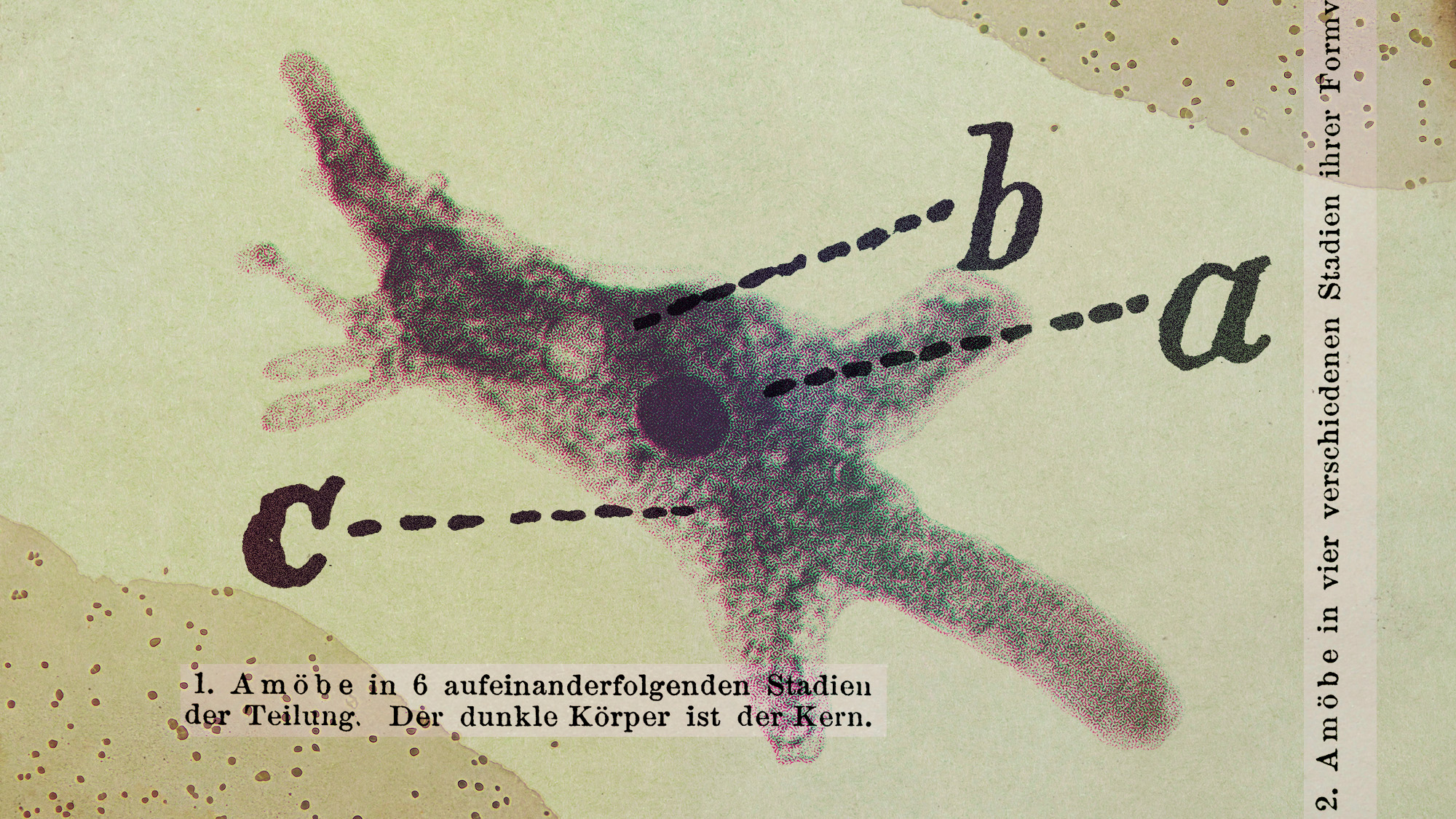

Scientists are worried about amoebas

Scientists are worried about amoebasUnder the radar Small and very mighty

-

Buddhist monks’ US walk for peace

Buddhist monks’ US walk for peaceUnder the Radar Crowds have turned out on the roads from California to Washington and ‘millions are finding hope in their journey’