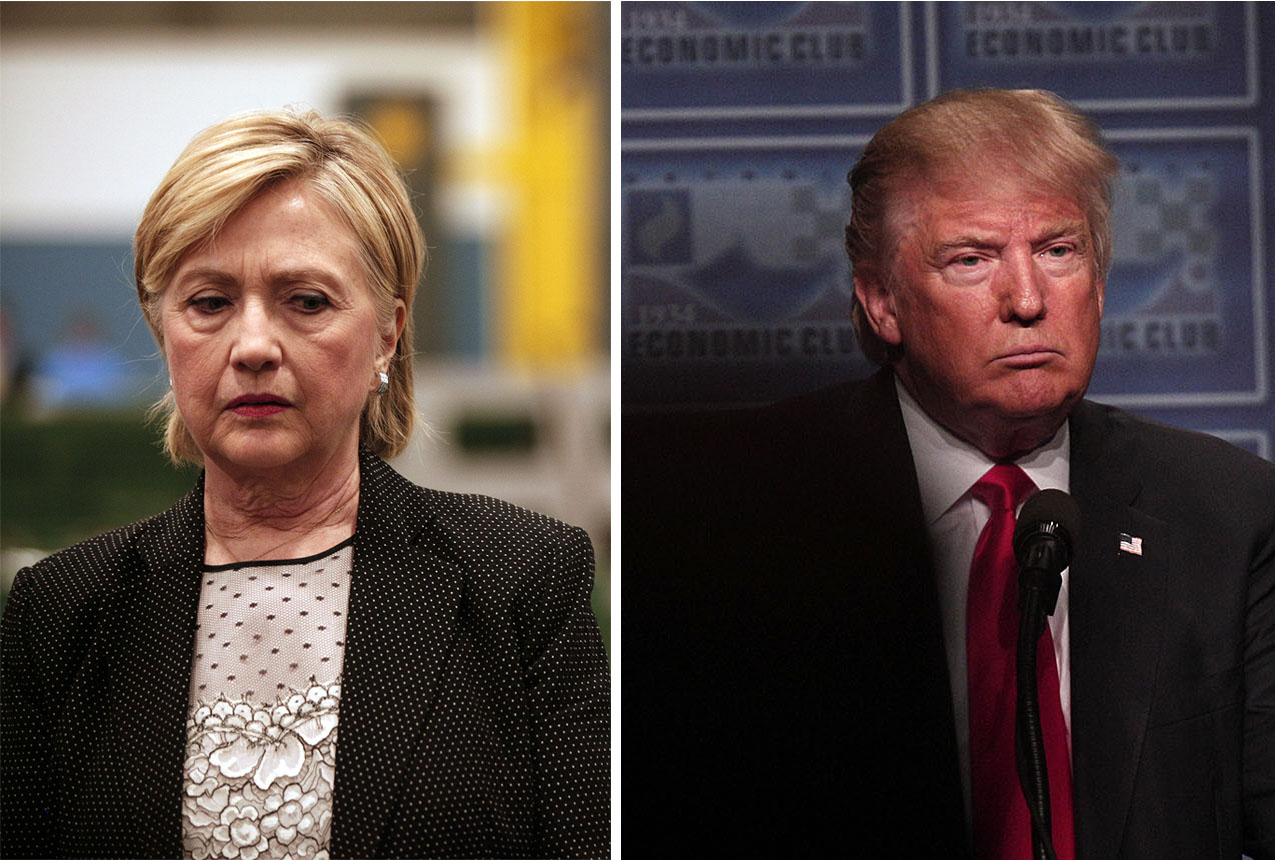

Why Clinton and Trump won't tell you what's really wrong with the economy

Woe be unto any candidate who says "secular stagnation" in a campaign speech

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Welcome to year eight of the "new normal." America continues to suffer its weakest economic recovery since at least World War II. The economy has grown at just a 2.1 percent annual rate since the Great Recession's end in June 2009, and just 1.2 percent over the past 12 months. Even in the Old Testament, famines lasted only seven years.

So does either Hillary Clinton or Donald Trump, both of whom gave big economic speeches in Detroit last week, have any clue about what's wrong?

One big idea currently being debated among economists is "secular stagnation." It's the theory that the U.S. economy is stuck in low gear because consumers and business are spending too little. This is partly because of income inequality and partly because capital goods — especially information technology — have gotten cheaper.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Now woe be unto any candidate who uses the phrase "secular stagnation" in a campaign speech. And Clinton didn't in her recent address. Her analysis was limited to characterizing the problem: "There is too much inequality, too little upward mobility. It is just too hard to get ahead today."

But Clinton's policy ideas hint at the influence of secular stagnation thinking, particularly her proposal to tax wealthier Americans to help pay for $275 billion in new infrastructure spending. Having government help fill the demand shortfall is a key ingredient of the policy mix recommended by the theory's leading proponent, Lawrence Summers, who served as Treasury secretary at the end of Bill Clinton's second term and as a top economist in the Obama White House.

Of course, secular stagnation might not accurately explain what's wrong with the U.S. economy. Economists Carmen Reinhart and Kenneth Rogoff have argued that after financial crisis-driven recessions — like the Great Recession, in their view — recoveries tend to be particularly slow. And by that standard, the current U.S. recovery is actually okay. As Goldman Sachs recently noted, "the post-2008 U.S. recovery has not been unusually weak or prolonged relative to other financial crisis episodes, and in fact has been notably stronger when judged from a labor market perspective." Growth may not be too impressive, but the jobless rate is below 5 percent and the economy has added 15 million private-sector jobs during the recovery.

But at least secular stagnation is a thoughtful, defensible framework for examining America's "new normal." Especially compared to Trump-onomics. The Republican presidential nominee's explanation is a combo of the unfortunately typical Republican response — "Thanks, Obama" — and his own anti-trade views. As Team Trump opined after the recent second-quarter GDP report, "It's the weakest recovery since the Great Depression — the predictable consequence of massive taxation, regulation, one-sided trade deals, and onerous energy restrictions."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

But wait: America is hardly the only country whose economy has been sluggish since the global financial crisis. Great Britain's rebound is maybe its worst in three centuries. Are ObamaCare and Dodd Frank also responsible for that nation's meh recovery? What's more, some worrisome trends, such as anemic productivity growth, predate the Obama years. And as for trade, big trade deficits are typically associated with high employment, not less.

In other words, Trump's theory appears to lack much explanatory power. Even worse, it lacks much intellectual curiosity about 21st century America and its economic challenges, instead settling for nostalgia about the era of Big Steel and King Coal.

Hilllary-onomics doesn't have anywhere near all the answers. Far from it. But at least it tries.

James Pethokoukis is the DeWitt Wallace Fellow at the American Enterprise Institute where he runs the AEIdeas blog. He has also written for The New York Times, National Review, Commentary, The Weekly Standard, and other places.