Republicans' remarkable self-deception on tax cuts

Do Republicans actually believe what they say about taxes?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

In this polarized age, it's tempting to believe that those on the other side are stone-cold liars, not just wrong in their goals and unethical in their methods but utterly dishonest in everything they say. But most of the time, that just isn't true: Your opponents want what they say they want, pretty much for the reasons they cite.

Most of the time. But lately, I've been struggling with this question: Do Republicans actually believe the things they say about taxes?

I don't mean their conviction that lower taxes are better than higher taxes, and we'd have a more just society if taxes were as low as possible. There's no question they sincerely believe that. I'm talking more about the set of empirical claims they offer up as justification whenever they propose a new set of tax cuts for the wealthy and corporations.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

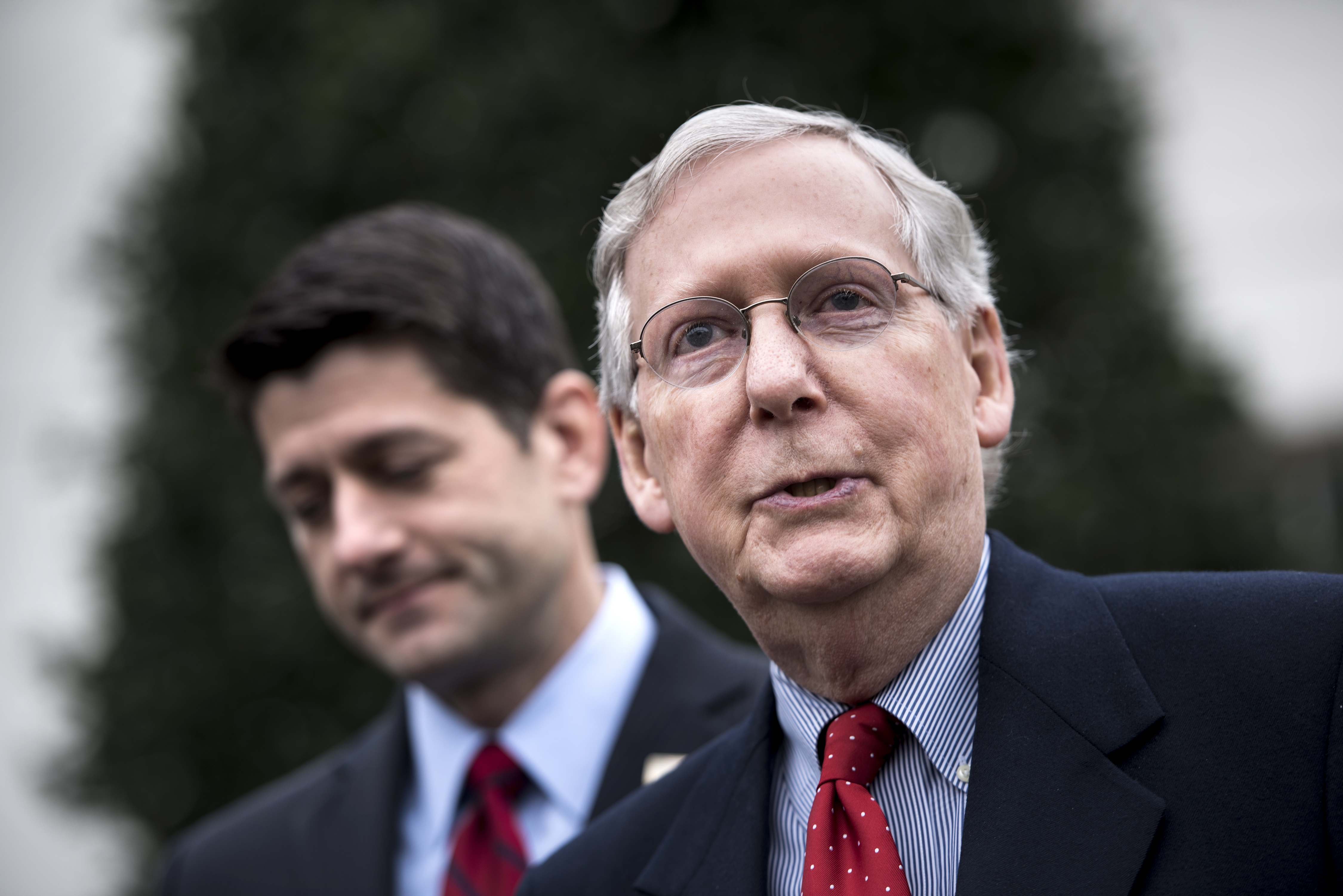

Some of those claims are obvious lies, and no serious person could believe the person making them doesn't know it. When President Trump says that the tax bill "is going to cost me a fortune, this thing — believe me. Believe me, this is not good for me," he's lying. When Paul Ryan says, "The whole purpose of this is to get a middle-class tax cut," he knows he's full of it.

But what interests me more at the moment are the predictions Republicans make about the future. Because that's really at the heart of their rationale for why everyone should support their approach to tax reform. It's the same trickle-down argument they've been making for decades: Give benefits to the wealthy and corporations, and everyone will share in the rewards.

Subsidiary to that are a number of more specific claims. Cutting taxes will cause economic growth to skyrocket. A corporate tax cut will lead to huge increases in wages. The tax cut will produce so much extra growth that government revenues will actually increase, enabling the bill to pay for itself. And the unspoken presumption under them all: When you change the tax code, even by a little, it has huge effects across the economy.

Now I try whenever I can to give Republicans the benefit of the doubt. But all of these assertions are demonstrably, obviously false.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

To understand why, let's review our recent history, which shows that every single time we have a tax debate, Republicans make predictions that turn out to be wrong. In 1993, Bill Clinton raised taxes on the wealthy, and Republicans all said it would cause a "job-killing recession." They were wrong; 23 million jobs were created over Clinton's time in office, and the deficit turned into a surplus. Then George W. Bush cut taxes in 2001 and 2003, and Republicans promised exactly what they're promising now: a supercharged economy bestowing wealth on all from the humblest street-sweeper to the loftiest penthouse-dweller. They were wrong; the economy limped along until 2008, when it imploded in the worst financial crisis in eight decades. Then when Barack Obama raised taxes on the wealthy in 2012, they said the result would be economic disaster. They were wrong; the economy kept improving at pretty much the same rate it had been since we began climbing out of the Great Recession.

You might look over that experience and say that the best economic strategy is to raise taxes. But the truth is that tinkering with tax rates has only a tiny effect on the economy one way or the other, which is why Republican predictions are always mistaken. They say that tax increases will destroy everything, and tax cuts will bring us to nirvana, but neither ends up happening. Cutting taxes doesn't kick growth into overdrive, and they don't ever pay for themselves. While Republicans might honestly believe that as a general matter lower taxes are better for the economy than higher taxes, they can't possibly believe that any change in taxes will have immediate and enormous effects, because that hypothesis has been proven wrong again and again. But that's what they always say.

So it's pretty clear that their position doesn't grow from any clear-eyed assessment of empirical reality. It's an expression of their moral principles, namely that taxation is fundamentally unjust, and if we have to tax somebody, it shouldn't be the wealthy who have proven their virtue by being rich. They don't usually put it that way, of course, although they sometimes do; just recently Sen. Chuck Grassley (R-Iowa) offered this justification for getting rid of the estate tax, which only applies to inheritances of over $5.5 million: "I think not having the estate tax recognizes the people that are investing, as opposed to those that are just spending every darn penny they have, whether it's on booze or women or movies."

That kind of candor may be rare, but it's obvious that Republicans are unconcerned with the distance between their empirical claims and reality. After all, they've been through this before. They'd surely prefer it if their predictions didn't always prove to be wrong, but that fact isn't going to be enough for them to change their rhetoric, let alone the policies they propose. Memories are short enough and the public is distracted enough for them to pass yet another tax cut for those at the top, and if this one too turns out not to deliver what they promised, they will still have gotten what they wanted.

Last week, Sen. Mike Rounds (R-S.D.) was asked about the consensus among experts that cutting taxes will only have a tiny effect on economic growth. He responded that he and his colleagues agree that all the experts are wrong, and in fact the GOP tax bill will cause growth to surge. "If we didn't believe that we wouldn't be doing this," he said. But that's awfully hard to believe.

Paul Waldman is a senior writer with The American Prospect magazine and a blogger for The Washington Post. His writing has appeared in dozens of newspapers, magazines, and web sites, and he is the author or co-author of four books on media and politics.