Will the tax bill help or hurt the GOP in 2018?

There are several ways this could play out

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

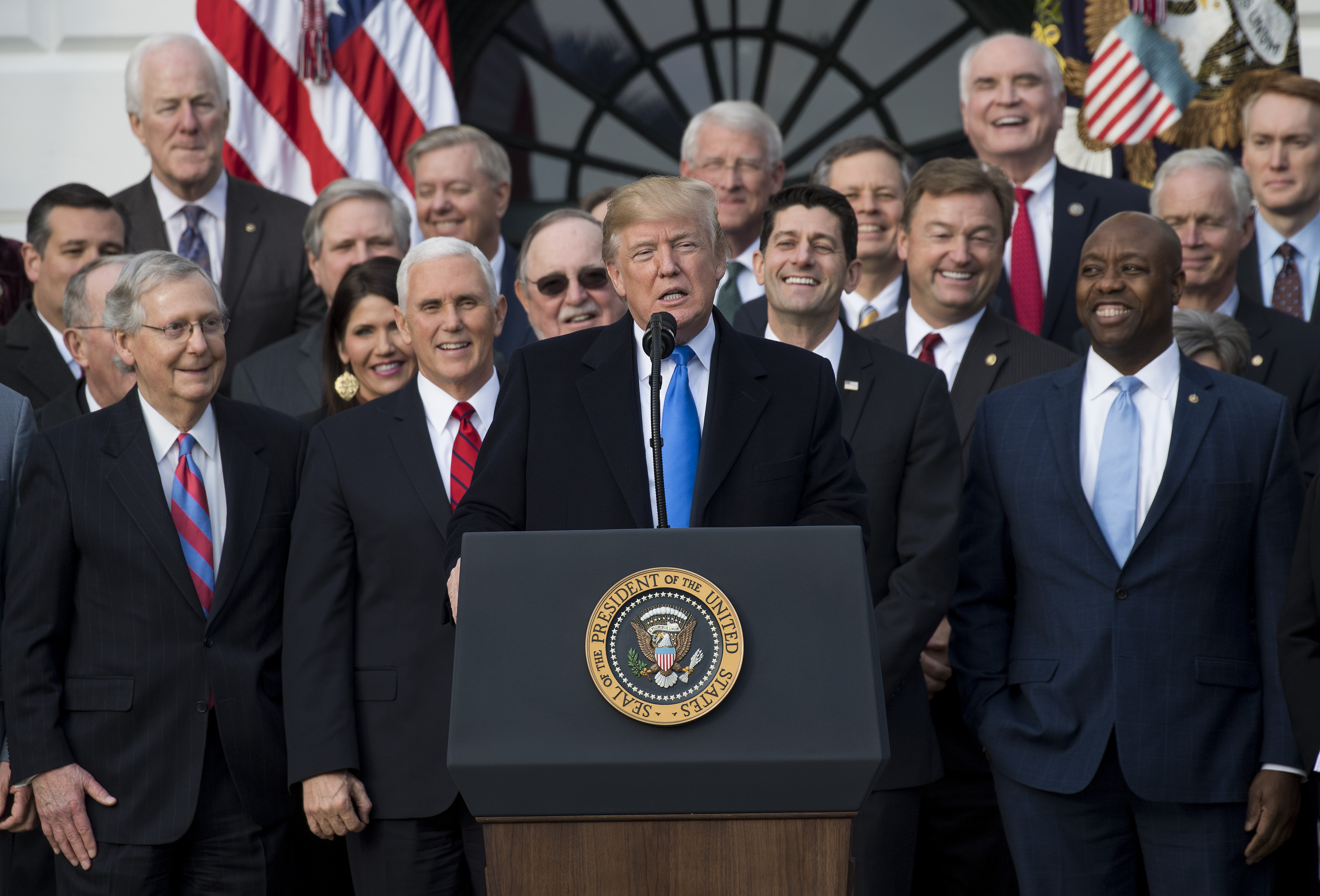

Congress has finally, really and truly, passed the Republicans' long-sought tax overhaul. All that remains is for President Trump to sign the bill.

So what happens now? Specifically, how will the tax overhaul affect next year's midterm elections?

A third of the Senate and all of the House of Representatives will be up for grabs in November 2018, along with myriad state-level offices. Republicans are hoping to run on the tax bill as a legislative victory and a boon to working Americans. Democrats are equally eager to cast the bill as a plutocratic giveaway to the wealthy and beat the GOP over the head with it.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But one thing we know from political science is that politicians' speeches, ad campaigns, and messaging strategies all have murky effects on voter behavior. Most likely, the tax law's political impact will come from what it does for economic growth and people's pocketbooks.

There are several ways this could play out.

Will the tax overhaul juice business investment? Republicans argue the big cuts to corporate and pass-through business taxes will encourage investment, leading to more job creation and higher wages. A handful of major companies have already announced new pay hikes for workers or plans for expansion. "This is a case where the results will speak for themselves, starting very soon," as Trump put it. "Jobs, Jobs, Jobs!"

But not so fast. At least some of those companies had those plans in place already. The numbers they're trumpeting are tiny fractions of the money freed up by the tax law, and piddly compared to the payouts they're planning for shareholders. Most likely, these are PR stunts to get in the White House's good graces.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Yet even as business investment plumbs new lows, after-tax corporate profit margins are higher than they've been in almost 60 years. The idea that expanding corporate profits even more is the key to opening the investment floodgates is ... not plausible, to put it mildly.

Will it help the average taxpayer? The law's obvious purpose is a big tax payday for corporations and the 1 percent. But Republicans did try to give themselves political cover by handing out tax breaks to everyone else in 2018. People won't file their final 2018 taxes until April 2019, but they should see more in their paychecks from changes to IRS withholding throughout the year. Ironically, if anything's going to help the economy, it'll be that.

The poorest 20 percent of American households will get $60 more in 2018, the next 20 percent will get $380 more, and the next 20 percent will get $930 more. But these are also piddly amounts: well under $100 billion in new total spending next year. That will increase aggregate demand — the true driver of jobs and wages — but not by much in the context of an $18 trillion economy.

The money going back to the bottom 40 percent is also far less than they got from President Obama's stimulus package. And we all know how the 2010 elections worked out for the Democrats. History suggests the tax law's benefits for the non-wealthy are too small to make much of a political difference for the GOP.

Will it spook the Federal Reserve? The GOP's tax overhaul will increase deficits by $1.5 trillion over the next decade, which could convince the central bank to increase its interest rate hikes in 2018. And that could put a damper on economic growth.

It would be foolhardy of the Fed to react this way. But the central bank could also become considerably more hawkish in the next few months. There are several vacancies on its governing board, and while Trump himself at least sounds dovish on monetary policy, congressional Republicans have a long history of hard money crankery. So it depends on who wins that tug-of-war, which makes this one really tough to predict.

How was the economy already likely to perform? If the tax law's effects on the economy and pocketbooks in 2018 is uncertain or a wash, that means the biggest factor might be what trend the economy was already on. We know from political science that whether changes in overall economic trends are positive or negative in the year running up to an election tends to play a big role in the incumbent party's fortunes.

President Obama's economic legacy was a mixed bag. But he did manage to shepherd a steady if agonizingly slow recovery from the Great Recession, and it shows every sign of continuing. Assuming the effects of the tax cut are a wash, President Trump will still inherit the political benefits of this long run of success.

Of course, wage growth remains remarkably low compared to what you'd expect at 4 percent unemployment, and recently started falling again. Labor force participation is also still depressed. So things are technically improving, but at such a slow pace the political benefits to Trump may be meager.

That would change if labor markets tighten enough for wage growth to really pick up. But then an unforeseen crisis or a trigger-happy Fed could also knock the economy off its stride.

The X-factor. Basically, 2018 is going to be a mess of uncertain structural forces pushing voter sentiments in different directions. Which means this might be an election where politics and messaging really does make the difference.

Thus far, the tax bill has proven spectacularly unpopular, as has Trump and his party. The president stands to personally gain millions from the tax overhaul, as will many Republicans in Congress. That's absolutely horrible optics, and the Democrats will be cutting ads with them all year. The tax law's new deficits could very well trigger automatic budget rules that cut spending on programs like Medicare. The GOP could even decide to cut entitlements in the name of deficit reduction, which would be absolute poison after putting $1.5 trillion on the national credit card in the name of tax cuts for the 1 percent.

One thing is for sure: Next year, which was already shaping up to be a political doozy, just got a lot more interesting.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

A dreamy long weekend on the Amalfi Coast

A dreamy long weekend on the Amalfi CoastThe Week Recommends History, pasta, scenic views – this sun-drenched stretch of Italy’s southern coast has it all

-

Can foster care overhaul stop ‘exodus’ of carers?

Can foster care overhaul stop ‘exodus’ of carers?Today’s Big Question Government announces plans to modernise ‘broken’ system and recruit more carers, but fostering remains unevenly paid and highly stressful

-

6 exquisite homes with vast acreage

6 exquisite homes with vast acreageFeature Featuring an off-the-grid contemporary home in New Mexico and lakefront farmhouse in Massachusetts

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred