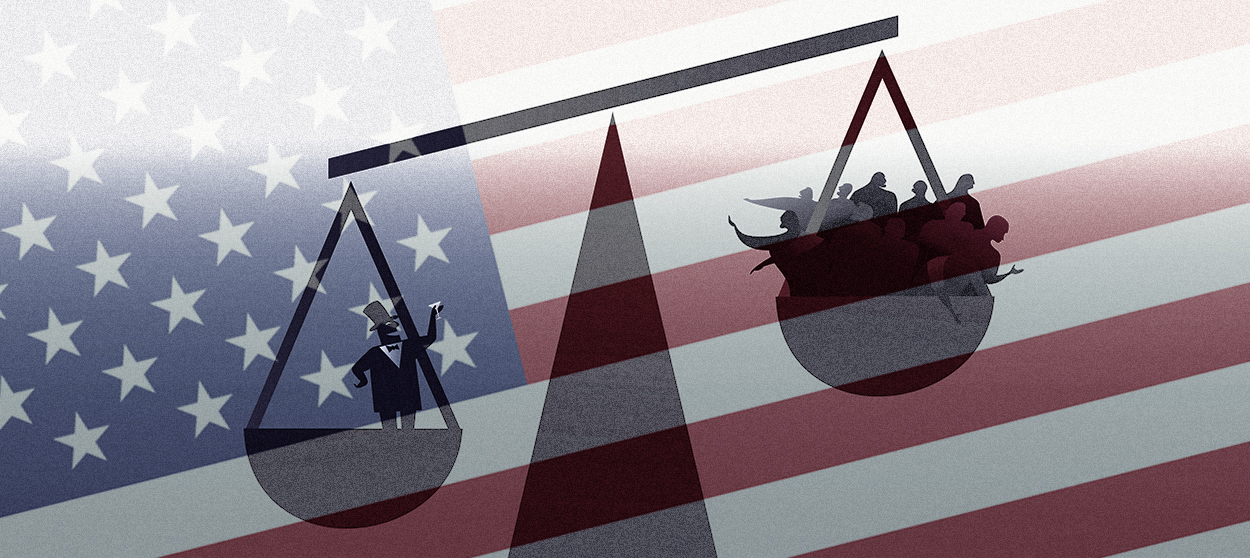

America's biggest tax delusion

A tax is not simply money taken out of your paycheck

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Rep. Alexandria Ocasio-Cortez (D-N.Y.) demonstrated once again her media savvy this weekend, dominating the political discussion with the clever strategy of saying interesting, correct things in the fashion of a normal person instead of a robot trained by focus groups. In an interview with Anderson Cooper on 60 Minutes, she suggested that the top marginal tax rate at $10 million ought to be perhaps 60-70 percent.

This is a good opportunity to take on the biggest American delusion about taxes: that they are simply taking money out of your paycheck. In sensible countries, what they are is a way to pay for nice goodies that benefit (almost) everyone.

Conservatives, of course, are trying to straight-up lie about what Ocasio-Cortez is actually proposing. House Minority Whip Steve Scalise, famously tax-averse political operative Grover Norquist, and dozens of other Republicans claimed that AOC wants to raise the tax on all income to 70 percent. In reality, as AOC herself carefully explains above, the top rate only kicks in on money made above that threshold. Referencing the actual history of the 1950s and '60s, she said: "Once you get to the tippy-tops, on your 10 millionth dollar, sometimes you see tax rates at 60 or 70 percent. That doesn't mean all 10 million dollars are taxed at an extremely high rate. But it means that as you climb up this ladder, you should be contributing more."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Indeed, as Eric Levitz explains, AOC actually considerably understated the historical aggressiveness of the top tax rate. When Ronald Reagan took office, the 70 percent rate kicked in at $216,000, or about $658,000 today.

But setting that aside, the conservative play here is to try to activate Americans' traditional tax phobia, which is by no means only coming from the right. Here's Chris Rock: "You know what's f*cked up about taxes? You don't even pay taxes. They take tax. You get the check, money gone. That ain't a payment, that's a jack."

Hyperbole aside, there are two major things missing from this view. The first is that much tax revenue pays for necessary services, many of which are universal even in the U.S. — roads, bridges, trains, airports, and so on. Deliberately leaving the benefit part out of the tax equation is a hallmark of a great deal of conservative "policy analysis." The Trump administration's big Council of Economic Advisers report on socialism from awhile ago, for example, heavily inflated the relative cost of owning a pickup truck in Nordic countries by fudging this exact distinction. (The details are complicated, but basically they made it seem as though a truck would require relatively more hours of work in Nordic countries than it really would by obscuring that Americans have to pay for many public goods out of pocket.)

Sweden, by contrast, has a top marginal tax rate of 70 percent that kicks in at a mere $98,000 (and does not suffer any notable economic harms as a result, by the way). Here's how one Swedish person thinks about the high tax level:

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The second thing missing is that most Americans still have to pay for the things they don't get through taxation. Americans still need health insurance, child care, a college education, and so on (depending on circumstances) — we just have to finance some or all of that privately, and it often strains Americans' budgets terribly. Indeed, later in that same bit I referenced above, Rock himself hits on this reality, when he complains about the necessity and cost of insurance. "You know what's worse than taxes? Insurance. You got to have some insurance … You better have some medical insurance, or you gonna die." No joke!

Of course, many American programs are means tested (like Medicaid, which is only available for poor people), which is surely a big reason why beliefs like Rock's are so prevalent. Means testing is not just inferior as a policy design matter, it also reinforces destructive, mistaken ideology about taxes.

At any rate, health care is where American tax aversion and Rube Goldberg policy designs combine to make obtaining and paying for medical treatment an ever-more senseless and expensive nightmare. We already pay more than enough taxes to fund a world-class universal government health-care program and then spend about that much again in private money. If we had just done Medicare-for-all back in the 1960s (and used the ensuing leverage to keep medical cost inflation within reasonable bounds), American paychecks would be considerably fatter than they are today even with the additional tax needed — and we would all have unquestioned coverage at all medical providers, without the enormous stress of navigating the current Byzantine (and often predatory) private-public hodgepodge.

A Nordic-style social democratic welfare state is based on an ethos of collective solidarity, but somewhat ironically it is also an excellent way of selfishly obtaining personal benefits. If I want really good and stable health care, I want the risk pool to be as large as possible, which is clearly best done by the state. If I want to have a family, I want government-supported parental leave, universal pre-K, and other benefits, which are only a small burden for me when I'm older and making more money anyway. And so on.

Unless you are very rich, the best way to have a secure, cushy life is to ensure everyone has one.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

Antonia Romeo and Whitehall’s women problem

Antonia Romeo and Whitehall’s women problemThe Explainer Before her appointment as cabinet secretary, commentators said hostile briefings and vetting concerns were evidence of ‘sexist, misogynistic culture’ in No. 10

-

Local elections 2026: where are they and who is expected to win?

Local elections 2026: where are they and who is expected to win?The Explainer Labour is braced for heavy losses and U-turn on postponing some council elections hasn’t helped the party’s prospects

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred