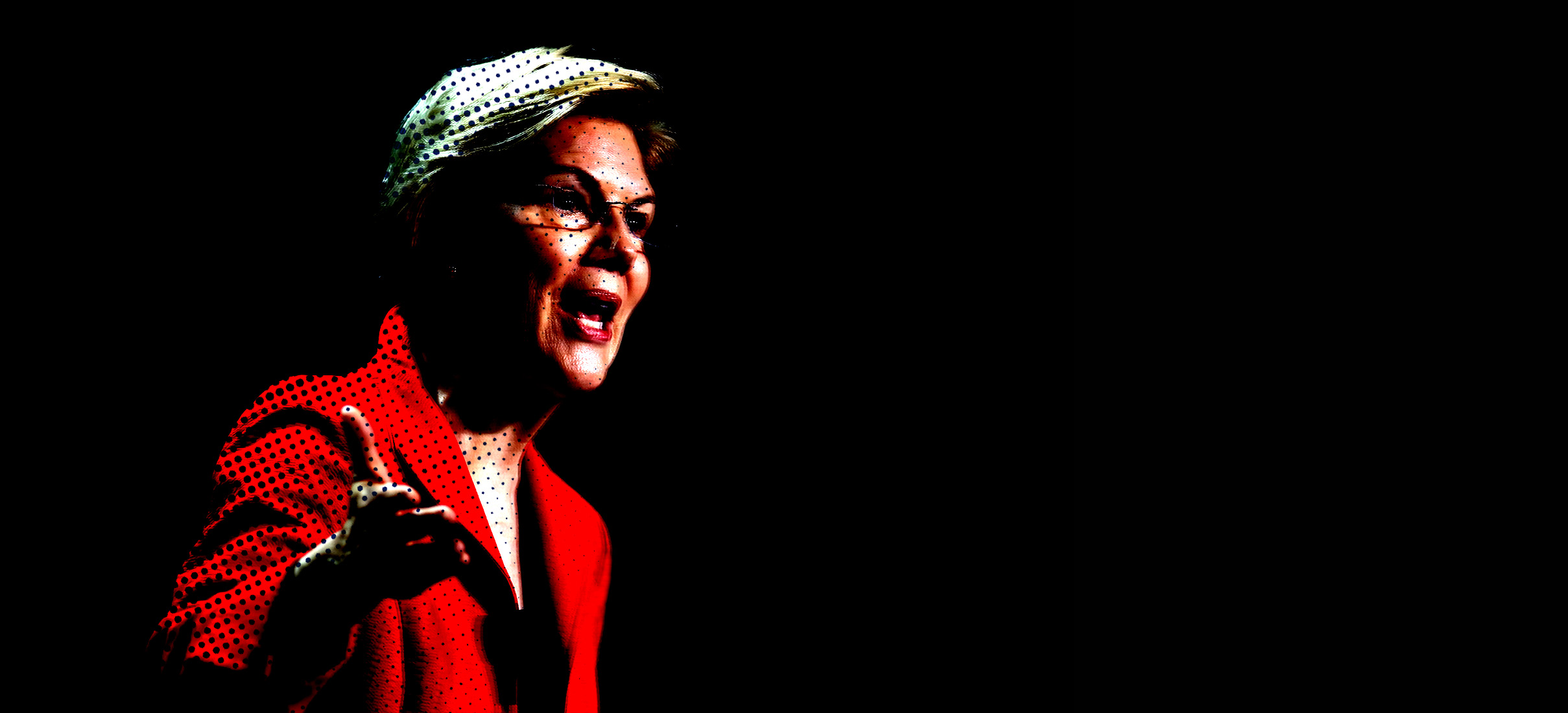

The unserious virtue signaling of Elizabeth Warren's wealth tax

In its rush to punish the rich, the plan gambles with American prosperity. Here's why.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Why does Elizabeth Warren want to hit America's 75,000 richest families with a $3 trillion wealth tax? Ostensibly to pay for stuff. Stuff that would supposedly create "an economy that works for everyone," as she puts it. And in the presidential candidate's view, that expensive effort means pricey new federal programs such as universal childcare and student loan debt relief. All paid for through her annual 2 percent levy on fortunes above $50 million, plus an extra 1 percent on wealth excess of $1 billion.

Those tax rates may seem modest. After all, the top personal income tax rate is 37 percent and progressives now routinely raise the prospect in increasing it to 50 percent or even much higher. But this would hardly be a minor tax of merely symbolic importance. A calculation by Emmanuel Saez and Gabriel Zucman — the University of California, Berkeley economists who helped devise Warren's plan — shows the 15 richest Americans would see a 54 percent reduction in their net worth, to $434 billion from just under $1 trillion if the scheme had been in place since 1982. (A more radical version contemplated by the advisers, a 10 percent tax on billionaires, would reduce that amassed wealth by nearly 90 percent.) And overall under the plan, the total share of national wealth owned by the 400 richest Americans would be reduced to about 2 percent from 3.5 percent currently.

One wonders how many American would be happier, really, in a world where Jeff Bezos was worth $24 billion instead of $113 billion. Activists who view the existence of any billionaires at all as a public policy failure would still be miserable. But regular Americans, less obsessed with the fortunes of the rich and famous, might share their mood, though for different reasons. They might be poorer.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

It's hardly novel economics to suggest that a wealth tax would reduce savings by those hit with the tax, leading to less investment, productivity growth, and wage growth than otherwise. Less risk taking, too. Saez and Zucman concede that a wealth tax "would reduce the financial payoff to extreme cases of business success" but disputes there would be any loss of "socially valuable innovation." As they see it, a wealth tax would really only hurt wealthy owners who have already built businesses and are worried merely about "protect[ing] their dominant positions by fighting new competition." In other words, even if Jeff Bezos, Mark Zuckerberg, and the Google guys had vastly smaller fortunes, nothing else about their business careers or companies would be meaningfully different.

But that's not an accurate description of the world we live in. For instance: The ultra-billionaire founders of America's most valuable technology companies run them seemingly under the assumption that if they don't keep innovating, those dominant positions will vanish. As a group, the five largest American tech companies spend some $60 billion annually on R&D, including long-shot bets on new technologies. They are paranoid about the future and fear that if they're not on the technological cutting edge, they'll get left behind. How could Saez and Zucman possibly be so confident that the de facto confiscation of the bulk of the tech leaders' fortunes would change nothing important?

Think of it this way: One thing the U.S. economy does really well is creating super valuable technology companies that, along the way, make their founders superrich, employ lots of people, and supply products we greatly value. The five most valuable tech firms — Microsoft, Apple, Amazon, Alphabet, and Facebook — are all American with not a single one in the top 25 from Europe. (Make no mistake, Europe would love to have lots of big tech firms.) To assume that would still be the case even with a radical change to how founder fortunes are taxed is an equally radical hypothesis. If you think big fortunes are intrinsically bad and immoral, fine. But don't pretend there might not be significant negative feedback to the economy in terms of dynamism, innovation, and growth.

And the impact on economic growth is just one of the many big questions about wealth taxes, including their legality and widely noted difficulty in administration. Given all that, it's hard not to conclude that wealth taxes are a form of virtue signaling that ignores less flashy alternatives to dealing with wealth inequality — but with more relevancy and far less potential of harming economic efficiency.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The story of wealth inequality seems to be largely one of housing inequality, not superrich techies. Why isn't the Warren plan focused around tackling land-use regulations that deter homebuilding, exclude workers from locating in high-wage places, and are prime drivers in wealth concentration? "Barriers to geographic mobility reduce the productive use of our resources and entrench economic inequality," noted a 2015 Obama White House report on the issue.

And if you want to directly tax rich people, why not start with tax breaks that mainly help wealthier American such as the mortgage-interest deduction — again housing! — and the tax exclusion for employer-provided health care? Phase them both out. Radical policy ideas — even if they have less visceral punch than a direct tax on wealth.

Want more essential commentary and analysis like this delivered straight to your inbox? Sign up for The Week's "Today's best articles" newsletter here.

James Pethokoukis is the DeWitt Wallace Fellow at the American Enterprise Institute where he runs the AEIdeas blog. He has also written for The New York Times, National Review, Commentary, The Weekly Standard, and other places.