What skyrocketing unemployment means for health insurance

Millions of Americans are losing their coverage — what options do they have?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

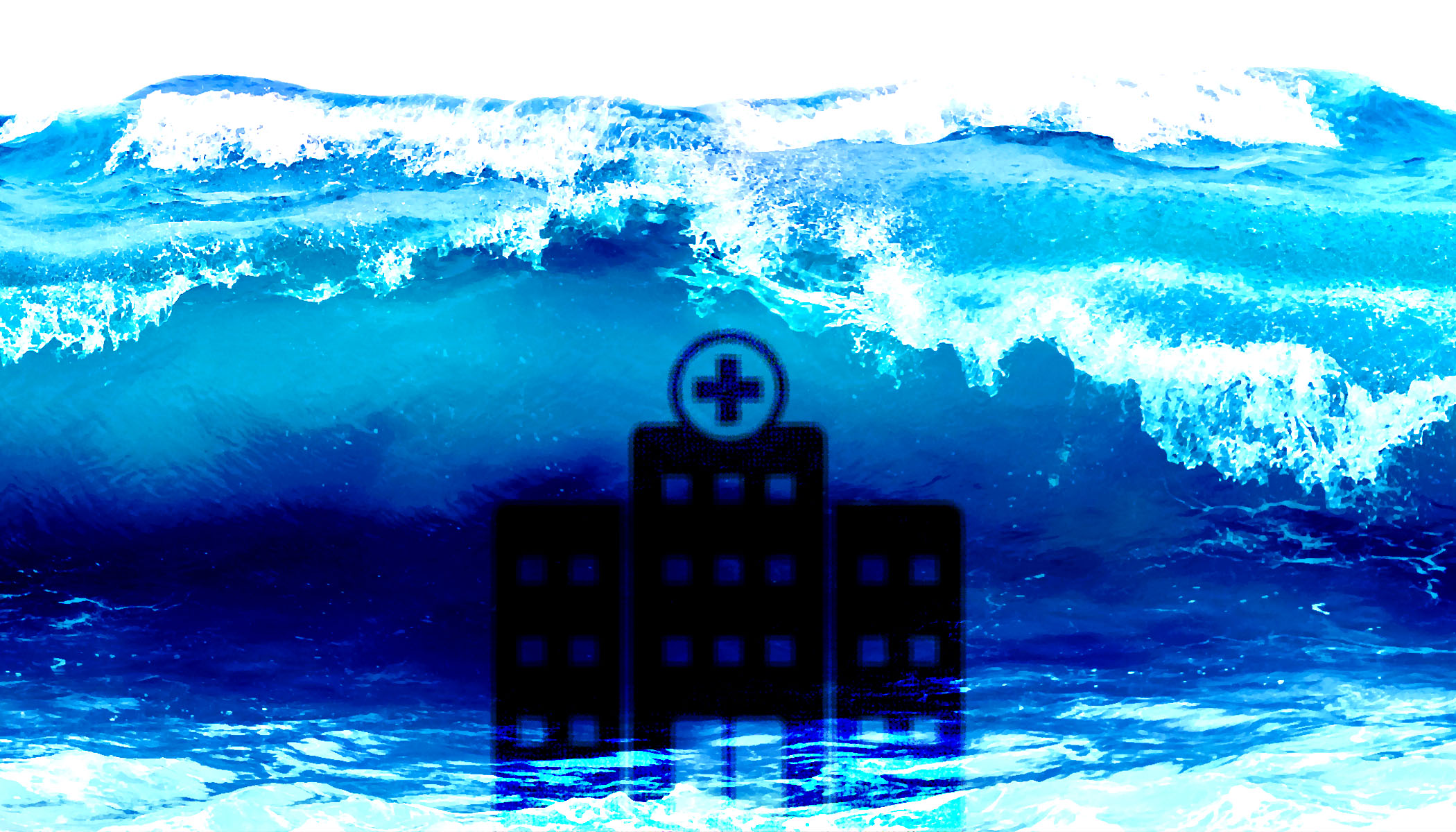

The economic tidal wave set off by the coronavirus is upon us. Last week, a record-setting 3.28 million Americans filed for unemployment benefits, utterly dwarfing the previous highest week of 695,000 in 1982. All by itself, this will knock the unemployment rate back up to almost 5.5 percent. And the total amount is likely even higher, simply because some people probably weren't able to file by the time the data was compiled and released. This is a staggering number of Americans who have lost their jobs all at once.

For a lot of workers, their job isn't just a source of paychecks, but of health insurance. Nearly half of all Americans get that coverage through their employer. Granted, the working population hardest hit by the coronavirus shock is in lower-paying jobs in service and food and retail that are much less likely to provide health benefits. But the damage to employment is likely to spread higher up the class ladder as the coronavirus crisis roles on. And even for those who didn't have health benefits, the loss of income will likely make getting coverage and care even more difficult when they need it.

So how does all that shake out? Just what does this massive unemployment shock mean for Americans' health coverage?

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Medicaid: If your income falls low enough (say, because you just lost your job due to the coronavirus shock) you'll be eligible for Medicaid — the country's single-payer health care system for low-income Americans. In fact, a fair number of the people who just hit the unemployment rolls were probably paid so little they already qualified.

Now, Medicaid is run at the state level, so eligibility thresholds vary. In the 37 states that took advantage of Obamacare's Medicaid expansion, anyone who makes less than 138 percent of the federal poverty level gets on the program. In non-expansion states, eligibility thresholds are a patchwork, ranging from slightly more stingy to way more stingy. Another perverse complication is that the unemployment benefits those 3.28 million people are applying for actually count towards the income for Medicaid qualification. If the benefits boost their income too high, they won't be able to get on the program. (Happily, it sounds like the extra top-up to unemployment benefits Congress is about to pass won't count towards qualifying income.)

Of course, like a lot of government aid programs, applying for Medicaid is often a much more complicated hassle than it should be. Among other things, eligibility is calculated month-to-month — as opposed to Obamacare's exchange subsidies, which look at your annual income. So some people who need the help may not realize they qualify.

But for those who can get on Medicaid or who already had it, the program is a pretty good deal: Its networks aren't massive, but they tend to be enough. There are no premiums, and copays and deductibles are very low. A 2017 survey of Medicaid beneficiaries gave the program a 7.9 out of 10, with 10 being "the best health care possible."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Obamacare exchanges: If a person or family is expected to make more than 138 percent of the federal poverty line in a given year, they can get on Obamacare's exchanges, where subsidies are available to help pay for private health coverage plans.

Unfortunately, Obamacare plans aren't as good as Medicaid: they do charge you premiums and other forms of cost-sharing. Furthermore, the subsidies phase out as your income goes up, and unless what you make isn't too far above that 138-percent cutoff point, the subsidies often don't provide enough help. So if you just lost your employer coverage, Obamacare may come to your aid — assuming you can afford the costs. Meanwhile, if you were already on an Obamacare plan and you just lost your job, you may or may not be able to afford to keep your plan. (And again, unemployment benefits count as income in Obamacare's calculus of who qualifies for subsidies, and how generous they are.)

Finally, simply navigating Obamacare's system and its paperwork can also be a tough challenge for people trying to get help — from figuring out what plans they're eligible for to the timing of when the subsidies actually land in their pocketbooks.

The gap: This part is perverse, but also pretty straightforward. Between the Medicaid expansion and the exchanges, Obamacare was supposed to create uninterrupted coverage of some form, both below and above the 138-percent threshold. But since some states didn't do the expansion, there's a gap. If you reside in one of those states that didn't do the expansion, and you just lost your job and your health plan with it, you might find your remaining income is too much to qualify for Medicaid — and too little to qualify for Obamacare subsidies. Some states have rejiggered their setups so that you can still potentially get the subsidies regardless, but it doesn't work that way everywhere.

Of course, you have to be pretty low income to fall into the gap to begin with. And like I said, low-income jobs are less likely to provide health coverage, though it does happen.

COBRA: No, it's not the villain in G.I. Joe. It's the Consolidated Omnibus Budget Reconciliation Act (or "COBRA") passed in 1985. Among other things, that law provides that if you lose a job that provided health benefits, you can continue holding onto that same coverage plan, anywhere from a year and a half to three years depending on why exactly you're unemployed.

There's a catch, though. The way health benefits generally work is that part of the premium is taken directly out of your paycheck, and the rest is paid by your employer before your paycheck is calculated. If you lose your job and get COBRA coverage, you have to pay the full premium — both your share and your employer's share. If you can't afford that, you're out of luck.

The good news in this instance is the big increase in unemployment benefits Congress looks set to pass, which should make COBRA considerably more affordable for a lot of people.

That's pretty much the ball game. For Americans who had health coverage and then lost it in the last couple weeks, they'll qualify for at least one of those programs, maybe two or even all three, although whether they can afford the costs will be a big question. People who didn't have health benefits before last week might also qualify for one of those programs now that their income is lower. And for all of those 3.28 million, those questions could be further complicated by the unemployment benefits they just applied for, and whether that income will make them eligible — or not eligible — for Medicaid or Obamacare.

It's a messy and ad hoc way to run a health care system, and frankly it's a pretty good argument for just having the government cover everyone regardless of their life circumstances.

Want more essential commentary and analysis like this delivered straight to your inbox? Sign up for The Week's "Today's best articles" newsletter here.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

Fed leaves rates unchanged as Powell warns on tariffs

Fed leaves rates unchanged as Powell warns on tariffsspeed read The Federal Reserve says the risks of higher inflation and unemployment are increasing under Trump's tariffs

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration