When is the ideal time to buy a house?

Rising interest rates and a volatile property market may deter would-be buyers

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Buying a house can be especially daunting in uncertain economic times, leaving many would-be homeowners struggling to decide if and when to take the plunge.

From finding a “perfect property” to applying for a home loan, said the Mortgage Advice Bureau, “the entire process of buying a house is full of stress”. And soaring inflation and the cost-of-living crisis are raising further doubts about whether now is the time to invest.

Traditionally, spring and autumn are the busiest periods for buying properties as there is “more housing stock available”, according to Ideal Home.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The “height of summer” tends to be quieter, said Which?, “as it's a more popular time to go on holiday”. Waiting until November or December may pay off, the consumer group added, as “fewer people tend to be on the hunt”.

What is happening in the market now?

The housing market boomed during the pandemic “thanks to a combination of stamp duty cuts, low-interest rates and the ‘race for space’”, said MoneyWeek. But buyer confidence began wobbling last year as living costs and interest rates increased, “and house prices have been falling since”.

Since December 2021, the Bank of England has increased the cost of borrowing from 0.25% to the current base rate of 5%, in a bid to bring down inflation.

Fears that the Bank will continue to raise rates “has made some of the big-name lenders cautious and prompted them to withdraw products and then raise their rates to safeguard against future losses”, Karen Noye, of wealth manager Quilter, told the magazine.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The average two-year fixed rate mortgage exceeded 6% in June, according to Moneyfacts, and five-year deals have since passed that level.

The hikes and rising living costs are expected to “reduce demand among potential buyers and cause house prices to fall” further, said The Times Money Mentor.

According to the Nationwide House Price Index, average property prices were down 3.5% year-on-year in June.

And data from Zoopla showed that a record four in 10 sellers accepted offers of more than 5% below their asking price, “the highest proportion since 2018”.

Sellers are also showing more “pricing realism”, said Rightmove, which reported that annual asking price growth slowed from 1.5% in May to 1.1% in June. The property portal predicted a 2% annual drop in asking prices by the end of 2023.

Zoopla expected house prices to fall by up to 5%, while analysts at Capital Economics predicted a total drop of 12% by mid-2024.

Should you buy or wait?

With “all the signs of a slow-down at best and a possible recession” in the economy, “now is the time to take some decisions”, said James Max in The Spectator.

If house prices fall significantly, “anyone who buys now risks seeing the value of their first home plummet”, said Faith Archer in The Times Money Mentor. Buyers “could end up in negative equity”, she added, “though this would only be an issue if you wanted to sell your home”.

By contrast, by holding off on buying until prices fall, “you may not need such a big mortgage loan, and the minimum deposit by the lender required may be smaller too”.

But waiting for a better market could also be “risky”, said personal finance expert Gemma Godfrey on Sky News. There is “no guarantee” of house price drops, she wrote, and mortgage interest rates may “continue to rise”.

Archer agreed in The Times Money Mentor that “buying now might make sense” for buyers who are confident they could keep up with mortgage repayments.

Rental prices are also soaring, and moving out of a rental property at least “means you would be paying off your own mortgage, rather than someone else’s”.

Anyone hoping for a big drop in property prices may also have a long wait, and that may “come at the expense of being able to secure a cheaper mortgage”, Archer continued.

Plus, “now could be a good time to find a bargain” if homeowners are keen to sell before interest rates rise further.

Whatever happens with house prices in the short term, said Archer, provided the mortgage repayments are affordable, now could be a good time to buy “if you plan to live in that property for some time, rather than treating it as an investment”.

Tips for negotiating house prices

- Sellers may accept a lower offer from a buyer who can move fast, so engage a solicitor and get your finances in order before you start looking. If you’re a cash buyer, get proof of funds so that you can include it in your offer letter.

- Estate agents and sellers favour reliable, upstanding buyers, so reply to messages, be on time for viewings and be polite to the owner. Behaving well can also open doors to off-market opportunities with agents, which is key in a seller’s market.

- Find out why the vendor is selling, how long they’ve lived there, when it went on the market and if they’ve had any offers.

- Sellers moving for work or schools may be motivated by the timing. If a house has been in the same family for years, stressing how much you love it may help. If it’s a buy to let, it may be more about price, so find evidence of comparable recent sales.

- Think about what the property is worth to you and how high you are willing to go. Don’t start with an unrealistically low offer.

Marc Shoffman is an NCTJ-qualified award-winning freelance journalist, specialising in business, property and personal finance. He has a BA in multimedia journalism from Bournemouth University and a master’s in financial journalism from City University, London. His career began at FT Business trade publication Financial Adviser, during the 2008 banking crash. In 2013, he moved to MailOnline’s personal finance section This is Money, where he covered topics ranging from mortgages and pensions to investments and even a bit of Bitcoin. Since going freelance in 2016, his work has appeared in MoneyWeek, The Times, The Mail on Sunday and on the i news site.

-

Local elections 2026: where are they and who is expected to win?

Local elections 2026: where are they and who is expected to win?The Explainer Labour is braced for heavy losses and U-turn on postponing some council elections hasn’t helped the party’s prospects

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

The people who raffle their homes

The people who raffle their homesUnder The Radar Offer the chance to win your house for £2 a ticket? It's simple and can make thousands but it's not stress-free

-

The end of leasehold flats

The end of leasehold flatsThe Explainer Government reforms will give homeowners greater control under a move to the commonhold system

-

Why baby boomers and retirees are ditching Florida for Appalachia

Why baby boomers and retirees are ditching Florida for AppalachiaThe Explainer The shift is causing a population spike in many rural Appalachian communities

-

The pros and cons of new-builds

The pros and cons of new-buildsPros and Cons More options for first-time buyers and lower bills are offset by ‘new-build premium’ and the chance of delays

-

How the Grenfell tragedy changed the UK

How the Grenfell tragedy changed the UKfeature Six years on since the government vowed to ‘learn lessons’ has sufficient progress been made?

-

Pros and cons of building on the green belt

Pros and cons of building on the green beltPros and Cons More housing and lower house prices must be weighed against urban sprawl and conservation concerns

-

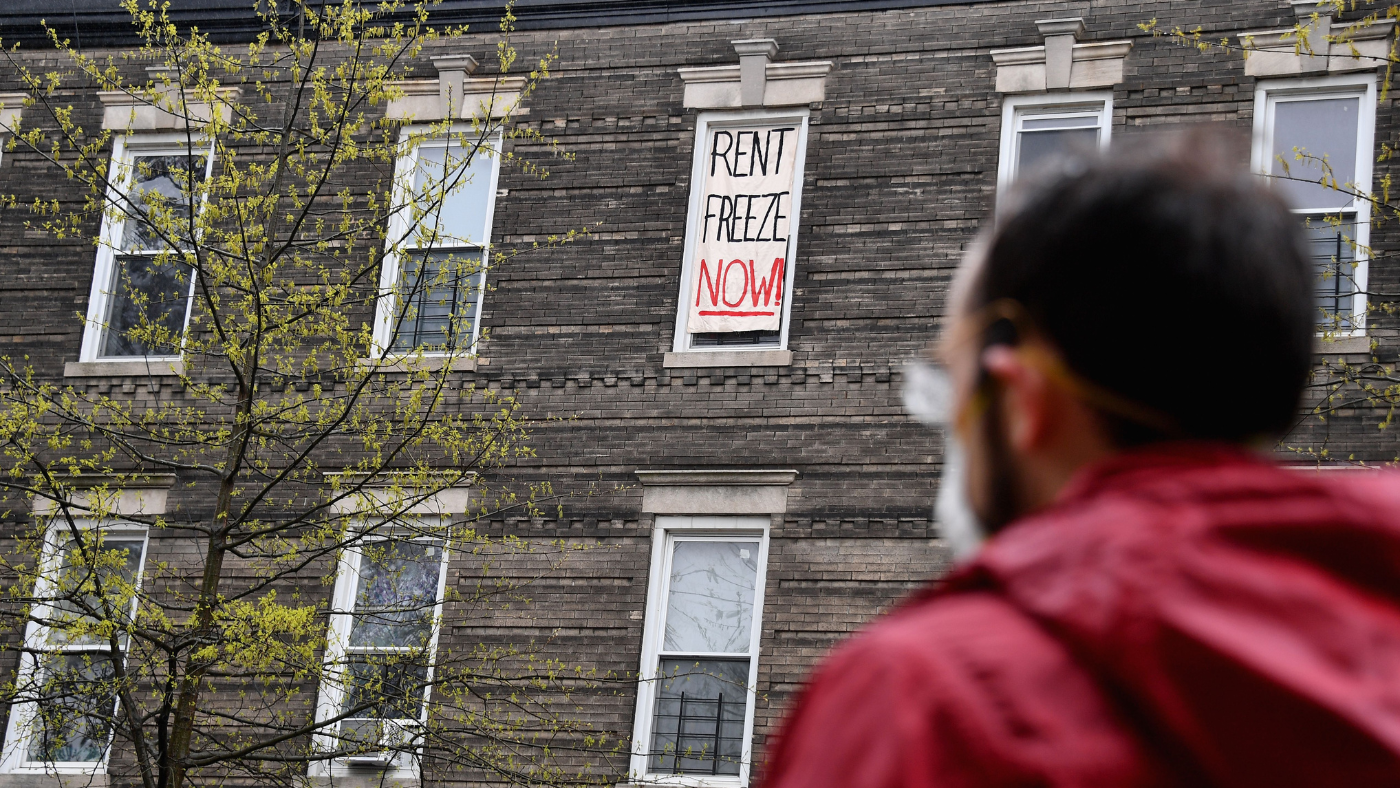

The pros and cons of rent freezes

The pros and cons of rent freezesPros and Cons Proponents say rent controls provide stability for tenants, but critics claim they won’t fix the housing crisis

-

Pros and cons of shared ownership

Pros and cons of shared ownershipPros and Cons Government-backed scheme can help first-time buyers on to the property ladder but has risks