The daily business briefing: February 4, 2022

Facebook-parent Meta's market value drops by $250 billion as stock crashes, Amazon profits nearly doubled in the holiday quarter, and more

- 1. Facebook-parent Meta suffers $250-billion stock crash

- 2. Amazon profits nearly doubled in critical holiday quarter

- 3. Snap stock soars after company reports 1st quarterly profit

- 4. Economists warn January jobs report could show Omicron-fueled losses

- 5. Stock futures mixed as investors digest earnings, brace for jobs report

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

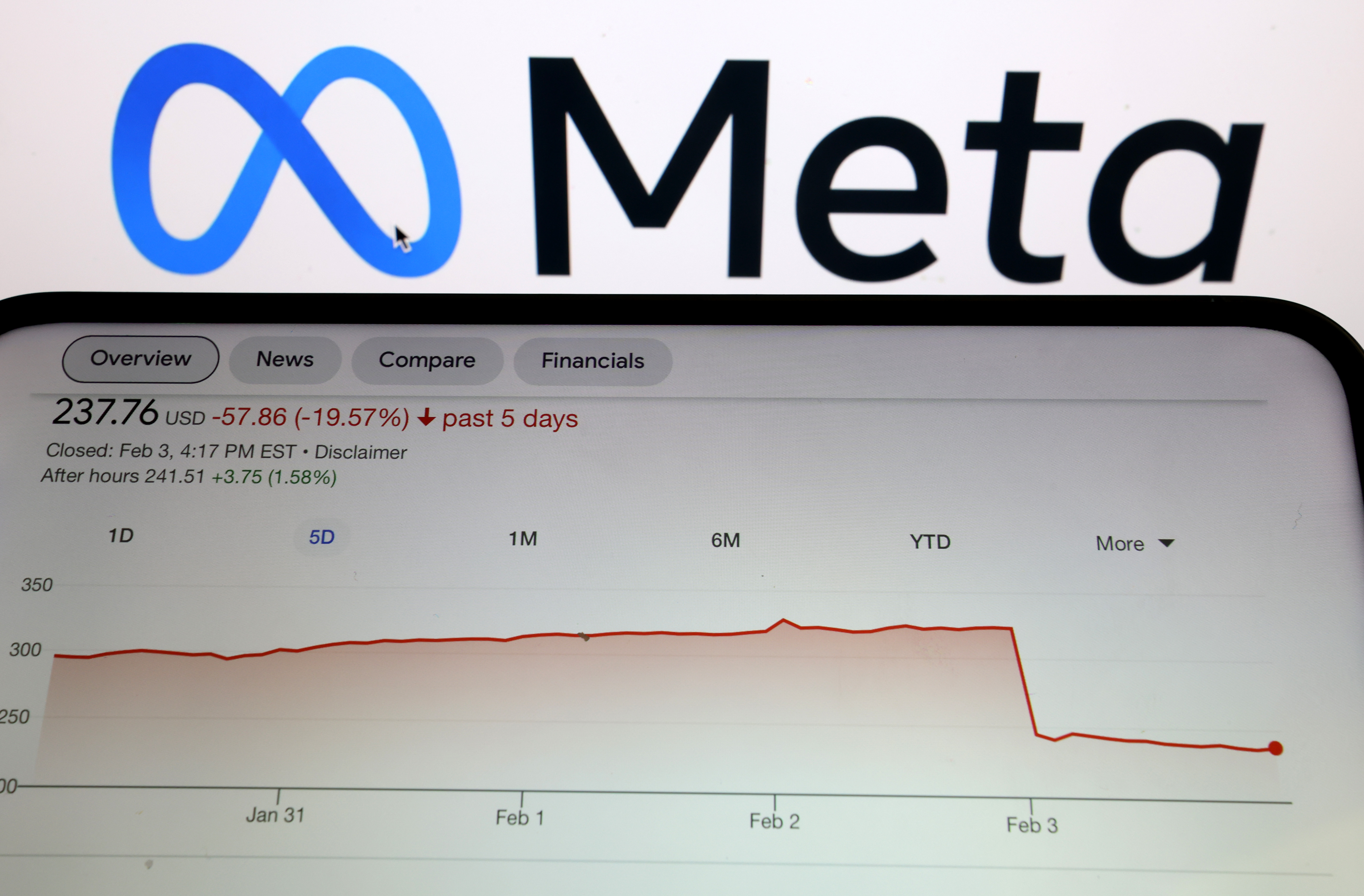

1. Facebook-parent Meta suffers $250-billion stock crash

Meta Platforms shares plummeted 26 percent Thursday following a disappointing earnings report, erasing more than $250 billion in market value in the biggest one-day loss ever for a U.S. company. The Facebook parent company reported weaker-than-expected earnings after the market closed Wednesday. The last quarter was the first ever in which Facebook lost users. Analysts said the painful quarter reflected tough competition from Tiktok and other rivals, while the magnitude of the stocks plunge demonstrated how much mammoth tech companies have to lose if they run out of room to grow. Bloomberg noted that Mega's Thursday losses exceeded the market value of 470 of the companies in the S&P 500.

2. Amazon profits nearly doubled in critical holiday quarter

Amazon on Thursday reported that its profits nearly doubled in the crucial holiday quarter despite higher costs from labor and supply crunches stoked by the Omicron coronavirus variant surge. The online retail giant also got a $12 billion operating-income boost from its investment in electric-vehicle maker Rivian, and from gains in its cloud-computing and advertising businesses. The company's quarterly revenue reached $137.4 billion, up from $125.6 billion in the same period last year. Profit came in at $14.3 billion, up from $7.2 billion a year earlier. Amazon shares jumped by more than 14 percent in after-hours trading following the report.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. Snap stock soars after company reports 1st quarterly profit

Snap shares jumped 53 percent on Thursday after the company reported its first quarterly net profit. The company's quarterly earnings, revenue, and user growth all exceeded analysts' expectations. Earnings per share reached 22 cents, compared to the 10 cents analysts surveyed by Refinitiv expected. Snap's guidance for the current quarter also was slightly better than analysts had estimated, with forecasts of up to 330 million daily users of its chat app, compared to the 327.8 million analysts expected, according to StreetAccount. Snap faces some of the same hurdles as Meta, which warned that Apple privacy changes would make targeting users with ads harder.

4. Economists warn January jobs report could show Omicron-fueled losses

New applications for jobless benefits dropped by 23,000 to 238,000 last week, after rising for weeks, the Labor Department reported Thursday. The fresh data came a day before a January employment report that could show that the winter wave of COVID-19 cases driven by the highly contagious coronavirus variant resulted in the first big job losses since late 2020. Economists polled by several firms, including PNC, Jefferies, Morgan Stanley, and Goldman Sachs, forecast significant losses. PNC estimated the biggest loss, 400,000. Economists surveyed by Dow Jones expected a gain of 150,000. "There's no question this is Omicron. It's a pandemic, and it's not without consequences," said Diane Swonk, chief economist at Grant Thornton.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. Stock futures mixed as investors digest earnings, brace for jobs report

U.S. stock futures were mixed early Friday after conflicting signals in some key earnings reports. Futures tied to the Dow Jones Industrial Average and the S&P 500 were down 0.4 percent and 0.1 percent, respectively, at 6:30 a.m. ET. Nasdaq futures were up 0.6 percent. The three major U.S. averages plunged Thursday as Facebook parent Meta plummeted after reporting disappointing earnings. The tech-heavy Nasdaq was hit hardest, falling 3.7 percent. But Amazon reported strong holiday earnings, helping to brighten sentiment. Ford shares fell 6 percent in pre-market trading after it missed estimates. Investors also are bracing for what could be an ugly January jobs report due to the latest COVID-19 wave fueled by the Omicron coronavirus variant.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.