The daily business briefing: April 28, 2022

Facebook shares surge after it adds more users than expected, Archegos owner Bill Hwang charged in stock manipulation scheme, and more

- 1. Facebook gains more users than expected

- 2. Prosecutors charge Archegos leaders over 'historic' stock manipulation scheme

- 3. Stock futures point to rebound from April sell-off

- 4. Government expected to report slow 1st-quarter growth

- 5. Disney's self-governing body says Florida can't dissolve it without paying off debt

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

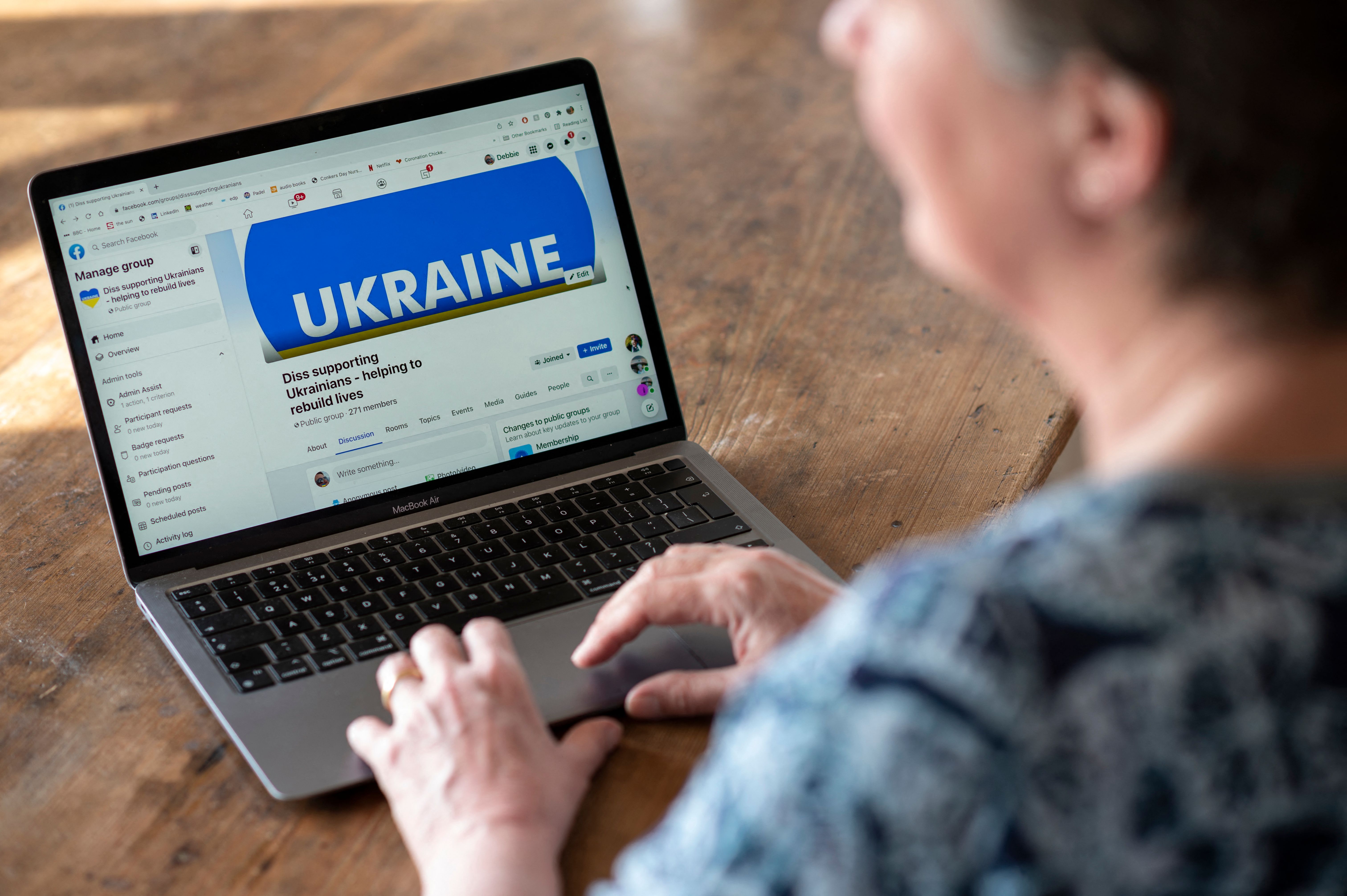

1. Facebook gains more users than expected

Facebook parent Meta Platforms on Wednesday posted its slowest revenue growth since it went public a decade ago, but it also added more users than expected in the first quarter, sending its stock jumping more than 18 percent. Facebook said Russia's war in Ukraine was partly to blame for the revenue problems. Meta's stock plunged in February after it reported a worse-than-expected decline in late 2021 quarterly profits, as well as a weak revenue forecast. After that report, the stock fell 26 percent in its worst one-day plunge ever, wiping out more than $230 billion in market value. Before Wednesday's gains, Meta shares had fallen nearly 44 percent since February's dismal report.

The Wall Street Journal The New York Times

2. Prosecutors charge Archegos leaders over 'historic' stock manipulation scheme

Federal prosecutors on Wednesday arrested Archegos Capital Management owner Bill Hwang and his former chief financial officer, Patrick Halligan, on racketeering conspiracy, securities fraud, and wire fraud charges. The leaders of the once-obscure private investment firm are accused of a stock manipulation scheme that "was historic in scope," said Damian Williams, U.S. attorney for the Southern District of New York. Archegos allegedly misled banks to borrow money and placed huge bets on a small number of stocks, inflating their values. When the scheme unraveled, Archegos collapsed, $100 billion in shareholder value vanished, and Wall Street banks suffered $10 billion in losses. Hwang was released on a $100 million bond.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. Stock futures point to rebound from April sell-off

U.S. stock futures surged early Thursday as Wall Street struggles to rebound from an April sell-off, with Facebook leading the way with an 18 percent after-hours gain after it reported better-than-expected earnings and user growth. Futures tied to the Dow Jones Industrial Average and the S&P 500 were up 0.9 percent and 1.4 percent, respectively, at 6:45 a.m. Futures for the tech-heavy Nasdaq were up 2 percent. The Dow and the S&P 500 gained 0.2 percent Wednesday. The Nasdaq was flat. Investors will be looking at Apple and Amazon earnings reports after the closing bell for indications of how the tech giants are handling high inflation and Federal Reserve interest rate hikes.

4. Government expected to report slow 1st-quarter growth

The Commerce Department is expected to report Thursday that economic growth slowed sharply in the first quarter of 2022, with inflation-adjusted gross domestic product barely rising at all after robust growth late last year. But economists noted that the numbers, reflecting the impact of the winter Omicron-variant coronavirus wave, will be misleading. The COVID-19 surge hurt spending on restaurants and travel, but the report is expected to show solid gains in overall consumer spending and business investment, signaling resilience. "This is one of these reports where the headline is kind of a head fake," said Ethan S. Harris, head of global economics for Bank of America. "It's actually a pretty good quarter if you look at the underlying data."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. Disney's self-governing body says Florida can't dissolve it without paying off debt

Disney World's self-governing body, the Reedy Creek Improvement District, says Florida can't go ahead with its plan to dissolve it without paying off its $1 billion in bond debts, under a provision in the law that established the district. Florida created Reedy Creek in 1967 to allow Disney governmental control over development and public works in the area housing its central Florida theme parks. Reedy Creek's statement came as Florida Republicans last week passed legislation to dissolve the district at the urging of Gov. Ron DeSantis in response to Disney's criticism of the state's Parental Rights in Education law, which critics call the "don't say gay" bill. Disney hasn't publicly commented on the law.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.