Budget 2017: what’s in Hammond’s red box?

In Depth: Chancellor weighs changes to corporate tax, student loans and pensions

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Chancellor Philip Hammond is under pressure to deliver a Budget that will decisively shape Britain’s future and reset the image of the Conservative Party.

“Hammond and Prime Minister Theresa May may not agree on much but they are both convinced of the importance of this week’s Budget - if only for the sake of their own careers,” the Financial Times says.

Demands are high. Hammond is expected to embrace fiscal conservatism while finding money to build new homes, increase public sector pay, fund the NHS and improve productivity. British businesses, millennials, homeowners and seniors are impatient for change.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

“Add in the economic uncertainty around Brexit, and Mr Hammond might be tempted to play safe and avoid any drama,” the BBC says.

This will be the first minority government Budget in almost four decades - the first since Denis Healey presented his final Budget in April 1978. If the Chancellor gets it right, it may not be their last.

With Hammond facing pressure from every direction, The Week examines the predictions for Hammond’s bold but stable budget:

Business tax

Cutting corporation tax

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

There is a possibility that Hammond will cut the 19% corporation tax rate - he indicated back in spring that he wanted to send the message that Britain is open for business. However, tax experts have urged the Chancellor to rethink plans to cut the tax to 17% by 2020 in order to free up £5bn a year for other spending priorities, the Financial Times says.

Likelihood: 5/10

Appealing to environmentalists

Takeaway tax

The introduction of a 5p charge for plastic bags at supermarkets and shops has been so successful that the Government is reportedly thinking about taking the plan a step further. According to City AM, the Tories are considering a tax on single-use plastic items such as packaging, bubble wrap and polystyrene boxes such as those used for takeaways.

Likelihood: 7/10

Diesel tax

AutoCar says Hammond looks “set” to raise tax on diesel fuel in an aggressive plan to fight air pollution while the Daily Express says ministers may raise taxes on diesel cars “to help meet budget requirements set out in the Clean Air Strategy in July”.

Likelihood: 7/10

Appealing to the millennials

Writing off students loans

Hammond is considering writing off old student loan debt, The Sunday Times reports. The Chancellor reportedly believes the historic loans will not be paid off anyway, so writing off the debts would help the younger generation obtain mortgages, provide extra spending money and, in turn, increase tax revenue.

“Philip has said that we have to have a radical budget, something that is a big offer to the nation,” the newspaper reports, citing an unnamed government source.

But is it too big of a gamble for a Chancellor not prone to risk?

Likelihood: 4/10

Tackling Britain’s housing crisis

Hammond would win admirers should he decide to tackle Britain’s housing crisis and its failure to build sufficient homes.

“This would send a clear message that the current government is on the side of younger people, who are not enjoying the security and assets that previous generations have had,” The Times reports.

Hammond could also push for the public sector to build on public land, filling in gaps left by the private sector. He’s reportedly “urging” Theresa May to allow building on green belts and letting councils borrow more, the Mirror says.

Likelihood: 7/10

Cutting stamp duty for first-time buyers

Iain McCluskey of PwC accountants says the UK would welcome a “stamp duty holiday” where a majority of first-time buyers don’t pay anything for up to two years.

“An idea of making stamp duty a price for sellers has even been floated but could have consequences pushing up asking prices,” the Daily Express says.

Likelihood: 4/10

Appealing to the mid-tier

Personal allowance

Former chancellor George Osborne promised to raise the personal allowance – the amount workers earn tax-free – to £12,500 by 2020. Hammond may decide to accelerate the increase, allowing a personal allowance of £12,000 or more, helping low-earning first time employees at the same time as pensioners.

Likelihood: 6/10

Cutting the annual pension contribution allowance

Britons can save up to £40,000 in their pension every year, so if Hammond cuts the limit it wouldn't attract too much attention. Only the very high earners are likely to lose out while the government raises billions at a stroke. That said, workers contribute to their pension in various ways. Larger contributions are often made by self-employed workers, so there could be some resistance.

“If Hammond were to cut the AA [annual allowance] by £5,000, or even £10,000, investors might not like it but mostly they’d accept it. Anything more than that and it would become increasingly unpopular,” Citywire says.

Likelihood: 8/10

Enrolling into workplace pension schemes

Baroness Altmann, former pensions minister, told The Times that Hammond could make automatic enrolment into workplace pension schemes compulsory. Workers would pay in at a minimum level and get a top-up from their employer as an incentive.

“Tax relief would apply only to those paying more than the minimum,” Altmann told The Times.

Likelihood: 7/10

Abolishing the lifetime allowance

Many want to abolish the £1m lifetime allowance – the maximum individuals can save into pensions before tax is charged. Hammond may concur. But if he decides to lower the allowance below £1m, Hammond is likely to “enrage higher earners in their 40s and 50s,” The Daily Telegraph says.

Likelihood: 6/10

Big spenders

Reducing tax benefits linked to venture capital trusts

Investors in venture capital trusts – those who fund start-up businesses – get a 30% tax break, but there are restrictions on which companies they can invest in. Hammond may decide to allow riskier investments and make other changes. After all, that’s why the trusts were set up.

The Tories spent £171m on the tax break in 2016 on £570m invested. The Telegraph says it’s possible that the tax break could be cut to 20%, or the total amount of tax relief available could be cut from £200,000 per person a year.

Likelihood: 7/10

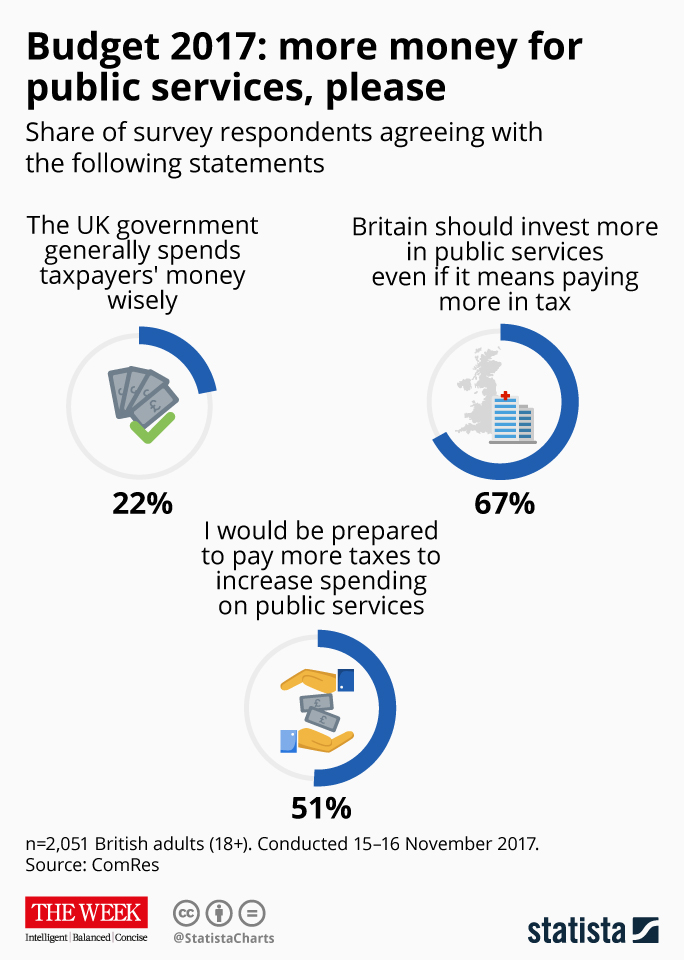

Infographic by www.statista.com/chartoftheday for TheWeek.co.uk

-

Corruption: The spy sheikh and the president

Corruption: The spy sheikh and the presidentFeature Trump is at the center of another scandal

-

Putin’s shadow war

Putin’s shadow warFeature The Kremlin is waging a campaign of sabotage and subversion against Ukraine’s allies in the West

-

Media: Why did Bezos gut ‘The Washington Post’?

Media: Why did Bezos gut ‘The Washington Post’?Feature Possibilities include to curry favor with Trump or to try to end financial losses

-

Is the UK headed for recession?

Is the UK headed for recession?Today’s Big Question Sluggish growth and rising unemployment are ringing alarm bells for economists

-

Should Labour break manifesto pledge and raise taxes?

Should Labour break manifesto pledge and raise taxes?Today's Big Question There are ‘powerful’ fiscal arguments for an income tax rise but it could mean ‘game over’ for the government

-

Will Rachel Reeves have to raise taxes again?

Will Rachel Reeves have to raise taxes again?Today's Big Question Rising gilt yields and higher debt interest sound warning that Chancellor may miss her Budget borrowing targets

-

Securonomics: what is Rachel Reeves' economic plan and will it work?

Securonomics: what is Rachel Reeves' economic plan and will it work?The Explainer Focus on economic security and the resilience of industry in an uncertain world is 'key to growth', say Labour

-

New austerity: can public services take any more cuts?

New austerity: can public services take any more cuts?Today's Big Question Some government departments already 'in last chance saloon', say unions, as Conservative tax-cutting plans 'hang in the balance'

-

Five key takeaways from Jeremy Hunt's Autumn Statement

Five key takeaways from Jeremy Hunt's Autumn StatementThe Explainer Benefits rise with higher inflation figure, pension triple lock maintained and National Insurance cut

-

Would tax cuts benefit the UK economy?

Would tax cuts benefit the UK economy?Today's Big Question More money in people's pockets may help the Tories politically, but could harm efforts to keep inflation falling

-

Mini-budget one year on: how the Truss-Kwarteng growth plan lingers

Mini-budget one year on: how the Truss-Kwarteng growth plan lingersThe Explainer Commentators say 'moron premium' has subsided but UK 'still stuck in first gear'