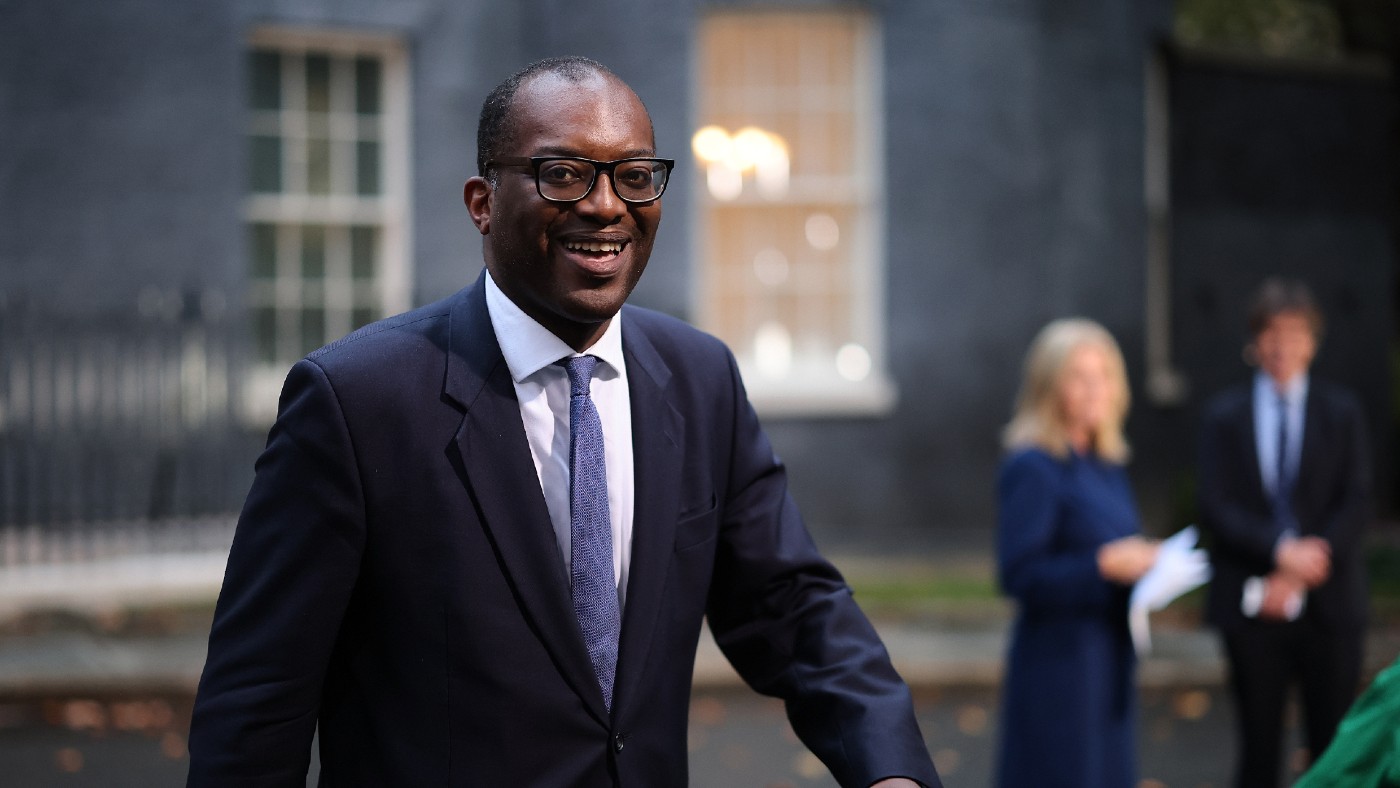

Kwasi Kwarteng vs. bankers’ bonuses: ‘a strange fight to pick’?

Pundits say limiting bonuses to twice a banker’s salary could ‘boost the City and bring in more revenue long term’

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Of all the measures expected in this week’s “mini-Budget”, the one causing Tory MPs the most disquiet was Kwasi Kwarteng’s decision to reverse the ban on bankers’ bonuses, said Steven Swinford in The Times.

The logic for a Chancellor wanting to “go for the growth” is straightforward: removing the cap – originally imposed by the EU, limiting bonuses to twice a banker’s salary – would “boost the City and bring in more revenue long term”.

But the politics, in the midst of a cost-of-living crisis, are another matter. The thinking across a broad spread of the party is that “the optics” are so “toxic” that the measure would be “a total gift to Labour”.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Ignore the noise, Kwasi…

Whatever the fallout, Kwarteng should stick to his guns, said Kate Andrews in The Daily Telegraph. “Attempts to compare a banker’s salary to a nurse’s… distract from the real debate” –which is that the cap “never made sense”. It merely increased the fixed element of pay, and limited the amount of flexibility that banks could have in rewarding performance.As the Bank of England has argued, “there are far better ways of controlling risk in the industry”, such as deferring bonuses.

There’s also a basic principle at stake. The decision of how much to dish out in pay “is explicitly a private one between an employer and an employee”.

Big Bung 2.0

The cap will make London slightly more attractive for the big American banks, said Helen Thomas in the FT. But “the Government will need to do better than Big Bung 2.0” if it wants a real “post-Brexit dividend”. It won’t be “enough to win over the City, let alone its critics”.

It certainly seems “a strange fight to pick” when inflation is “tearing chunks” out of most people’s realterms pay packets, said Nils Pratley in The Guardian. On pure logic, Kwarteng has a point. True to the “waterbed principle” – push down one area, and another goes up – the predictable result of the cap was to boost “fixed pay”.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

But the real concern is that the row over the “mostly irrelevant” bonus cap hogs 90% of the attention, while other parts of Kwarteng’s deregulation package for the City will be ignored. “Any dangerous stuff will lie in the boring but very important 10%.”

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

Earth is rapidly approaching a ‘hothouse’ trajectory of warming

Earth is rapidly approaching a ‘hothouse’ trajectory of warmingThe explainer It may become impossible to fix

-

Is the UK headed for recession?

Is the UK headed for recession?Today’s Big Question Sluggish growth and rising unemployment are ringing alarm bells for economists

-

Should Labour break manifesto pledge and raise taxes?

Should Labour break manifesto pledge and raise taxes?Today's Big Question There are ‘powerful’ fiscal arguments for an income tax rise but it could mean ‘game over’ for the government

-

Will Rachel Reeves have to raise taxes again?

Will Rachel Reeves have to raise taxes again?Today's Big Question Rising gilt yields and higher debt interest sound warning that Chancellor may miss her Budget borrowing targets

-

Securonomics: what is Rachel Reeves' economic plan and will it work?

Securonomics: what is Rachel Reeves' economic plan and will it work?The Explainer Focus on economic security and the resilience of industry in an uncertain world is 'key to growth', say Labour

-

New austerity: can public services take any more cuts?

New austerity: can public services take any more cuts?Today's Big Question Some government departments already 'in last chance saloon', say unions, as Conservative tax-cutting plans 'hang in the balance'

-

Five key takeaways from Jeremy Hunt's Autumn Statement

Five key takeaways from Jeremy Hunt's Autumn StatementThe Explainer Benefits rise with higher inflation figure, pension triple lock maintained and National Insurance cut

-

Would tax cuts benefit the UK economy?

Would tax cuts benefit the UK economy?Today's Big Question More money in people's pockets may help the Tories politically, but could harm efforts to keep inflation falling

-

Mini-budget one year on: how the Truss-Kwarteng growth plan lingers

Mini-budget one year on: how the Truss-Kwarteng growth plan lingersThe Explainer Commentators say 'moron premium' has subsided but UK 'still stuck in first gear'