What can we expect from Friday’s mini-budget?

The chancellor is likely to announce a raft of tax cuts to try to stimulate growth

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The government is set to announce a mini-budget on Friday to help ease the UK’s deepening economic crisis.

The new prime minister, Liz Truss, reaffirmed her economic strategy while on a trip to the United Nations in New York this week, saying that “lower taxes lead to economic growth, there is no doubt in my mind about that”. But she has already faced criticism for urging other world leaders to join her in cutting taxes. US President Joe Biden said on Wednesday that he was “sick and tired of trickle-down economics”.

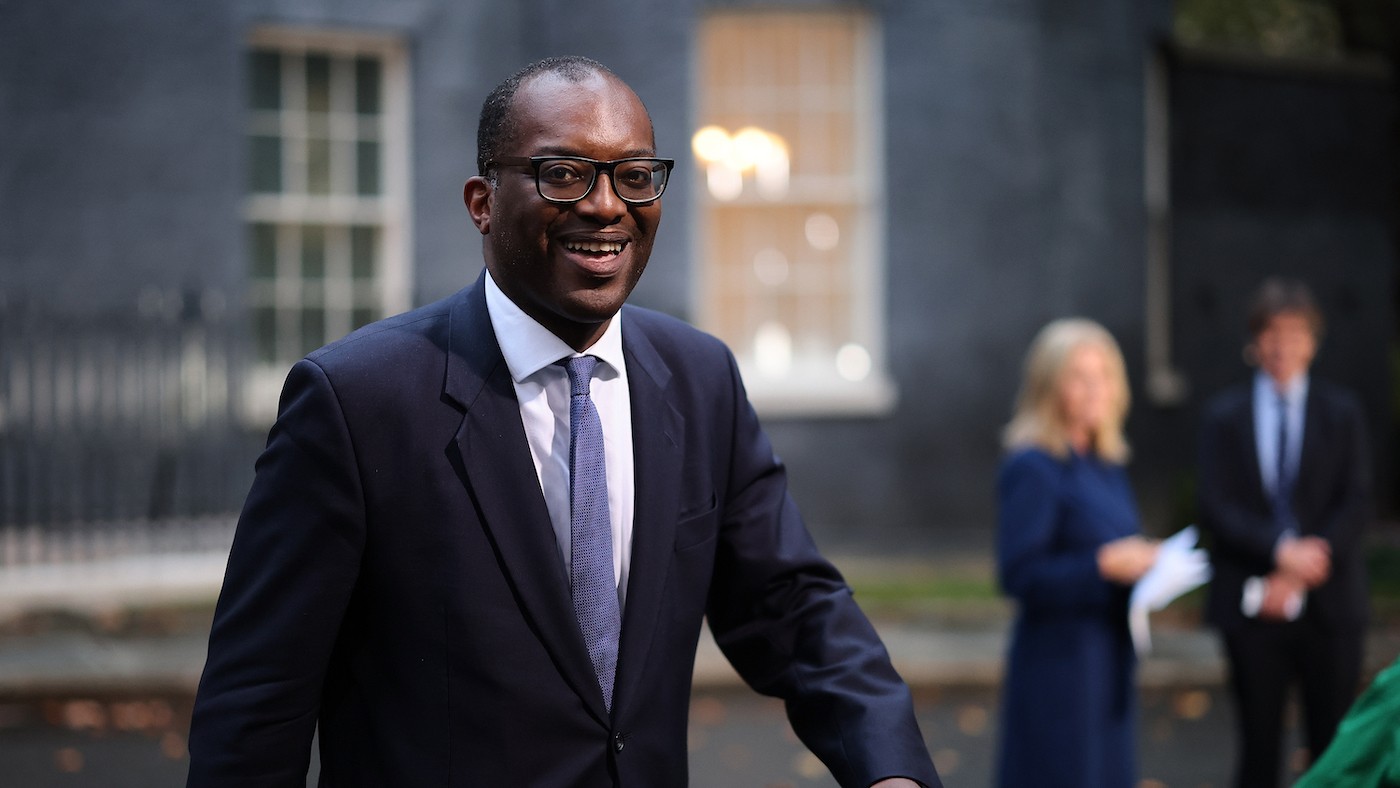

Chancellor Kwasi Kwarteng’s announcement on Friday is unlike a normal budget and will include only “a handful of major legislative proposals” to help businesses and households, said The Times.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

“Friday is about outlining a new approach to the economy,” one government source told Sky News’s deputy political editor Sam Coates. Broadly, this approach is “a new central mission – to secure 2.5% ‘trend’ growth in the medium term,” said Coates. Whether it is achieved “could determine the success or otherwise of Liz Truss’s premiership,” he added.

What did the papers say?

The National Insurance rise brought in by former chancellor Rishi Sunak will almost certainly be reversed. The prime minister has “made no secret” of her plan to scrap the 1.25% increase, said The Telegraph, which was brought in to provide extra funding for health and social care before it was to be replaced by a levy in 2023. While its unpopularity will mean scrapping it will “curry favour with the electorate”, said The Telegraph, economic experts have said it would “tend to benefit richer households”, according to The Times.

There could also be a “radical cut to stamp duty”, said the i news site, which it says has been in the works between the prime minister and the chancellor for “more than a month”. Cutting the tax, which is levied at home buyers as a percentage depending on the value of their property, “could help offset a potential slowdown in the housing market as the Bank of England raises interest rates”, said The Guardian. However, “without wider reforms” and a “boost to housing supply”, cutting stamp duty could “add to inflation”, said the paper, and would not benefit first-time buyers.

It is also widely expected that the planned rise in corporation tax will be scrapped. The prime minister has said she believes that if Britain has a higher corporation tax it is not “going to get that investment and growth” she hopes will stimulate the economy. But a recent report by the Institute for Public Policy Research (IPPR) said that previous cuts to corporation tax had not helped generate investment for the UK, according to Reuters. “Slashing corporation tax is just a continuation of a failed race to the bottom that hasn’t delivered for the UK economy,” said George Dibb, head of the Centre for Economic Justice at the IPPR.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Among other proposals, the chancellor could also announce a change to the higher threshold of income tax, raising it to £80,000 from £50,270, according to The Telegraph, though The Sun said that the basic rate of income tax will also be cut from 20p to 19p. Meanwhile, green levies on energy bills could be scrapped to accompany the government’s previously announced freeze on energy prices.

Investment zones – “areas with lower taxation and planning rules” – could also be included in Friday’s mini-budget, reported The Telegraph. The move will “likely result in tens of thousands of new homes being built in green areas that have previously been shielded from development by environmental regulations”, but one government source told the paper it would be unpopular with many voters in the south of England.

What next?

The total package of tax cuts is expected to cost “between £30bn and £50bn”. said The Guardian. Friday’s announcement will “lack the detail of a full budget”, though, said Sky News, as the government has refused to commission an Office for Budget Responsibility (OBR) forecast to assess the economic impact of the changes.

It is normal for an OBR forecast to accompany the chancellor’s spring and autumn budgets, and the government has been criticised for “avoiding scrutiny” by not allowing the watchdog to assess the impact of the mini-budget. The government said it needed to move quickly and couldn’t afford the time for the assessment.

Believing that “further tax cuts and deregulation (such as lifting the cap on bankers’ bonuses)” will transform the economy is “a fantasy”, wrote Martin Wolf in the Financial Times. He said that the idea the government will hit its 2.5% growth target is “ridiculous”.

“Truss has dictated on what terms her premiership will be tested,” wrote Kate Andrews in The Spectator, saying that the “bigger the announcements, the bigger the risks” the new prime minister will be taking. If the new “Growth Plan” is “rushed or not fully formed”, then Truss will be the one to “answer for it”.

Richard Windsor is a freelance writer for The Week Digital. He began his journalism career writing about politics and sport while studying at the University of Southampton. He then worked across various football publications before specialising in cycling for almost nine years, covering major races including the Tour de France and interviewing some of the sport’s top riders. He led Cycling Weekly’s digital platforms as editor for seven of those years, helping to transform the publication into the UK’s largest cycling website. He now works as a freelance writer, editor and consultant.

-

Sepsis ‘breakthrough’: the world’s first targeted treatment?

Sepsis ‘breakthrough’: the world’s first targeted treatment?The Explainer New drug could reverse effects of sepsis, rather than trying to treat infection with antibiotics

-

James Van Der Beek obituary: fresh-faced Dawson’s Creek star

James Van Der Beek obituary: fresh-faced Dawson’s Creek starIn The Spotlight Van Der Beek fronted one of the most successful teen dramas of the 90s – but his Dawson fame proved a double-edged sword

-

Is Andrew’s arrest the end for the monarchy?

Is Andrew’s arrest the end for the monarchy?Today's Big Question The King has distanced the royal family from his disgraced brother but critics claim a ‘fit of revolutionary disgust’ could still wipe them out

-

How are Democrats turning DOJ lemons into partisan lemonade?

How are Democrats turning DOJ lemons into partisan lemonade?TODAY’S BIG QUESTION As the Trump administration continues to try — and fail — at indicting its political enemies, Democratic lawmakers have begun seizing the moment for themselves

-

How corrupt is the UK?

How corrupt is the UK?The Explainer Decline in standards ‘risks becoming a defining feature of our political culture’ as Britain falls to lowest ever score on global index

-

How did ‘wine moms’ become the face of anti-ICE protests?

How did ‘wine moms’ become the face of anti-ICE protests?Today’s Big Question Women lead the resistance to Trump’s deportations

-

How are Democrats trying to reform ICE?

How are Democrats trying to reform ICE?Today’s Big Question Democratic leadership has put forth several demands for the agency

-

Why is Tulsi Gabbard trying to relitigate the 2020 election now?

Why is Tulsi Gabbard trying to relitigate the 2020 election now?Today's Big Question Trump has never conceded his loss that year

-

Will Democrats impeach Kristi Noem?

Will Democrats impeach Kristi Noem?Today’s Big Question Centrists, lefty activists also debate abolishing ICE

-

The high street: Britain’s next political battleground?

The high street: Britain’s next political battleground?In the Spotlight Mass closure of shops and influx of organised crime are fuelling voter anger, and offer an opening for Reform UK

-

Do oil companies really want to invest in Venezuela?

Do oil companies really want to invest in Venezuela?Today’s Big Question Trump claims control over crude reserves, but challenges loom