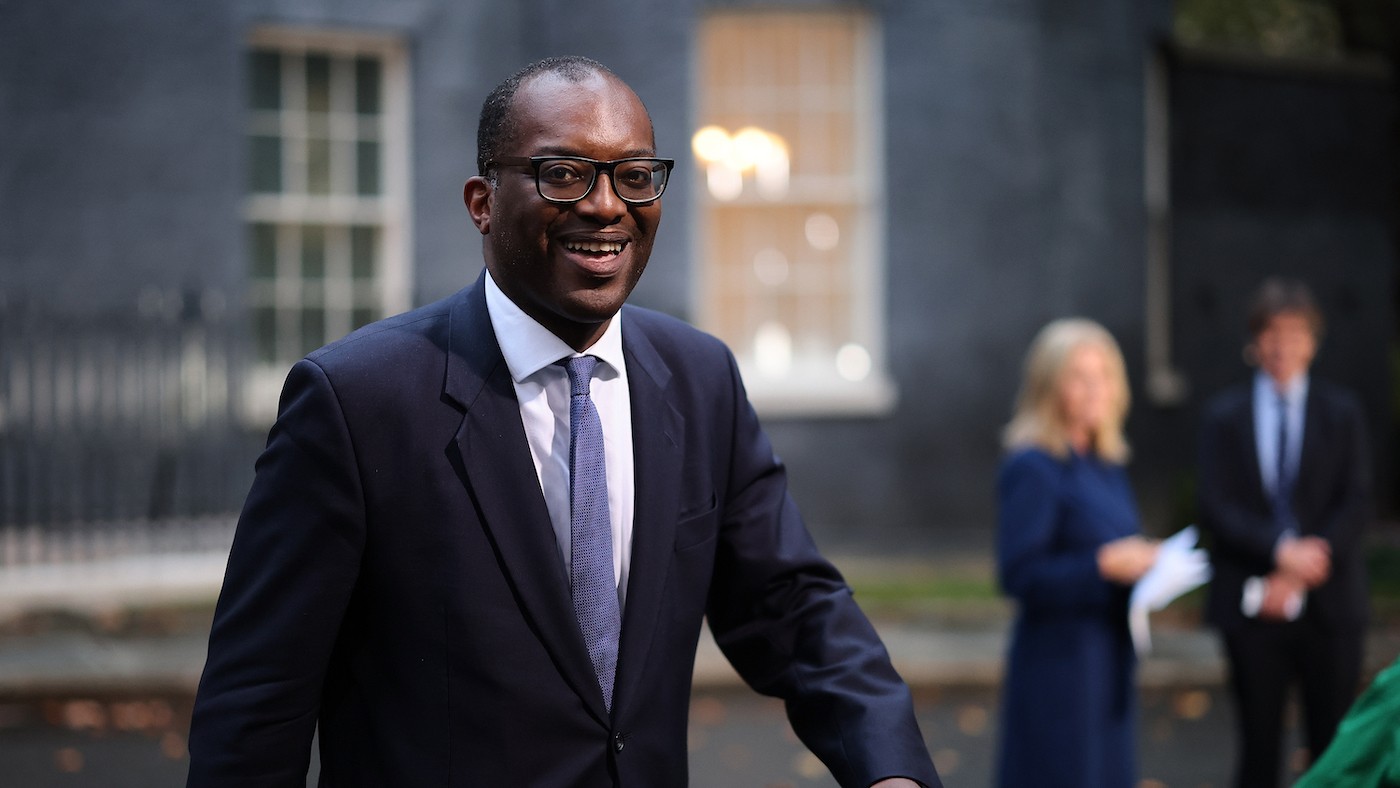

Mini-budget 2022: Kwasi Kwarteng’s ‘growth plan’ in seven bullet points

The chancellor has insisted his changes will make the tax system ‘simpler and fairer’

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

In what he called a “fiscal event” – a Budget in all but name – Chancellor Kwasi Kwarteng this morning outlined a series of measures he believes will boost growth, including what he claims are the biggest tax cuts in a generation.

Here’s the chancellor’s growth plan explained in seven bullet points.

• Income tax

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The chancellor announced that he is cutting the basic rate of income tax from 20% to 19% from April 2023, a year earlier than the previous government had planned. For higher wage earners, the “additional” rate of 45% (for those paid more than £150,000) will be scrapped, with a new single top rate of income tax of 40% (for earnings above £50,270).

Currently, people in England, Wales and Northern Ireland pay 20% on annual earnings from £12,571 to £50,270. That will drop by 1% from next April. Rates in Scotland are different.

In his speech to the Commons, the chancellor said: “We will review the tax system to make it simpler and fairer,” he said, adding that “we will embed tax simplification in government”.

Labour’s shadow chancellor Rachel Reeves said Kwarteng’s statement was an “admission of 12 years of economic failure” by the government. “It is all based on an outdated ideology that says if we simply reward those who are already wealthy, the whole of society will benefit,” she added. “They have decided to replace levelling up with trickle down.”

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

• Stamp duty

The chancellor also announced a cut to stamp duty, which is paid when people in England and Northern Ireland buy property.

Coming into operation today, the tax-free band is being doubled from houses worth £125,000 to £250,000. And it will be raised to £425,000 for first-time buyers.

According to Kwarteng, the measure will mean that 200,000 more people will be relieved of paying stamp duty.

“For the average first-time buyer, however, the tax changes are unlikely to make a difference,” said The Telegraph. The average first-time buyer home costs £254,110, “a price which already fell below the previous £300,000 nil-rate band”.

• Energy

To counter the effects of rising energy prices due to Russia’s invasion of Ukraine, the government announced three key steps: an energy price guarantee, equivalent support for businesses, and an energy markets financing scheme delivered by the Bank of England.

The total cost for this package of measures, Kwarteng said, is in the region of £60bn for the six months from October.

According to The Guardian’s political correspondent Aubrey Allegretti, Kwarteng attempted to “pin the blame for inflation and spiralling energy bills directly on Putin.

“After the criticism the Conservatives faced over the summer for months of inaction while the leadership contest dragged on, the chancellor [tried] to counter that narrative by claiming the new prime minister, Liz Truss, acted with ‘great speed’,” Allegretti added.

• Shopping

The mini-budget also introduced VAT-free shopping for overseas visitors, while cancelling planned increases in the duty rates for beer, cider, wine and spirits.

The move is welcome, said The Sun, because by expanding duty-free shopping into cities, “tourists will have wider access to cheap goodies, and will then be more likely to spend money, boosting the local economy”.

• Bankers’ bonuses

As became clear recently thanks to a leak, the rules limiting bankers’ bonuses are set to be scrapped, with a broader package of regulatory reforms to be set out later in the autumn.

On this point, Kwarteng is “walking a thin line between the various factions of the Conservative parliamentary party”, said Allegretti. On the one hand, he knows that lift the cap “will go down like a cup of cold sick with some colleagues”, but given the news was leaked, “it is unlikely to draw as much outrage as if it had been announced today for the first time”.

• National Insurance

Kwarteng announced that he will reverse the recent rise in National Insurance conributions (NICs) from 6 November.

In April, NICs increased by 1.25% for both employees and employers. The move to scrap this rise “means 28 million workers will have more money in their pockets”, said The Times Money Mentor’s Katherine Denham, adding that “on average, each worker will get an extra £330 in take-home pay over a year”.

• Benefits

Rules around Universal Credit will be tightened by the mini-budget, reducing benefits to people who don’t fulfil job search commitments.

During his statement, Kwarteng said that people will now have to work more hours per week in order still to claim Universal Credit.

Currently, those working up to nine hours a week at the national minimum wage are required to meet regularly with their job centre coach and take active steps to increase their earnings. This will rise to 12 hours from Monday and to 15 hours from January 2023.

Consequently, those claiming “could have their benefits sanctioned if they fail to take active steps to boost their income”, The Daily Record explained.

Arion McNicoll is a freelance writer at The Week Digital and was previously the UK website’s editor. He has also held senior editorial roles at CNN, The Times and The Sunday Times. Along with his writing work, he co-hosts “Today in History with The Retrospectors”, Rethink Audio’s flagship daily podcast, and is a regular panellist (and occasional stand-in host) on “The Week Unwrapped”. He is also a judge for The Publisher Podcast Awards.

-

Why is the Trump administration talking about ‘Western civilization’?

Why is the Trump administration talking about ‘Western civilization’?Talking Points Rubio says Europe, US bonded by religion and ancestry

-

Quentin Deranque: a student’s death energizes the French far right

Quentin Deranque: a student’s death energizes the French far rightIN THE SPOTLIGHT Reactions to the violent killing of an ultraconservative activist offer a glimpse at the culture wars roiling France ahead of next year’s elections

-

Secured vs. unsecured loans: how do they differ and which is better?

Secured vs. unsecured loans: how do they differ and which is better?the explainer They are distinguished by the level of risk and the inclusion of collateral

-

Is the UK headed for recession?

Is the UK headed for recession?Today’s Big Question Sluggish growth and rising unemployment are ringing alarm bells for economists

-

Should Labour break manifesto pledge and raise taxes?

Should Labour break manifesto pledge and raise taxes?Today's Big Question There are ‘powerful’ fiscal arguments for an income tax rise but it could mean ‘game over’ for the government

-

Autumn Budget: will Rachel Reeves raid the rich?

Autumn Budget: will Rachel Reeves raid the rich?Talking Point To fill Britain’s financial black hole, the Chancellor will have to consider everything – except an income tax rise

-

Pros and cons of a wealth tax

Pros and cons of a wealth taxPros and Cons Raising revenue and tackling inequality vs. the risk of capital flight and reduced competitiveness

-

Is Rachel Reeves going soft on non-doms?

Is Rachel Reeves going soft on non-doms?Today's Big Question Chancellor is reportedly considering reversing controversial 40% inheritance tax on global assets of non-doms, after allegations of 'exodus' of rich people

-

Foreigners in Spain facing a 100% tax on homes as the country battles a housing crisis

Foreigners in Spain facing a 100% tax on homes as the country battles a housing crisisUnder the Radar The goal is to provide 'more housing, better regulation and greater aid,' said Spain's prime minister

-

Will Rachel Reeves have to raise taxes again?

Will Rachel Reeves have to raise taxes again?Today's Big Question Rising gilt yields and higher debt interest sound warning that Chancellor may miss her Budget borrowing targets

-

What's next for electric vehicles under Trump?

What's next for electric vehicles under Trump?Today's Big Question And what does that mean for Tesla's Elon Musk?